FinTech in Africa is on the rise. The latest sign is DPO Group noticing a 35% spike in digital transactions during Black Friday in South Africa.

The payment service provider reported the year-on-year jump of digital transactions made in South Africa on its platform during the shopping holiday, saying the number of payments exceeded its own forecast and represented a rise of nearly 500% on usual daily transaction volumes.

“These numbers reveal the rapidly growing appetite amongst businesses and consumers in Africa to be able to transact securely online, underlining the enormous potential of e-commerce to boost economic growth on the continent,” said Eran Feinstein, CEO and co-founder of DPO Group.

“We are also starting to see the Black Friday phenomenon gaining traction in other African countries – there was a significant increase in transactions on our platform in East Africa during the Black Friday weekend.”

When PayFast, a payment processing company that is also a DPO Group company, looked at the data from Black Friday, it found that 61% were made via smartphones and 39% were made on a desktop. Only 1.5% of the transactions in the desktop category were made via a tablet.

“Kenya has led the continent in revolutionising mobile transactions over the past decade. Around 20% of adults in sub-Saharan Africa now have a mobile money account, a higher share than any other region in the world,” Feinstein added. “This access, combined with our secure and fast payment services has resulted in a huge swing towards a preference for transacting via mobile phone, illustrating the significant possibilities for business growth across Africa.”

Rising digital payments are one sign of Africa maturing as a FinTech hotbed.

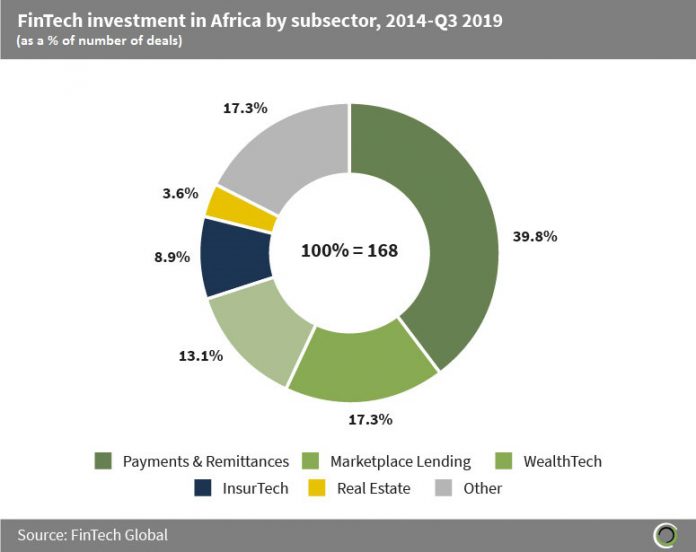

Another is the fact that the Sub-Saharan industry has attracted over $1.1bn since 2014, according to FinTech Global’s data.

Of that, 39.8%, was invested into payments and remittances companies. Marketplace lending businesses attracted 17.3% of the money.

More recent investments include AZA Group collecting $15m in debt financing from The Development Bank of Southern Africa, South African-based Standard Bank investing $4m in Nomanini and Visa investing in Interswitch, making the digital payments firm the continent’s latest unicorn.

Copyright © 2019 FinTech Global