On the back of having raised a $85m fund, the founders of venture capital firm Luge Capital are ready to help Canadian FinTech startups thrive.

Karim Gillani (pictured left) is an early riser, but it doesn’t mean what you think. Usually, describing tech leaders’ morning routines involves things like Twitter boss Jack Dorsey’s regular ice baths or Elon Musk immediately responding to work emails the moment he wakes up, propagating the idea that there is something almost superhuman about them.

However, despite being tapped as one of the people that will bring Canadian FinTech into the next decade, the beginning of Gillani’s daily routine is comparatively down to earth. “My mornings are filled with daddy duties,” he tells FinTech Global. The first thing he does is to wake up his two-year-old son, prepare breakfast and wait for his wife to take over when its time for the kid’s drop-off.

Only then does Gillani head out the door to go to work as one of the two co-founders and general partner at Luge Capital, the new venture capital firm that recently raised $85m to support the growth of Canadian FinTech startups. But he reveals that taking on this role was something he had not imagined he would ever do. “I didn’t really have strong ambitions to go into venture capital,” Gillani says.

While most VC investors launch their business after a successful career as entrepreneurs themselves, Gillani and his co-founder David Nault (pictured right) had to be convinced to go down this route.

Before deciding to take the plunge, Gillani had been the vice-president of strategy and corporate development at Xoom until the funds-transfer company was acquired by PayPal in 2015. He then took on the role of leading PayPal’s Canadian corporate development practice. “I was also part of the team that was investing out of our PayPal Ventures fund, which is a $350m fund,” Gillani recalls.

Things changed when one of his friends, Chris Arsenault, partner at VC firm iNovia Capital, called him. “And he basically said, ‘Look Karim, I want to tell you that there is a FinTech fund that’s coming together in Canada and I think you should help run it,’” Gillani remembers.

He was initially hesitant about the offer. “At the time we were doing really big things with PayPal,” Gillani explains. “We had a lot of big opportunities ahead of us and my first instinct was [to say], ‘You know what, I’m good where I am. I’m happy.’” Still, Arsenault convinced him to at least meet the investors backing the potential fund and Nault. “No commitment, just to see how it goes and that seemed innocent enough to me and I said ‘Yes, let’s do it,’” Gillani continues.

Nault is an investment veteran, having clocked time as a mentor at startup accelerator FounderFuel, an advisory board member on startup-supporting non-profit Venture for Canada and, most recently, as vice president of investments at iNovia Capital. While Nault had been tapped to lead the round, he had been told he needed the right partner. Arsenault suggested they should give Gillani a ring and offer him the role. “Chris and I had known each other for years and he had been wanting me to come to iNovia for a long time,” Gillani says.

He met up with Nault and the two of them began to discuss what the potential new venture’s investment strategy would be and how the portfolio would look like. At the same time Gillani met up with the new fund’s anchor investors: pension fund Caisse de dépôt et placement du Québec (CDPQ) and the credit union Desjardins Group. And Gillani liked what he heard.

“Very soon we reached this point of no return where we, David and I, kind of sat down and said, ‘We either do this or we don’t do this and if we do it, we really do it. We jump in with both feet,’” he recalls. And after getting the thumbs up from their respective wives, the two made the leap. “It was the right thing for us and it was the right thing for the ecosystem,” he says.

With the two co-founders having agreed to spearhead the venture, CDPQ and Desjardins Group committed to put in the first $50m of the future $85m fund. The rest of the funding was raised by additional backers La Capitale, Sun Life Financial and Fonds de solidarité FTQ.

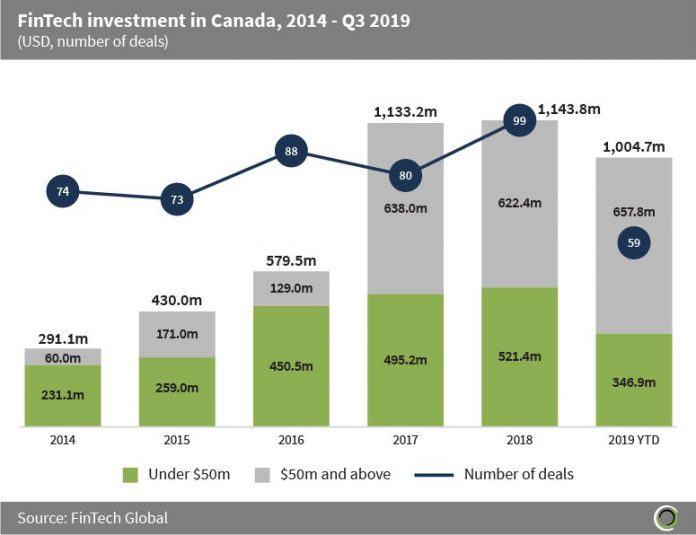

The launch of Luge Capital comes as the Canadian FinTech scene is scaling at a tremendous speed. The industry in the country attracted $291.1m of investment in 2014, according to FinTech Global’s data. That number jumped in the following years, reaching $1.14bn in 2018. And 2019 could be another record year, with $1bn having already been invested in the Canadian industry. In total, Canada’s FinTech sector has attracted nearly $4.6bn since 2014.

Gillani explains that this growth depends on several things. “One, there is more access to capital, particularly in the early stages and, you know, Luge fits squarely into that category of providing early-stage capital for the FinTech industry,” he says. That includes domestic as well as US and European investors injecting investments into the Canadian FinTech growth.

A second reason he has identified is that there has been an increase in collaborations between big businesses and startups in the industry. “We’re seeing a lot more integration of different technologies between incumbents and the FinTech companies in Canada, and that has been driving a lot better user experiences for both consumers and businesses,” Gillani says.

Thirdly, Canadian policymakers have made moves to create initiatives, like the ones surrounding open banking, which has contributed to making the Great White a FinTech hotbed. “Those are, I’d say, a handful of the factors that I think are contributing to the sort of recent uprising [of startups],” he continues.

Of those companies, Luge Capital look at between 40 to 60 new enterprises every quarter to find out whether or not they are the right fit for the firm. To find the cream of the crop, Gillani and Nault look for several things in the startups they invest in.

“No two deals are ever really the same, but it’s usually a combination of the founders and the team that surrounds the founders, he says. “Their calibre, perseverance, pedigree and just their raw energy to make their business flourish.”

Luge Capital also looks at what the market opportunity is. “Is this really a big problem that needs to be solved or is this just a one hit wonder?” Gillani explains. Importantly, the team looks if the candidate startup can scale, what the next five to ten years may look like and if it is sustainable.

That includes their global opportunity. “We want to ensure that this business has the path ahead of them to do business, not just in Canada or the United States, but also in Europe and Australia, the Far East and other geographies,” he continues.

The investors also take a deep dive into the startup’s technology to understand how it works. That means checking if it is built on micro-services, API driven, multilingual and multi-currency adaptable.

Similarly, Luge Capital is adamant entrepreneurs should also feel the firm is right for them. “It’s like getting married and once you get married, it’s a lot harder to get divorced, so to speak,” he says.”You have to choose the right investor because they get involved in the business sometimes in a very big way.”

That being said, Gillani is convinced that Luge Capital can provide unrivalled support to fledgling FinTech founders. “For one, everyone at Luge has an operating background, we’ve all been operators and most of us have been entrepreneurs,” he argues. “We all have expertise in financial services or FinTech, so we understand the space.” Gillani adds that the team also have a strong understanding of international regulations, enabling it to help companies grow around the globe, and that Luge Capital will also set up the startups in its fold for potential partnerships with its partners.

Gillani and Nault plan to exit 2019 key “somewhere between seven and ten” startups in their portfolio. “And then, rather than then give you a number for 2020, it’s probably more illustrative for me to say that we’re planning to have somewhere between 20 and 25 companies in our portfolio in total for fund one,” Gillani adds.

Copyright © 2019 FinTech Global