Social payments app VibePay has released a new service which enables users to request payments from anyone, not just through their contacts list.

The new tool will ensure a secure bank account transfer which will remove processing fees for online sellers and accelerate speed they get paid from days to seconds, it claims.

VibePay released the service to support “social sellers” which sell products through platforms such as eBay and Gumtree. It stated that other providers often have lengthy processes which last up to 21 days. Some of the other services also charge up to 3.4% per transaction.

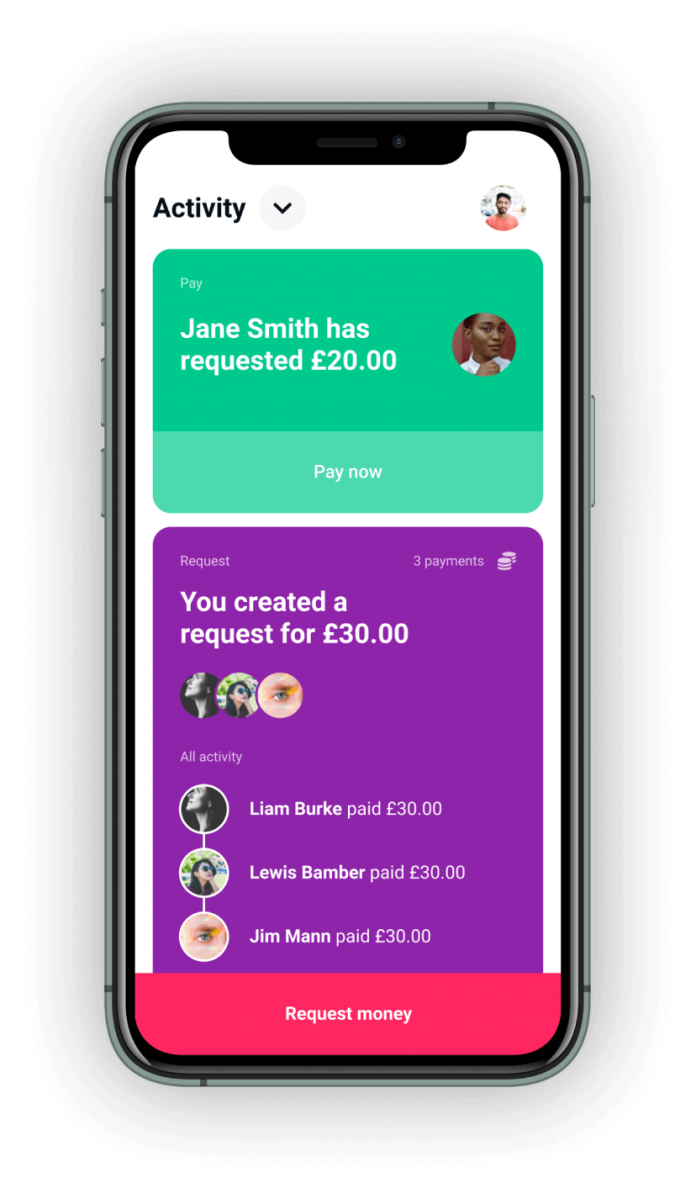

In the VibePay app, users can create a payment request and generate a unique, secure link. This can be shared with anyone either through WhatsApp or the website they are selling on. A recipient simply clicks the link and they will be taken through to the VibePay app where they can complete the transaction.

Vibe founder and CEO Luke Massie said, “Our community are telling us that they’re getting ripped off when they sell their goods online – not only paying extortionate fees but having to wait days, sometimes weeks to receive payment into their bank account. With our new payment offering, we’re putting an end to seller payment fees and waiting times.”

The FinTech platform launched six months ago and has already seen more than £1m requested through the app.

“Open banking is allowing us to eliminate the middlemen who have dominated the payments space for years and offer consumers a fast, free way to request payments online,” Massie added. “The VibePay app is just the start for us. Our vision is to use our unique payment platform and technology to enable any business to deliver a unique experience for consumers, wherever they shop online.”

The company has partnered with banks including Monzo, First Direct, Revolut, Lloyds Banking Group, Barclays and Santander. It also recently acquired licenses to enter markets across Europe including France, Luxembourg and Germany.

In the coming weeks, the company is going to announce the next phase of its growth which includes a new banking infrastructure layer.

Copyright © 2020 FinTech Global