COVID-19 could be great for the InsurTech industry as the crisis highlights where insurers’ shortcomings are. But that does not mean there won’t be hard times ahead.

While the coronavirus could a huge challenge for all businesses, it could also prove to be an opportunity for InsurTech startups. The insurance industry has famously been very slow to embrace new technologies. However, the coronavirus crisis is forcing them to take a hard long look at their own limitations, their legacy systems and infrastructure. Some believe it might be the nudge insurers need look for new solutions and startups to provide them.

Of course, that does not mean that the insurance industry has been void of any innovation. Sector giants like Generali and AXA have launched several initiatives over the years to work more closely with technology startups in the sector. Nevertheless, the current coronavirus crisis could encourage them to seek out more InsurTech solutions.

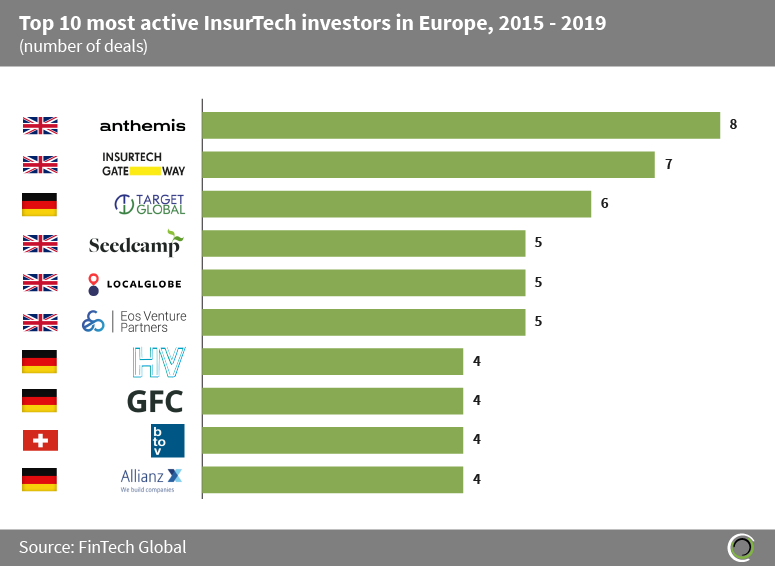

Slow as insurers’ digitalisation processes might have been in the past, the coronavirus highlights the need for them to do more. “This has already been a huge wake up call for many large companies that have been slow to modernise,” says Stephen Brittain, co-founder of Insurtech Gateway, the InsurTech incubator and one of the European sector’s most active investors.

It’s easy to see why insurers could be motivated to get out of their comfort zone. Several countries have been forced to go into lockdown to contain the contagion. Consequently, shops have closed, travel agents and airlines have gone into administration or been forced to fire a massive number of employees, others have started to promote remote working, schools and universities have sent their students home and the economy in general have been severely disrupted.

It’s easy to see why insurers could be motivated to get out of their comfort zone. Several countries have been forced to go into lockdown to contain the contagion. Consequently, shops have closed, travel agents and airlines have gone into administration or been forced to fire a massive number of employees, others have started to promote remote working, schools and universities have sent their students home and the economy in general have been severely disrupted.

Many of the people and businesses affected have overwhelmingly turned to their insurers for help. The Association of British Insurers expect that the travel insurers will pay out a record £275m in claims this year because of the coronavirus.

Moreover, while a lot of insurers are arguing that their policies do not cover the outbreak of a global pandemic, lawmakers on both sides of the Atlantic urge insurers to consider the losses to businesses and communities and still pay out. All of this combined means that insurers may be more prone to change.

So the COVID-19 outbreak might have created a prime moment for innovative InsurTech startups to seize upon. “When everything changes rapidly, the lean and agile startups really start to shine,” Brittain says. “Passionate founders are pushing their fledgling companies to overcome the odds and will come out the other side stronger.”

He argues that a “startup community with incredible access to technology” is out there and “looking for problems to solve.” “This is going to [be] a huge accelerant for InsurTech,” Brittain predicts.

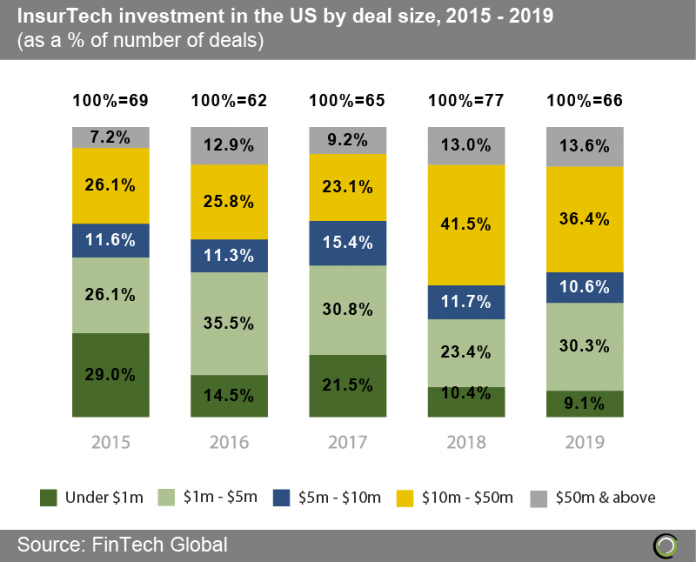

He is not wrong. Since 2015, the European InsurTech community has already raised over over $4.2bn across more than 300 transactions, according to FinTech Global’s data. Across the pond, US InsurTech companies attracted over $7.8bn of investment across 418 transactions between 2015 and 2019. During that period, the average deal size increased from $13.7m to $38.2m.

It’s easy to see how new players in the industry may perfectly suited for the changing environment. Startups, by their definition, are smaller businesses, which means they can quickly adapt to new circumstances and help solve insurers’ problems. “Where insurance companies need to adapt fast InsurTechs are well positioned to allow insurance carriers to adapt rapidly,” Samuel Falmagne, CEO and co-founder of Akur8, the InsurTech company, tells FinTech Global.

It’s easy to see how new players in the industry may perfectly suited for the changing environment. Startups, by their definition, are smaller businesses, which means they can quickly adapt to new circumstances and help solve insurers’ problems. “Where insurance companies need to adapt fast InsurTechs are well positioned to allow insurance carriers to adapt rapidly,” Samuel Falmagne, CEO and co-founder of Akur8, the InsurTech company, tells FinTech Global.

As an example, he says that AKUR8 has been able to develop a fully virtual model for running pilots and on-boarding clients on the platform which allows its prospects and clients to maintain their plans.

That does not mean the startups in the sector won’t face any challenges. These ventures often don’t have long cash horizons and may only be able to keep the lights on for another few months. With a global pandemic wreaking havoc on the global economy, these ventures have found themselves in a particularly tenuous situation. “They’re having to make some pretty serious decisions about what they do, how they survive,” says Brittain.

Insurers could put projects on hold or even cancel them because of the uncertain climate. “This is a major risk for InsurTechs as many of them will not survive if the industry is pausing all the projects,” says Falmagne. “As InsurtTechs we also need the support of our clients. Insurance companies have the chance to have a highly dynamic InsurTech ecosystem that can support them in facing the crisis but that also needs them to continue the business as they are not yet as financially robust as their clients. It’s a win-win situation.”

Some ventures, particularly the ones operating in the travel and gig economy insurance segments, have seen their revenue forecasts plummet by as much as 95% in the past two weeks alone.

To retain staff and keep them motivated, startups do also have the opportunity to give staff equity instead of salaries during the months they cannot afford to pay them, which is seldom an option for more established players. “I have never heard a corporate talk like this,” Brittain says, adding that startup staff are more likely to take this option as they believe in the business. “And I think that’s a wonderful thing.”

Yet, if these companies can survive the crisis, there may be several opportunities out there for them. For instance, Brittain believes InsurTech companies could benefit from looking beyond just how risky something is and offer solutions to ensure bad things from happening instead of simply “paying out when the thing goes wrong.”

“I’m intellectually super excited about this because the timing couldn’t be better with the insights and data on our ability to see where things are happening so that we can prevent thing,” he says.

Brittain is optimistic about where he thinks the InsurTech segment is going, even though things are changing very quickly right now. “Last week was a week of panic and trying to get stability,” he says. His team spent the period trying to figure out how to secure funding and be able to support founders.

“Panic after panic,” Brittain says. “And then this week I’ve gotten 150 WhatsApp messages with jokes in them. Next week I’m going to get business plans in my inbox. That’s the nature of where we are now. It’s just things are moving so faster. How do I feel? I feel optimistic. I feel I’m just watching a very powerful force going through a period of change.”

And Brittain is not the only one who is optimistic. Earlier this month the agency brokerage Rosenblatt Securities looked into how different segments of the FinTech industry would be affected by the coronavirus. It noted that many startups might soon find it more difficult to raise money at decent terms, go public or achieve high valuations.

Yet, the researchers noted that the InsurTech industry might weather the storm particularly well. For starters, the crisis might motivate more people to buy additional coverage. Moreover, other unconventional risks like cybersecurity, climate change and social disruption have not seen investment decline, so Rosenblatt Securites predicted that investment in this segment will continue to rise.

Brittain concludes, “I’m excited about the insurance industry, learning some agility working from home, learning how to you know reevaluating themselves when they go back to work. I mean, it can only be good for the development of the sector.”

Copyright © 2020 FinTech Global