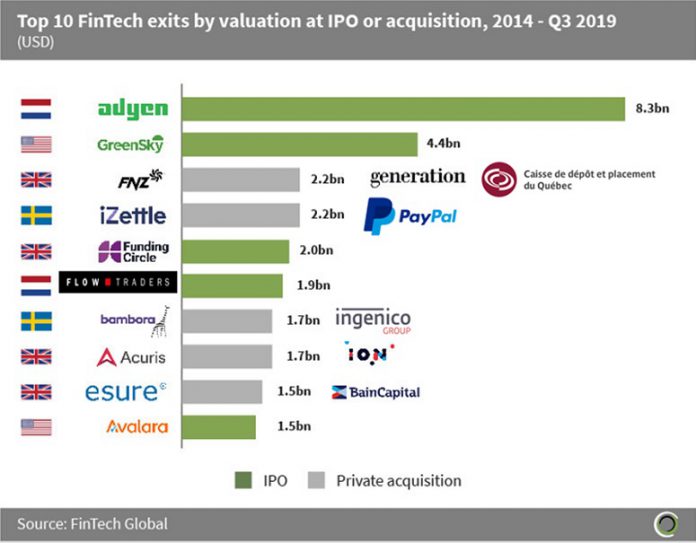

A breakdown of top FinTech exits globally shows that eight transactions involved FinTech companies based in Europe and just two in the US. The UK dominated with four of the largest exits, as London is set to overtake San Francisco as the FinTech unicorn capital of the world.

Dutch payments processor Adyen went public in June 2018 at a valuation of $8.3bn. Its IPO was a huge success, with the stock price surging 90% in its first day of trading, ending the day with a $15.8B valuation. This is the largest realised FinTech exit globally to date.

FNZ is a global FinTech firm, transforming the way financial institutions serve their wealth management customers. It partners with banks, insurers and asset managers to help consumers better achieve their financial goals. The London-based WealthTech company was acquired by Generation Investment Management and Canadian pension fund Caisse de Depot et Placement du Quebec in October 2018 for $2.2bn, marking the largest FinTech exit in the UK to date.

iZettle, the Swedish payments processing and mobile payments solution provider founded in 2010, was acquired by payments giant PayPal for $2.2bn in 2018, with the deal finally clearing in June 2019. This is the largest exit for a Swedish FinTech company and the joint third largest FinTech exit globally. The rationale for the deal was that the combination of these two companies brings together iZettle’s in-store expertise, recognised brand and digital marketing strength with PayPal’s global scale, mobile and online payments leadership, and trusted brand reputation.