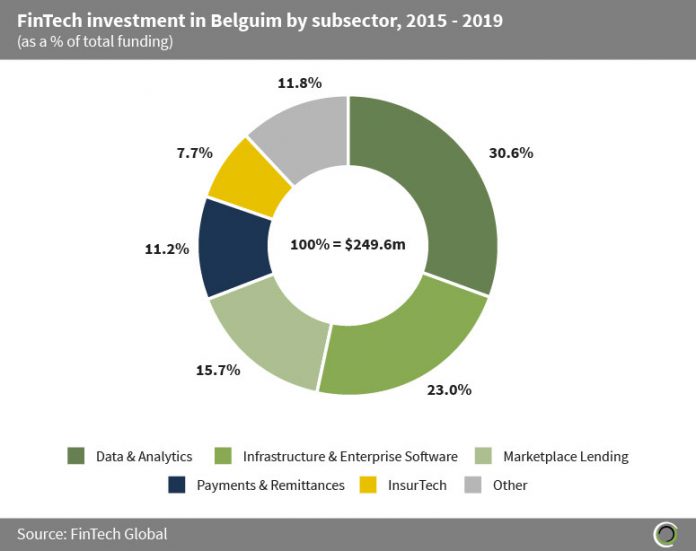

Belgian FinTech companies raised over $249.5m across 51 transactions between 2015 and 2019, with Data & Analytics and Payments & Remittances companies capturing 53.6% of investment in the country. According to ResearchGate, Belgium’s financial sector has experienced a large amount of international financial service companies opening offices in the country to exploit the unified European Union market.

MobileXpense, a Belgian expense management company, raised $23.7m in a venture round led by Fortino Capital in December 2017, which was the largest transaction raised by a Belgian Infrastructure & Enterprise Software company since 2015. The investment was used to increase marketing efforts, fund international expansion, and improve the quality of the product portfolio. Currently the company provides services to more than 1.2 million users in over 100 countries, with clients including Bridgestone and Canon.

NGDATA, a Belgian customer experience management solutions company, raised $19m in a series C round led by HPE Growth in December 2017, which is the largest amount of funding received by a Data & Analytics company in the country to date. The Data & Analytics subsector captured the lion’s share of Belgian FinTech investment with 30.6% which equals to $76.2m in funding since 2015.

The Other category comprises of Belgian WealthTech, Funding Platforms, RegTech, Real Estate, and Blockchain & Cryptocurrencies companies, which collectively raised 11.8% of FinTech investment in the country during the period.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global