Singaporean FinTech is popping. A slew of international players has noticed and has jumped on the opportunity to cut out a slice of the pie for themselves.

MoneyGram, the cash transaction and payment company, is the latest FinTech enterprise to make the move. Hot on the heels of having signed a partnership with LuLu Money and another one with the Suez Canal Bank in January, MoneyGram’s website is now live in Singapore. By giving customers in the city the chance to use its services, the venture hopes to tap into the market that annually sends $7.2bn out into the rest of the world.

“Accelerating digital growth and growing our direct to consumer business is core to our company strategy,” said Kamila Chytil, COO at MoneyGram. “Customers are increasingly valuing the investments we’ve made to enhance their experience and we’re thrilled to bring these capabilities to the digitally-savvy population of Singapore to send money to friends and family around the world.”

MoneyGram is not alone in recognising the opportunity of the Singapore market. For instance, UK challenger bank Revolut went live with its services in Singapore in October 2019 and Dutch banking software provider Backbase joined it in January this year.

And when Singapore opened up for companies to apply for five new digital banking licences, more than 20 businesses reached out to compete for the slots.

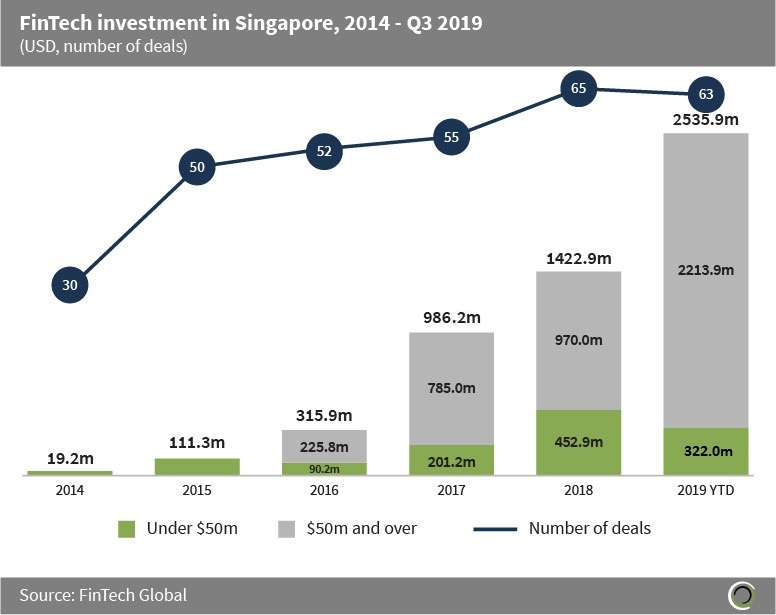

It easy to see why people are excited about the market. Since 2014, the FinTech sector in the city-state has attracted over $5.3bn in investment, according to FinTech Global’s data.

In 2014, the nation’s ecosystem drew in a total of $19.2m. That figure skyrocketed to $2.53bn in the first three quarters of 2019.

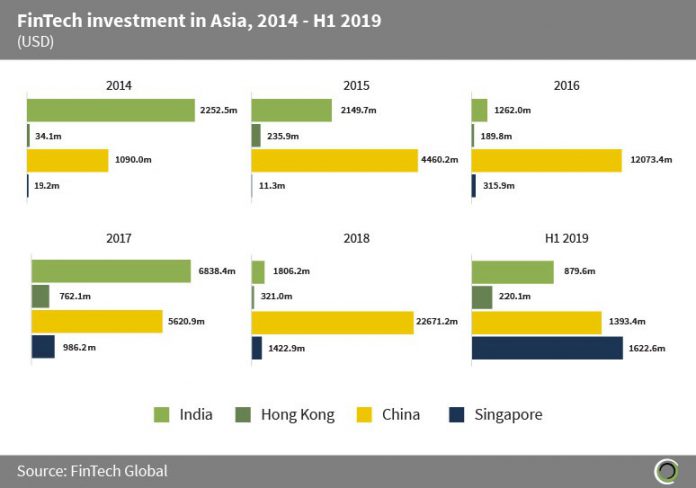

In fact, in the first six months of last year, FinTech investment in Singapore even exceeded the amount raised in China and India.

Part of the reason why Singapore has been able to become an Asian FinTech hotbed is because it has created a culture embracing disruption, a solid regulatory foundation and that its regulators support innovation.

For instance, the Monetary Authority of Singapore (MAS) and the Bank for International Settlements launched an innovation hub in Singapore in November 2019.

In the same month, MAS also signed a cooperation agreement with eight Canadian regulators to improve FinTech collaboration between the two nations.

Nevertheless, MAS has stated that there is still more work to do ensure people in Singapore trust financial services. In a recent speech, Ong Chong Tee, regulator’s managing director, stated that while Singapore has created a lot of regulations to protect customers against dodgy behaviours, more must be done.

“Just being safe is not good enough,” Chong Tee said. “A vibrant financial sector must be able to support the smooth functioning of credit and money flows. It should meet the savings, investment and insurance protection needs of the people. Investors on their part want to have the confidence that they are treated fairly by financial institutions and that their savings are safe. This is why building trust in our financial institutions is so important. That trust goes beyond doing what is legally required, to include what is good and what is right.”

Copyright © 2020 FinTech Global