German FinTech companies have raised more than $5.9bn since 2015

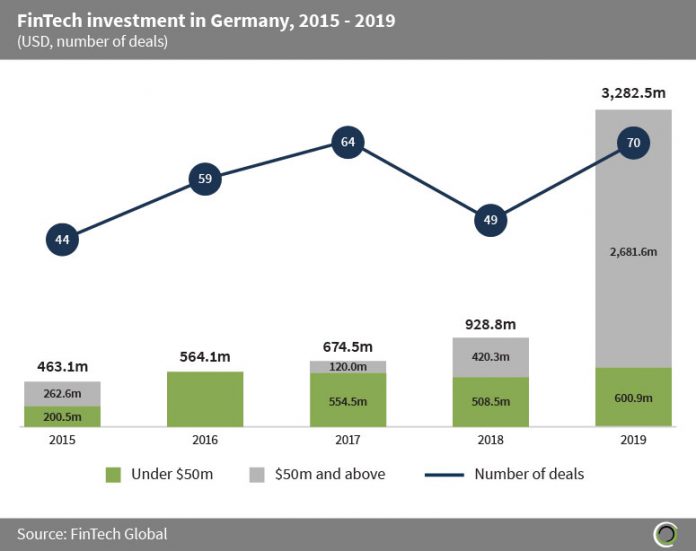

- FinTech companies in Germany collectively raised over $5.9m in funding across 286 transactions between 2015 and 2019. Last year was very successful for the German FinTech industry, in terms of both deal activity, which reached 70 transactions, and investment which hit $3.3bn, a significant increase in comparison to previous years.

- The country’s FinTech market has become more developed as interest increased from foreign investors, which led to the rise in average deal sizes and volume of transactions. Evidently, this is most noticeable in the funding from deals valued at $50m and above, which has grown by over 10x since 2015.

- In Germany there were no deals valued at $50m and above in 2016, which shows that all the transactions were early stage funding rounds for FinTech companies. This indicates that the established FinTech companies in Germany were not ready for large scale expansion of their operations during the year. The reason for this was due to the combination of political uncertainty caused by the UK referendum in June 2016 and the economic uncertainty from the two largest lenders in Germany (Deutsche Bank & Commerzbank) experiencing sharp drop in shares that year. This indicates that investors were waiting for the political uncertainty to clear up before committing to large investments into the FinTech sector.

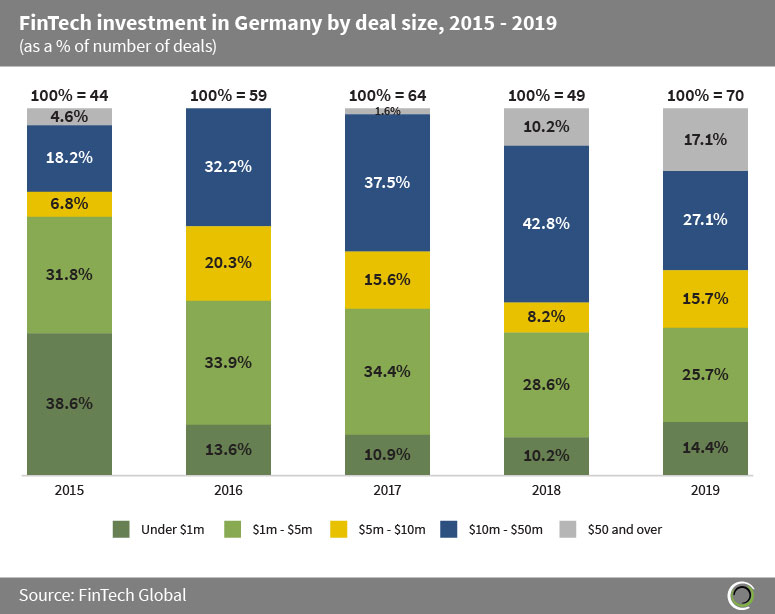

German deals valued at $50m and over have increased their share of deal activity by 12.5 percentage points (pp) since 2015

- The volume of deals valued at $50m and above increased by 12.5pp since 2015, which is a sign that the German FinTech market has been maturing throughout the period. According to EY, the FinTech market is the largest recipients of Venture Capital funding in the country. The sector has provided great opportunities for foreign investors especially in subsectors like Payments & Remittances, InsurTech, and WealthTech.

- Furthermore, the deals valued at less than $5m experienced a drop in their share of deal activity by 30.3pp since 2015. Another explanation for this could be that investors backed later stage funding rounds due to the success these companies had in the market.

- The German FinTech market had no deals valued at $50m or more, which does indicate that no company was ready for large scale expansion or growth of operations in 2016. However, there was a significant rise in the volume of deals valued between $10m and $50m by 14pp from 2015 to 2016. This demonstrates that FinTech companies in the country were experiencing internal growth that year.

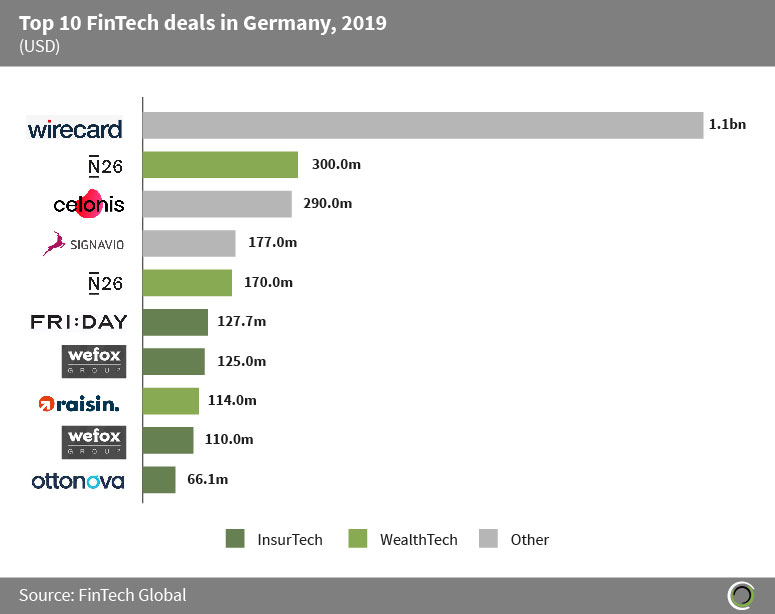

Seven of the top 10 FinTech deals in Germany last year were raised by InsurTech and WealthTech companies

- The top 10 FinTech deals in Germany raised $2.6bn with four of these transactions raised by InsurTech companies FRIDAY, Wefox Group, Ottonova and three by WealthTech companies Raisin, and N26.

- Wirecard, a German payments company, raised $1.1bn in a post-IPO equity round led by SoftBank in April 2019. SoftBank’s investment was part of a strategic partnership to spearhead the newest innovations on an international scale. Furthermore, with Wirecard’s new partnership and funding, the company will expand into the Eastern Asian markets to strengthen its position on the continent.

- According to a Germany Trade & Invest report, the German InsurTech subsector has continued its upward trend due to high investor activity in the market. The subsector is quite active across the country with large InsurTech hubs in Berlin, Munich and Cologne. Unsurprisingly, the InsurTech companies FRIDAY, Wefox Group, and Ottonova are all based in either Berlin or Munich.

- The Other Category contains a Data & Analytics company (Celonis), a Payments & Remittances company (Wirecard), and a RegTech company (Signavio).

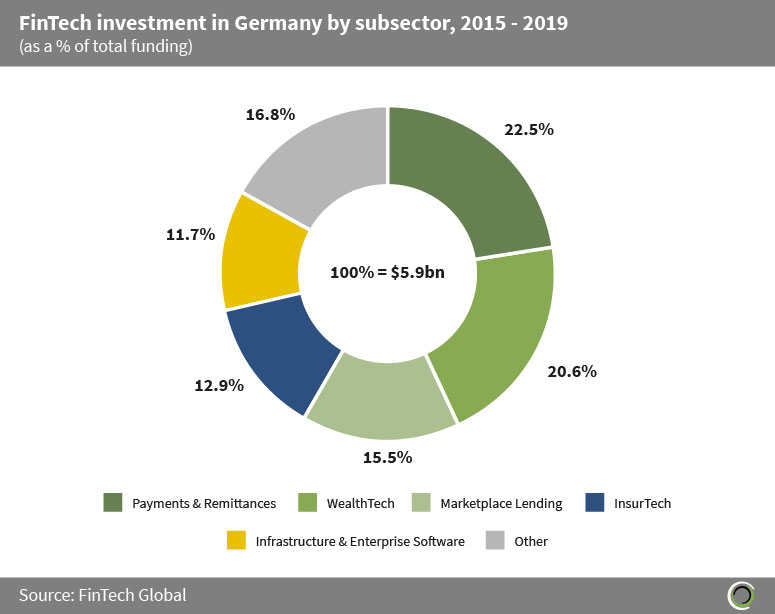

Three FinTech subsectors almost captured 60% of FinTech investment in Germany since 2015

- The Payments & Remittances subsector captured the lion’s share of FinTech investment with 22.5% which equals to $1.3bn in funding since 2015. FinTech plays an important role in providing digital payment services such as e-commerce and mobile payments. Germany has the second largest Payments & Remittances market in Europe. According to Statista Digital Market Outlook 2019 report the country also had the largest number of e-commerce users on the continent.

- However, over three-quarters of the total Payments & Remittances funding was driven by one extremely large deal raised by Wirecard in 2019, which the transaction was valued at over $1bn.

- The Other category contains companies operating in Data & Analytics, RegTech, Real Estate, Blockchain & Cryptocurrencies, Funding Platforms, and Institutional Investment & Trading subsectors collectively capturing 16.8% of funding since 2015.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global