The ICO (Initial Coin Offering) market first gained real momentum in 2017, as a way for cryptocurrency developers to raise capital for their projects without going through the same costly and compliance heavy processes encountered with traditional fundraising and IPOs.

Data from CoinMarketCap shows that the crypto universe has a combined total market capitalisation of $225bn however, the ICO market has since been mired with controversy with respect to companies breaching SEC federal securities laws in the ICO process.

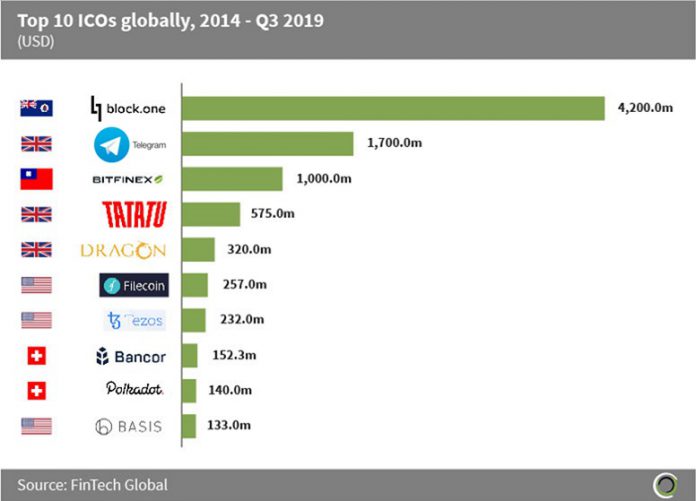

Block.one, the Cayman Islands registered developer of blockchain platform EOS.IO, raised $4.2bn in an ICO in May 2018 which is the largest ICO ever recorded. EOS.IO is a next-generation, open-source blockchain protocol with industry-leading transaction speed and flexible utility.

The UK has been home to two of the largest ICOs in history, with Telegram Messenger raising $1.7bn in March 2018 from ARK FUND, Oyster Ventures, Dalma Capital and 79 other investors. This is the largest ICO in the UK to date and the second largest ICO on record globally. Telegram is planning to launch the Telegram Open Network (TON); an ecosystem including apps, services, and a store for digital and physical goods. It plans to use the money raised by the ICO to fund this development.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global