Companies in the sector collected $925.9m in funding across 71 deals with over half of transactions recorded in North America

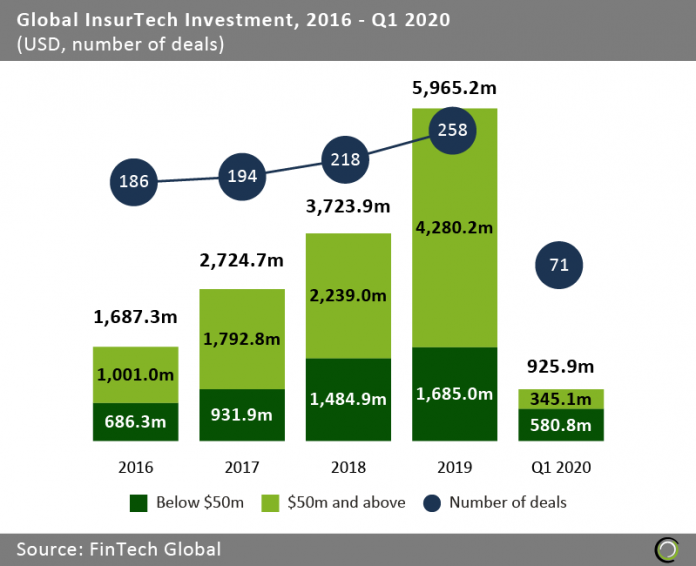

- The global InsurTech industry saw tremendous growth in investment between 2016 and 2019 as investors sought to take advantage of the increased demand for digital services from traditional insurance companies and financial institutions. Total funding grew at a CAGR of 52.3% from $1.7bn to nearly $6bn at the end of last year.

- Increased share of total funding came from deals over $50m reaching 71.8% in 2019. However, capital invested and deal numbers also grew for transactions under that threshold. This shows that the sector received a healthy portion of investment in the early-stage market during the period as more areas of the insurance value chain were targeted by innovative startups.

- Deal activity also increased during the period from 186 transactions in 2016 to 258 funding rounds in 2019 as innovation in the sector spread to other regions in the world, specifically to the large insurance markets in Asia.

- Investment in the sector had a strong start to 2020 with $925.9m invested across 71 deals. The funding raised in deals under $50m showed increased promise and is already at 34.4% of the record levels reached in 2019. However, it remains to be seen how the coronavirus pandemic will impact investment activity across the sector.

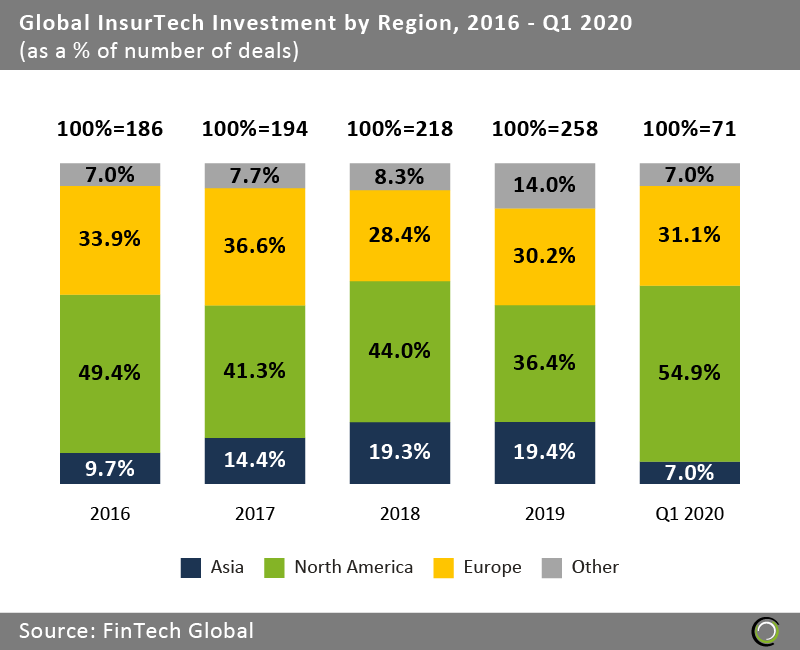

North American companies’ share of deal activity surged in Q1 2020 as investors withdrew from Asia

- North America’s share of deal activity has declined since 2016 from 49.5% in 2016 to 36.4% in 2019. The country led the insurance digitalisation efforts with US companies trying to disrupt the healthcare industry post Obamacare. However, the continent’s share of transactions saw a strong rebound to 54.9% in the first three months of 2020 – the highest level over the past five years.

- On the flip side, Asia saw a big decline during the period in its share of deal activity from 19.4% to just 7.0%. Investment plans were disrupted by the lockdown in China which started in January and growing fears coronavirus will spread to other neighbouring countries due to the highly connected economies in the region.

- The Other category which includes Latin America, Australasia, Africa, the Middle East & Israel also saw its deal share halved in Q1. This was mainly a result of the lack of deal activity in Africa and South America which recorded only one deal compared to 18 in 2019. South Africa-based JaSure, a mobile app for on-demand insurance, received corporate backing from Santam Insurance in February this year.

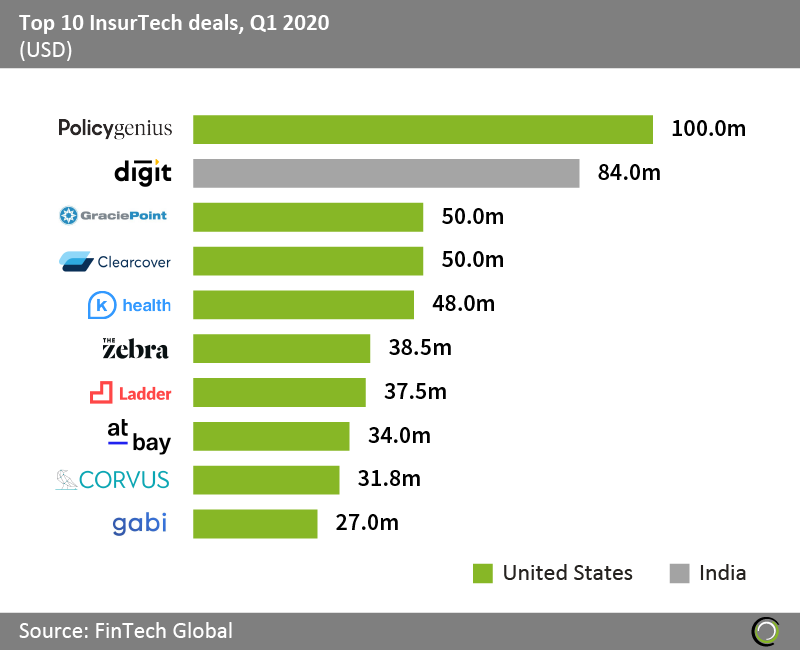

US Companies raised nine of the top ten InsurTech deals in the first quarter of 2020

- The top ten InsurTech deals in the first three months of the year collectively raised just over $500m, making up 54.1% of the overall investment in the sector during the quarter. The ratio is much lower than the one recorded in Q1 2019 when 83.0% of total funding came from the largest ten transactions. This suggests that so far this year we are seeing a more even distribution of capital across the different stages of funding in the InsurTech industry.

- Notably, as investors have moved away from the Asian region at the start of the year they heavily backed US companies which completed nine of the biggest transaction in Q1. The only company to break the country’s dominance was India-based Digit Insurance, a tech-driven general insurance company, which raised $84m from A91 Partners, Faering Capital and TVS Capital Funds.

- The largest deal of the period was raised by Policygenius, an online insurance platform where users can discover coverage gaps and shop online for insurance products. The company raised $100m in a Series D round led by private equity firm KKR. With the new capital, the company is looking to hire more staff and release new financial protection products in 2020.

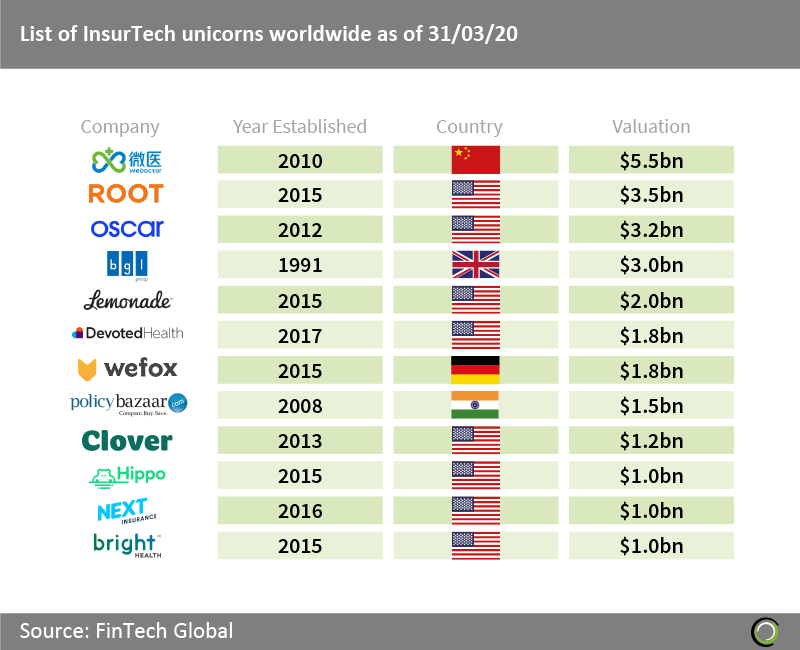

The United States is home to eight InsurTech unicorns

- As of 31st March 2020, there are now 12 InsurTech unicorns worldwide. WeDoctor, a developer of online and mobile healthcare solutions based in China, tops the list with a whopping valuation of $5.5bn. The company obtained its unicorn status back in 2015 when it raised $394m in a private equity deal lead by Goldman Sachs and Hillhouse Capital Group which valued it at $1.1bn. WeDoctor has raised additional $520m worth of funding since then increasing its valuation 5x in the process.

- United States has the highest number of InsurTech unicorns mainly driven by the massive opportunity in the healthcare space after the passing of Obamacare. Half of the eight unicorns in the country provide services in the sector – Oscar, Devoted Health, Clover and Bright Health.

- The most recent inductee on the list is Bright Health, a provider of health insurance that connects users to various physicians and healthcare services, which raised $635m in a Series D transaction in December 2019.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2020 FinTech Global