Australian personal finance app Cheq has reportedly scored $1.1m in a new funding round as it prepares to launch its services.

The round was comprised of $918,000 in equity and $230,000 in debt, from investors including VFS Group and more, according to a report from Tech in Asia.

Founded in 2019, the company claims it managed to reach 600 users within just two days of the beta launch.

Its mobile app empowers users to get instant access to money they earned at work, removing the need of waiting until payday. The pay on-demand solution starts by connecting with a user’s bank account so it can detect their pay schedule and spending. After this, the user can cash out up to $200 of their wages instantly.

When the next payday rolls around, Cheq deducts the amount taken out early and a 5% transaction fee.

The mobile app also helps users to better manage their finances. Tools are available which analyse spending to automatically create realistic budgets. Furthermore, if a user connects all their bank accounts to Cheq, they can see their income, spending habits, upcoming bills and how much cash they will have left.

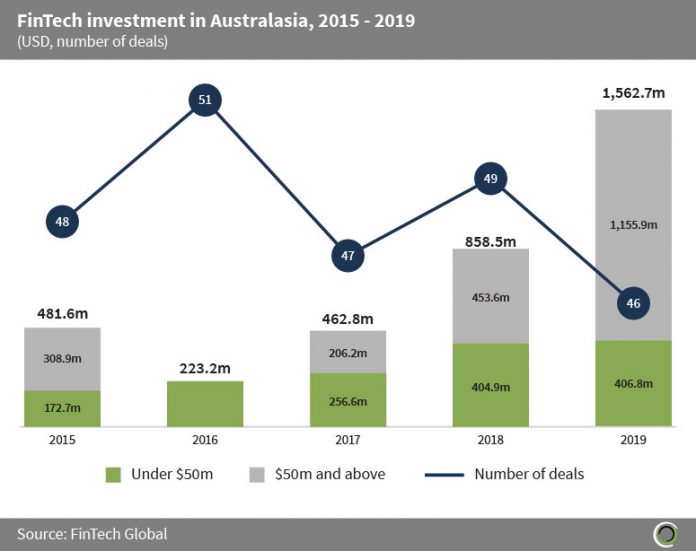

FinTech investment took off last year in Australasia. During 2019, a total of $1.5bn was invested across the continent across 46 transactions, compared with the former year when just $858.5m was invested over 49 deals.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global