?Total funding in the sector over the last five years surpassed $66bn as digital payment methods become more common.

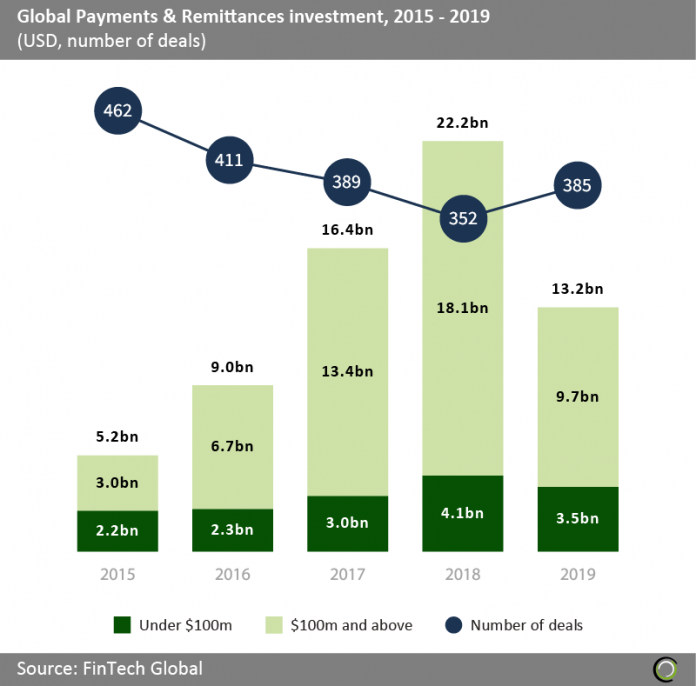

Payments & Remittances companies raised more than $66bn across 1,999 deals globally, with large transactions ($100m and above) accounting for 77.1% of total investment in the sector between 2015 and 2019.

Total capital invested globally increased at a CAGR of 62.2% from 2015 to 2018, demonstrating the increased backing from investors as digital means of payments become the norm. However, investment in the sector last year declined by over 40% to $13.2bn as the sector reached saturation and consolidation efforts were underway.

Total capital raised in the sector reached a record of $22.2bn in 2018, which was driven by large-scale investments. Ant Financial, a Chinese mobile and online payments platform, accounted for 63.1% of global investment that year with one massive funding round. The company raised $14bn in a series C round led by GIC and Temasek Holdings in June 2018.

One fifth of Payments & Remittances deals raised last year were valued at $50m and above

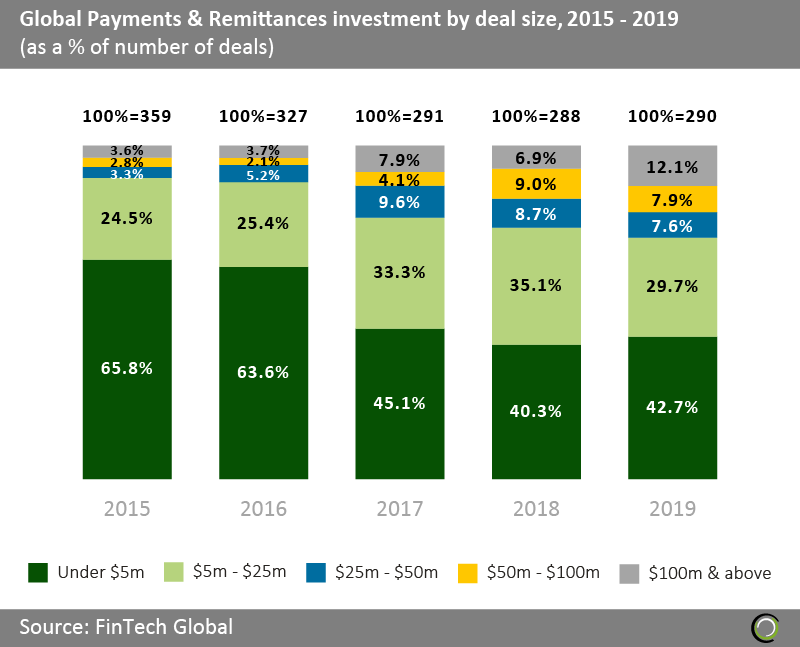

The share of deal activity for transactions valued under $5m dropped by more than a third from 65.8% in 2015 to 42.7% in 2019, showing a shift in investment towards later stage funding rounds.

Global Payments & Remittances landscape has been maturing between 2015 and 2019, with the proportion of deals valued at $50m and above increasing from 6.4% to 20% over the five-year period.

The number of transactions valued over $100m almost doubled YoY in 2019. Further supporting that the record global investment level in 2018 was driven by the one-off abnormally large transaction raised by Ant Financial.

Last year recorded the highest proportion of deal activity for transactions valued over $100m during the 2015-2019 period. However, global Payments & Remittances investment in 2017 exceeded the level of investment in 2019 by $3.2bn. The investment was driven by six abnormally large funding rounds, which collectively raised $9.9bn in 2017.

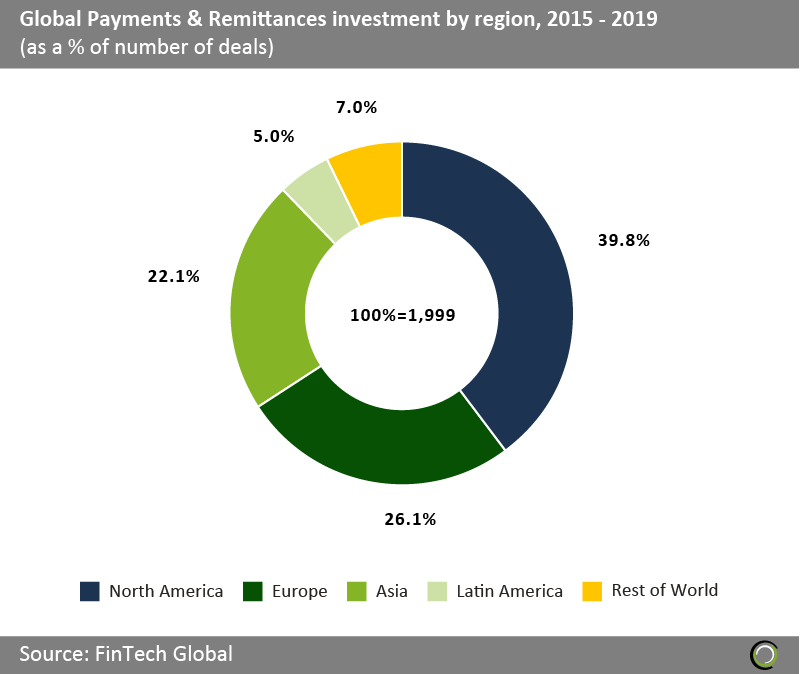

North American companies captured nearly 40% of global deal activity since 2015

As payments worldwide move towards digitalisation the Payments & Remittances subsector has seen explosive growth over the last five years, with North American companies driving this innovation. Companies in the region accounted for 39.8% of total transactions in the sector since 2015, followed by European companies receiving 26.1% of global deals.

As payments worldwide move towards digitalisation the Payments & Remittances subsector has seen explosive growth over the last five years, with North American companies driving this innovation. Companies in the region accounted for 39.8% of total transactions in the sector since 2015, followed by European companies receiving 26.1% of global deals.

Asia is the third most active region for investment in the Payments & Remittances subsector. However, the companies operating in the continent raised more than two thirds of total global funding, which was driven by extremely large deals. Digital payments businesses need large scale investments to build the infrastructure to serve the large populations in the region, specifically in India and China.

The Rest of World category contains Australasia, Middle East & Israel, and the African regions, which collectively accounted for 7% of total Payments & Remittances transactions.

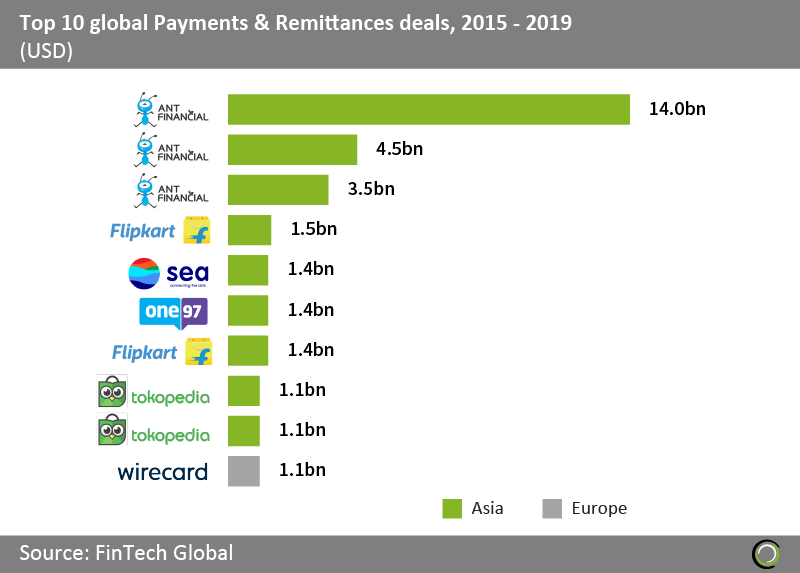

Nine of the top 10 global Payments & Remittances deals since 2015 were raised by Asian companies

The top 10 Payments & Remittances transactions raised $31bn between 2015 and 2019, with the top nine deals being raised by Asian companies in the subsector.

Flipkart, an Indian e-commerce company, raised $1.5bn in a private equity round led by SoftBank Vision in August 2017. During the same period SoftBank Vision invested another $1bn into the company. In 2018, Walmart acquired a 77% stake in Flipkart for $16bn, which led to SoftBank selling its 20% share of the company.

The only European company in the top 10 Payments & Remittances deals was Wirecard, a German payment processing platform, which raised $1.1bn in a post-IPO equity round led by SoftBank in April 2019. The company has entered into a strategic partnership with SoftBank in order to expand their capabilities in digital payment solutions.

Copyright ? 2020 FinTech Global