InsurTech companies in Asia present an attractive investment opportunity due to the many underinsured population groups present across the region. The traditional insurance market in Asia is often targeted at high net worth individuals due to agents being disproportionately driven by commission. This leaves a huge market which can be tapped into by InsurTech solutions aiming to bring insurance to the masses.

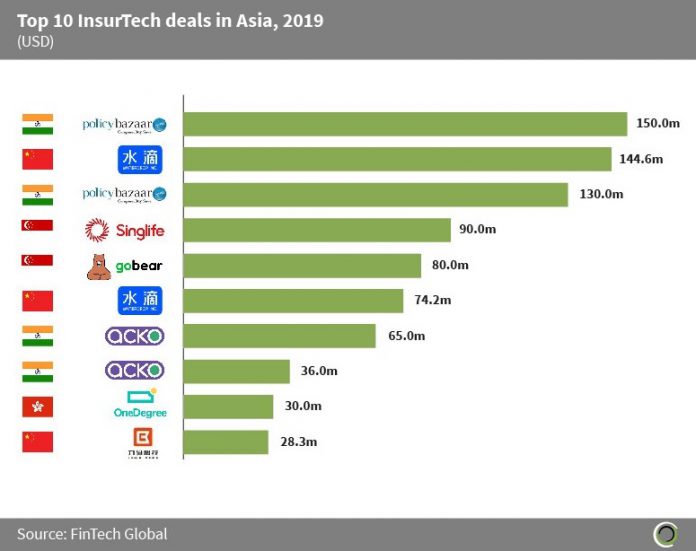

InsurTech companies in Asia raised $1.1bn during 2019 across 53 transactions, with $828.1m raised in the top 10 transactions of the period. The amount invested in these deals equates to 74.7% of the total capital raised during the period. Companies in India account for four of the top 10 deals. India is a strong contender for a leader in the region due to the vast population but yet limited reach of insurance companies in the country, with insurance penetration sitting far below the global average at only 3.69% in FY18.

The largest deal of the period went to Indian insurance aggregator PolicyBazaar which raised $150m in a Series G round led by Tencent Holdings, which took a stake of between 7% and 10% in the company. The company which is India’s prominent online life insurance and general insurance aggregator, specialising in making comparative analysis of insurance products will use the capital to move into new segments of financial services.

The largest deal raised outside of India or China was digital life insurance provider Singlife’s $90m corporate round in July 2019 led by Sumitomo Life Insurance Company. Singapore differs from many other Asian countries in that around two-thirds of the population is already insured and therefore InsurTech disruption must come from the improvement of existing services.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global