Singapore’s FinTech companies have attracted a lot of investment recently. But will the good times keep on rolling?

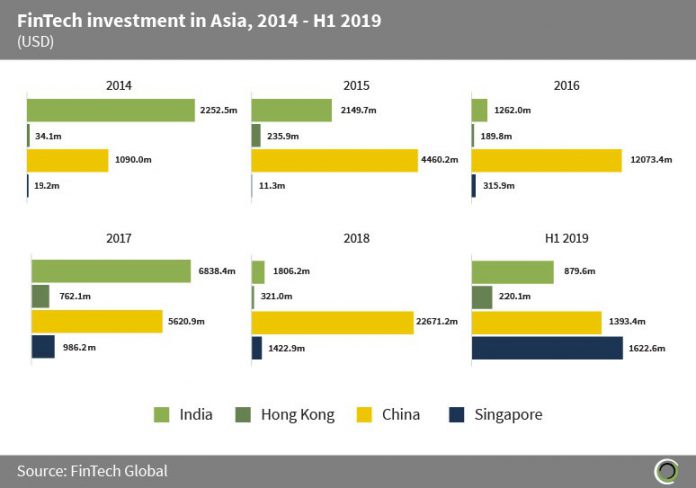

In the first six months of 2019, Singapore did something extraordinary – the country overtook China as Asia’s biggest destination for FinTech investment, according to FinTech Global’s data. During that period, Singapore’s FinTech sector raised $1.62bn whilst their Chinese peers only raised $1.39bn. India, which was leading the Asian FinTech investment league in 2014, raised $879.6m in the first six months of this year.

Singapore’s FinTech scene has gone from strength to strength over the past six years. Back in 2014, it only raised $19.2m. Flashforward to 2018 and that number jumped to $1.42bn.

And if you ask Wissam Khoury, senior vice president and general manager for MEA and APAC at Finastra, the FinTech company creating providing banks and other financial services companies with a platform for innovation, it is hardly a secret why that is the case.

“Singapore continues to attract an increasing number of FinTech investors with its strong regulatory approach, ability to embrace disruption and innovation and its prime location as a gateway to the dynamic SEA region,” he tells FinTech Global.

“The steady flow of funds into Singapore demonstrates the city-state is taking the right steps towards becoming a global FinTech hub and that investors are confident of the future potential for both Singapore and its fintech industry.”

And the country is looking to keep innovating. For instance, the nation is now accepting application for five new digital bank licences. “For Singapore, the upcoming digital banking licences will be an important development to look out for,” Khoury says. “[This] will open up opportunities for fintech startups and traditional banks to partner and cooperate, and looks set to add another wave of investments in the sector.”

But that does not mean Singapore will always remain ahead of China. After all, the country’s FinTech scene raised a whooping $22.67bn in 2018 alone. “With its expansive market and developed tech industry, China will always whet the appetite of global FinTech investors,” Khoury says. “Moving forwards, a determining factor in investment influx will be how the government recalibrates itself with regards to the ongoing trade tensions with the US.”

Nevertheless, he believes Singapore’s has a bright future ahead as a hub for FinTech innovation. “The stability and sophistication of Singapore’s financial and FinTech ecosystem and forward-looking approach to progressive regulation provides clear upsides for investors looking to bet on Asia’s rising FinTech trailblazers and solutions,” Khoury adds.

“Singapore’s leading FinTech infrastructure in the region also places it ahead in the race to power Asia’s future financial services solutions and attract quality investment. According to Finastra’s inaugural market first Open Banking Readiness Index released in 2018, Singapore currently tops the race in open banking readiness across 14 APAC markets surveyed, and is the pace-setter for leveraging APIs in data monetization, primarily owing to the maturity of its Open API and data infrastructure.

“The priority is ensuring Singapore continues to build and sustain a FinTech ecosystem that is open, collaborative, and diverse. If it maintains a stable, forward-looking approach to FinTech and fosters an appropriate balance between regulating and affording industry players ample space to create, collaborate and innovate, Singapore should be well placed to sustain a steady influx of FinTech investment.”

Copyright © 2019 FinTech Global