From: RegTech Analyst

Drug cartels, political corruption, economic struggles and internet censorship are all factors that have contributed to making Latin America a hotbed for cybercrime, according to a new report.

IntSights, the threat intelligence company, and CipherTrace, the leader in cryptocurrency intelligence, have taken a deep dive into the criminal underbelly of Latin America in their new report The Dark Side of Latin America: Cryptocurrency, Cartels, Carding, and the Rise of Cybercrime.

They stated that even though the region has birthed some of the most sophisticated digital threats in the world, businesses without a presence in Latin America tend to overlook it.

“Cybercrime in LatAm happens out in the open, through open-source channels,” said Charity Wright, cyber threat intelligence advisor at IntSights. “This highlights the lack of government response and cultural acceptance of cybercrime as an alternative way to make money. These cybercriminals are not forming advanced persistent threat groups, but rather are partnering with local cartels and drug groups to expand businesses and opportunities. This cybercrime ecosystem is now extending beyond the continent to countries and organisations that underestimate the sophistication and impact of attacks emanating from LatAm.”

Cryptocurreny is playing a big roll in the rising threat as criminal networks use the tech to launder money. The report noted that organised crime groups and drug cartels in Latin America are taking advantage of technological advances in digital banking and money transfers.

“LatAm cybercriminals are operating almost exclusively through unregulated cryptocurrency exchanges, capitalising on the anonymity cryptocurrency offers,” said Pamela Clegg, director of financial investigations and education at CipherTrace. “While these exchanges are popular, some bad actors still use trusted networks or illegal peer-to-peer exchanges to launder their cryptocurrency. Although this method is not novel, it is evolving with the introduction of cryptocurrencies in the criminal underground and is enabled by widespread political corruption in many countries.”

Cybersecurity is the biggest RegTech sector out there when it comes to investment. The cybersecurity sector has attracted 22.2% of the total RegTech investment between 2015 and 2019, according to RegTech Analyst’s data.

Comparatively, the compliance sector only picked up 17.7% of the investment. The identification and background checking companies netted 16.2% of the total investment. In total, RegTech companies raised over $17bn between 2015 and 2019 across 947 transactions.

The news about the rising tide of Latin American cyber-threats comes as the region’s FinTech sector is coming into its own. For instance, it has birthed Brazilian challenger bank Nubank which boasts having a valuation of $10bn and more than 20 million customers under its belt.

Comparatively, UK neobanks, who are usually seen as the market leaders, only had a collective 19.6 million customers around the world at the end of 2019. Additionally, British challenger bank Revolut hit a valuation of $5.5bn after closing a Series D round on $500m in February.

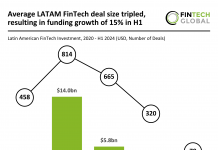

In total, Latin American FinTech companies raised $5.5bn across 328 transactions between 2015 and 2019, according to FinTech Global’s data.

Copyright © 2020 FinTech Global