The Swedish FinTech ecosystem has ambition to become a global leader. However, companies in the region struggle to find the right staff.

The Swedish FinTech Association surveyed and interviewed its members about their current outlook.

The interviews revealed that 96% of FinTech companies in Sweden are looking to recruit new team members in 2020. Yet, they may struggle to find the right talent.

For instance, 77% of the companies polled said they will be looking for software engineers in the next three to five years. Unfortunately, Arbetsförmedlingen, the Swedish Public Employment Service, has said that there is a huge shortage of people in this profession.

FinTech ventures would have to compete for this talent with other sectors.

The researchers also asked the association members about what kind of support they had received from politicians and regulators. The companies replied that its especially challenging to get the right licence to establish themselves.

Of the people polled, 79% felt that lawmakers had a poor understanding about the emerging Swedish FinTech industry.

The Swedish FinTech Association was particularly peeved about the lack of a FinTech regulatory sandbox in the region where startups could safely test their products.

The Swedish FinTech Association’s report showed that the industry is looking to grow, with 96% saying that they are looking to expand in the next five years. Most of them seem to look to first establish themselves in Sweden and then move on to the rest of the Nordics.

While Norway is not part of the EU, its membership of the European Economic Area means that many of the nation’s regulations are aligned with that of the EU.

Sweden’s EU membership also means that once the nation’s FinTech startups have established themselves in the Nordics, it falls naturally for them to expand into the rest of Europe afterwards, according to the Swedish FinTech Association report.

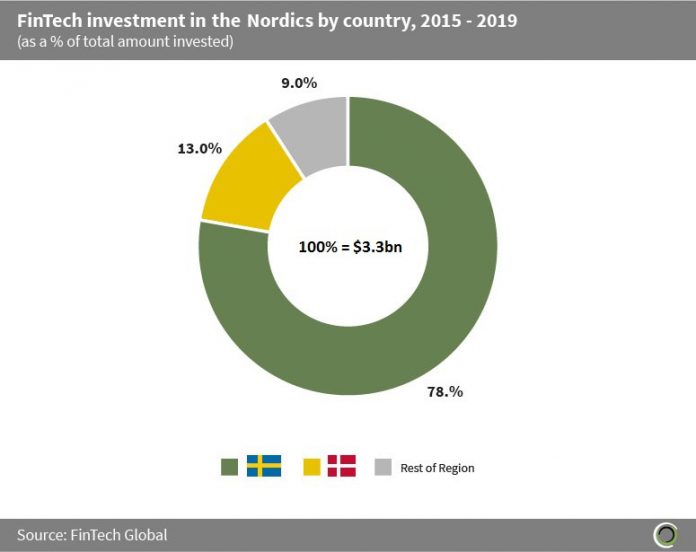

Looking at funding, the report noted that two out of three FinTech investment deals in the Nordics had happened in Sweden in the past two years.

This correlates with FinTech Global’s research that showed that 78% of the FinTech investments made into the Nordics between 2015 and 2019 flowed into the Swedish ecosystem.

Despite Swedish position as a FinTech leader in the region, many of the people polled for the report said it was difficult to raise money to get their ventures off the launchpad. Many had to rely on their own capital or loans from people they know, which the Swedish FinTech Association referred to as FFFs – friends, family and fools.

While some are saying that it gets easier to raise money once they have secured their first investment, they say its more challenging to raise funds for FinTech companies than for startups in other sectors.

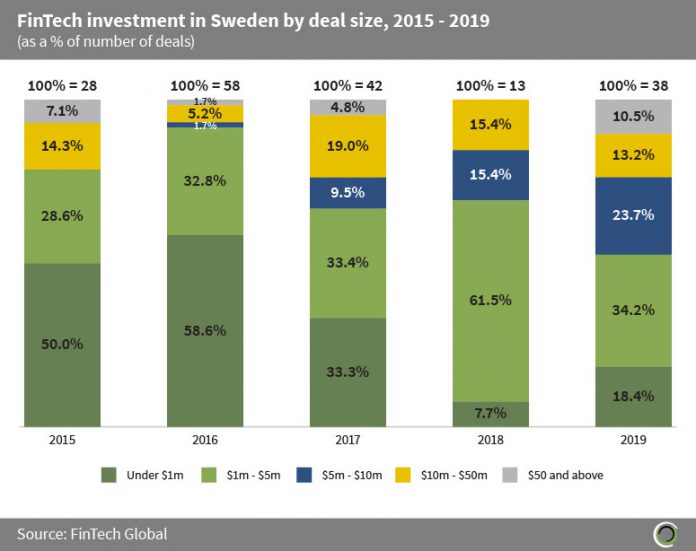

FinTech Global’s research noted that the rounds in Sweden are growing. Investment deals under $1m represented 50% of all deals in 2015. This figure shrunk to 18.4% in 2019.

At the same time, the amount of deals valued between $1m and $5m have grown from 28.6% to 34.2% in the same period. Deals worth between $5m and $10m were non-existent in 201, but grew to 23.7% in 2019.

There are now roughly 400 FinTech companies operating in Stockholm alone, according to figures from Stockholm Invest, the agency promoting the region.

Copyright © 2020 FinTech Global