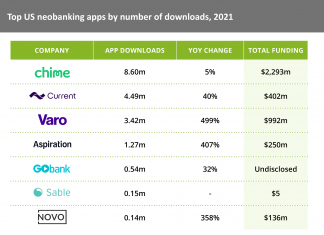

From angry vendors turning up to the company headquarters demanding payment to multiple redundancies, rumour has it that digital banking scaleup Aspiration is facing some financial problems.

Before now, the American business has been pitched as one of country’s next unicorns. Not only does it offer a compelling and environmentally conscious solution that enable customers to pick how much they pay for services, but it has also picked up over $100m in investments.

Actors Leonardo DiCaprio and Orlando Bloom have famously bet on the company’s success by injecting money into the business. FinTech Global reported about Aspiration’s $47m Series B funding round in 2017.

However, a new CNBC report suggests the good times may be at an end. The report noted the $200m new founding round the enterprise’s CEO Andrei Cherny had advertised in April had still failed to manifest.

A person familiar with the startup’s affairs told CNBC that the Series C round, which was reportedly supposed to bring the scaleup into the realms of unicorns, said that the company is unlikely to close the round until the end of the year.

The source also denied Aspiration laying off 15% of its staff in October had anything to do with any financial troubles. Instead, the person suggested that it was due to a project having been completed.

Cherny also denied the claims about the company having run into any financial problems, citing that the company had received $50m in 2019 and that more was in the pipeline.

Moreover, he noted the company has already signed up 1.5 million customers and argued that changing the team and having “prudent cash management” was “part of being a startup.”

Nevertheless, the CNBC report suggested that neither vendors nor employees are taking the company’s situation with a similar sense of optimism.

Vendors had reportedly been irate about the company withholding payments since this summer, according to sources speaking with CNBC.

Some have allegedly even showed up the Californian headquarters, demanding payment whilst others have supposedly reached out to Aspiration’s workers on LinkedIn, wondering if the company was still up and running.

The report also claimed several of Aspiration’s workers were actively looking for employment elsewhere.

An anonymous recruiter who had helped Aspiration find engineers had since sued the scaleup after it allegedly failed to pay him for his service. “The last thing I want to be is another creditor in line in a bankruptcy,” he told CNBC. “Everyone over there wants out because they see the writing on the wall.”

Some of the experts CNBC spoke with suggested that Aspiration failing to close the Series C round might be due to investors having cooled down after several high-profile unicorns have failed to live up to expectations. Uber’s unimpressive IPO and WeWork’s botched one are two recent examples.

Despite global FinTech investments growing, Ben Cukier, a FinTech investor at Centana Growth Partners, told CNBC, “I think the bubble will burst or at least slowly deflate,” adding that there would “certainly going to be consolidation” as well as failures.

Copyright © 2019 FinTech Global