Interswitch, the digital payments firm, has confirmed that it has reached a $1bn valuation after Visa, the payments company, invested in the enterprise.

While it has revealed the valuation to TechCrunch, it still refused to say exactly how much Visa had injected into the business. However, Sky News has estimated that the deal saw Visa pay $200m for a 20% stake in the company.

A source with knowledge about Nigeria’s newest unicorn also told TechCrunch that it might still be aiming for an initial public offering in London sometime in the first six months of next year.

Nigeria has long been hailed as one of Africa’s three leading FinTech nations, Kenya and South Africa being the other two. The FinTech sector in the continent is leveraging the opportunity of catering to the continent’s underserved population.

There are also signs that the FinTech landscape is maturing. The clearest sign of this is the fact that the Sub-Saharan industry has attracted over $1.1bn since 2014, according to FinTech Global’s data.

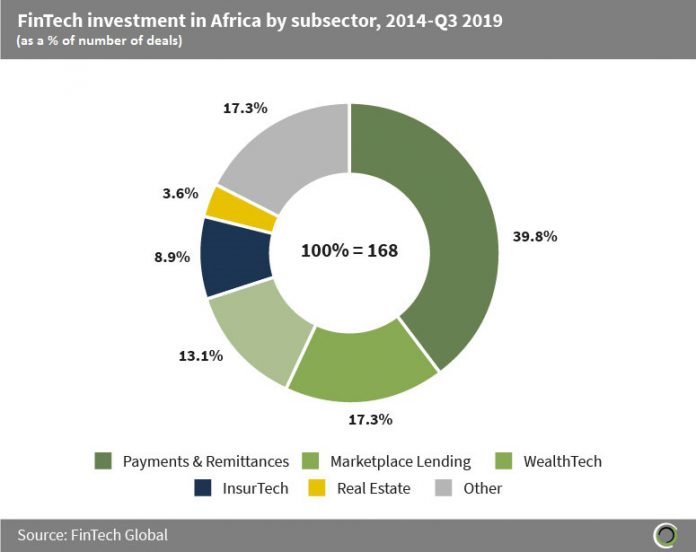

The majority, 39.8%, of that investment has been put into payments and remittances companies. Marketplace lending businesses are the second most popular African FinTech ventures investors like to bet on, having attracted 17.3% of the money.

Another example can be spotted by the behaviour of some of its startups. Carbon, the digital credit and payment company, broke with tradition earlier this year by releasing its audited financials to the public, something that was virtually unheard of among Nigeria’s FinTech companies.

When FinTech Global asked the co-founder and CEO Chijioke Dozie why he had opted to release the audit, he answered, “We want our employees and potential employees to know that we are achieving success and are set to continue to achieve success.”

Dozie added, “We also think it is important to showcase our success to the world. When you look at challenger banks and other similar financial services platforms from across the world, our numbers could easily compare to theirs. Sharing our performance data was an opportunity for us to shine a light on our success and also a chance to tell the world (particularly, potential investors) that you can achieve good success in the markets we’re in.”

Copyright © 2019 FinTech Global