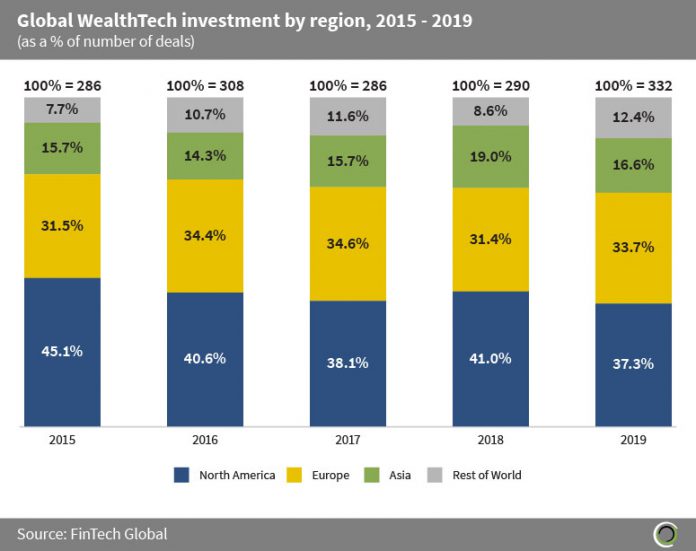

Rest of World’s share of WealthTech deal activity is up 1.6x since 2015

- Since 2015, WealthTech companies have raised over $25.9m, with North American companies taking the lion’s share of funding, attracting $9.4bn during the period.

- However, North America’s share of deal activity had slowly declined from 45.1% in 2015 to 37.3% in 2019, showing that investors have been increasingly looking to fund WealthTech companies in other countries. This is seen most notably in the “Rest of World” category containing Africa, Australasia, Latin America, Middle East & Israel where deal activity increased by 4.7 percentage points (pp) since 2015.

- The share of global deal activity in Europe & Asia has seen minimal fluctuation, increasing by 2.2 & 0.9 pp over the same period, respectively.

- N26, a German challenger bank, raised $300m in 2019, which is the largest recorded WealthTech investment in Europe. Founded in 2015, N26 has raised a total of $683m in funding and has reported strong growth from its main market in Europe, as well as recently expanding into the US. The company now has five million customers across 24 countries and was last valued at $3.5bn in July 2019.

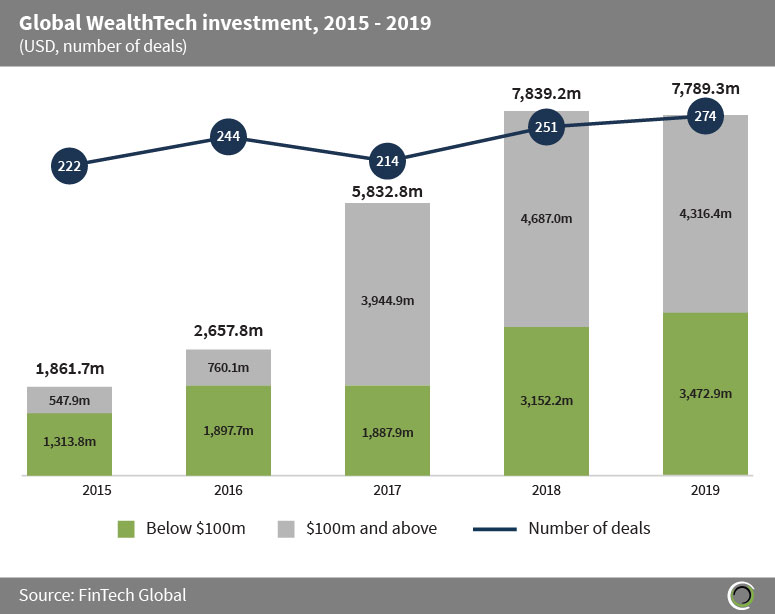

Global WealthTech deal activity in 2019 set a new record of 274 transactions

- Deal activity hit an all time high of 274 WealthTech investments globally in 2019. However, total WealthTech funding in 2019 was lower compared to the previous year. In 2019 the number of transactions that fell into the $100m and above category was smaller in comparison to 2018. This indicates that globally a higher proportion of investors have backed smaller sized deals compared to the previous year.

- Global WealthTech investment is concentrating less in North America dropping by 7.8 pp since 2015 and spreading out more to the rest of the world, which explains the change in investor behaviour. Deals raised by North American WealthTech companies tend to be larger in comparison to the rest of the world, which explains the slight drop in total investment in 2019. The $100m and above category accounts for 10.9% of deals in North America, which is more than countries outside the region where only 8% of deals were valued at $100m or higher. North America is loosening its hold on the global WealthTech market as FinTech hubs start to form in other regions around the world.

- Funding increased year on year from almost $1.9bn in 2015 to over $7.7bn in 2019, at a CAGR of 33.1% during the period.

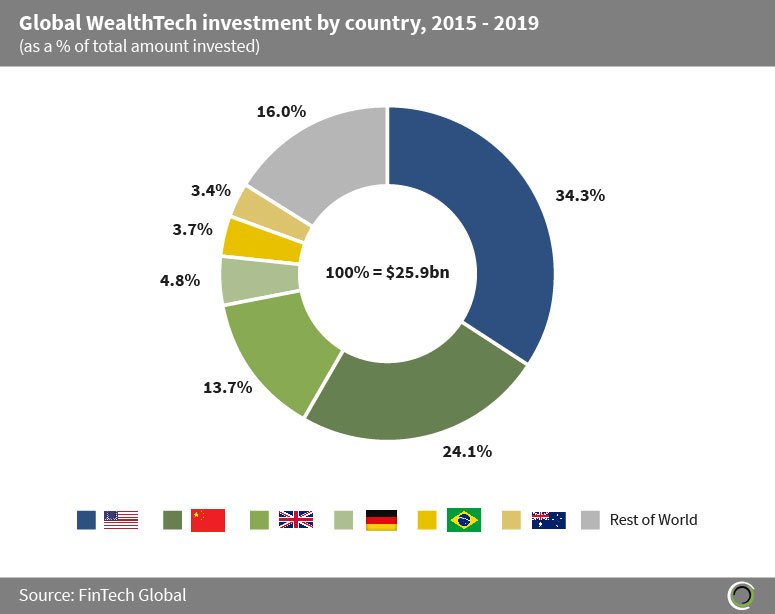

Over 70% of the capital raised in the sector since 2015 has been raised by WealthTech companies in just three countries

- In last five years the global WealthTech sector has received over $25.9m in funding and over 70% of that funding was raised by WealthTech companies in US, China, and the UK.

- In recent years the United Kingdom & China have been developing an economic environment for their FinTech ecosystems to thrive. The success of the UK FinTech (WealthTech) ecosystem comes from the supportive government policies such as corporate tax incentives, government subsidy schemes, and regulatory/ legislative initiatives. In comparison China’s ecosystem is driven by strong access to a very active IPO market, government owned funds, and FinTech (WealthTech) powerhouses such as Tiger Brokers, Wacai, and Qianbaomu.

- JD Digits (JD Finance) is one of China’s WealthTech giants offering financial solutions in areas such as asset management, payment solutions, financial loans, and crowdfunding. Since 2017 JD Digits has raised over $4bn in two rounds (Series A & B) led by China Creation Ventures, CICC, COFCO, and APOFCO.

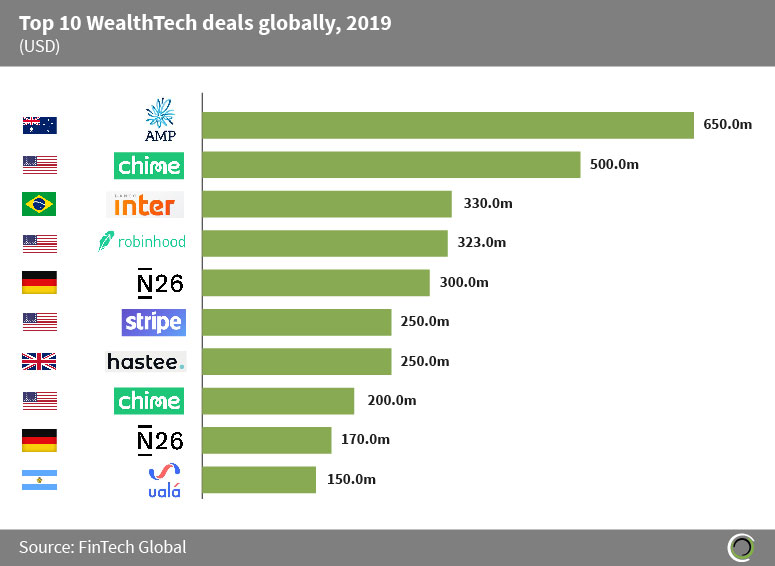

Over $3.1bn was raised by the top 10 WealthTech deals in 2019

- More than $3.1bn was raised in the top 10 global WealthTech transactions and four of these deals were raised by US companies, Chime, Robinhood, and Stripe. This shows that transactions in the United States are more commonly larger sized deals in comparison to other countries.

- Chime, a US challenger bank, raised $500m in a Series E round led by DST Global. This is the largest recorded investment into a challenger bank and is now valued at $5.8bn. The investment will be used to open an office in Chicago and grow its product line, alongside potentially acquiring other FinTech companies.

- AMP, an Australian wealth management company, received the largest WealthTech investment of $650m in 2019. The company offers a range of services like financial advice, investment products, insurance, income protection, and banking services. AMP’s CEO Francesco De Ferrari stated the $650m investment combined with the $3bn raised from selling its life insurance business will be used to simplify AMP’s operations. This will be achieved through a change in their business strategy to generate higher returns and internal growth.

We are currently looking out for the 100 most innovative WealthTech companies worldwide. If your company or a company you work with is a leader shaping the future of the WealthTech industry please tell us more about it on our website

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global