Insurtech Gateway has quickly made a name for itself as a champion for early-stage InsurTech startups since the launch in 2017, but the incubator’s founder says it’s only getting started.

Insurtech Gateway, the only investor and incubator with Financial Conduct Authority (FCA) insurance authorisation, looking for tech startups to revolutionise insurance, was born out of the desire to remove the barriers to entry that make Insurance such a tough place for entrepreneurs to play.

Stephen Brittain (pictured), the co-founder of Insurtech Gateway, explains how the whole concept is deeply rooted in collaboration. “There is no archaic incumbent in our story and there’s no arrogant tech founder trying to take them down,” he says. “Neither of them is welcome here. We need old to meet new and work together towards common goals.”

His statement might sound odd in the world of tech where the narrative is often skewed to pitch the old guard against the innovative ideas of new startups eager to replace them. However, to Insurtech Gateway it is not productive to buy into the myth that established insurers are somehow supposed to be outplayed, complained about or mocked by InsurTech entrepreneurs.

For the Gateway, that attitude creates a barrier making it harder for them to bring these startups and established insurers closer together.

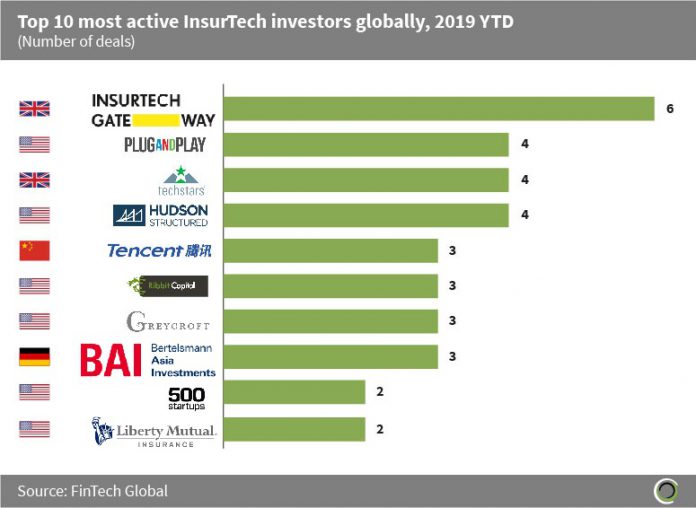

Being the person-in-the-middle that brings together insurers and innovative InsurTech startups, has proven a winning recipe for Insurtech Gateway. Ever since the incubator first launched in 2017, it has quickly become known as one of the world’s most active InsurTech investors, launched a sister incubator in Australia and raised millions in its own fund to back innovative entrepreneurs.

Brittain is a veteran entrepreneur. Having spent time honing his craft at innovation agency Seymour Powell, he took his passion for product design to venture capital firm Hambro Perks, where he helped tech startups find product market fit.

Brittain is a veteran entrepreneur. Having spent time honing his craft at innovation agency Seymour Powell, he took his passion for product design to venture capital firm Hambro Perks, where he helped tech startups find product market fit.

However, it was when he met his future co-founder Robert Lumley in November 2016 that the first step to launching Insurtech Gateway was taken. “Robert and I were introduced by a mutual friend,” Brittain says. The friend knew that Brittain was interested in getting into the insurance space. “Someone said, ‘You’ll like Robert. He’s entrepreneurial and he really understands insurance. He’s a rare combination,’” Brittain recalls.

It’s hardly a secret why he was considering moving into the insurance industry. “Insurance is one of the last big industries to get hit by digital tech transformation,” Brittain explains. “Fundamentally, what happened to the music industry, what happened to the video industry [and] what happened to entertainment [and] to banking has finally got to insurance.”

Just like in those sectors, Brittain believed insurance had the opportunity to leverage tech to modernise working practises, change risk profiles and create smoother customer experiences. He believed it had taken longer for insurance to catch on innovation because the complicated web of regulations was off-putting to entrepreneurs.

In other words, getting into InsurTech could potentially yield massive gains if Brittain could find a way or a partner to help him tackle the hurdles.

Lumley certainly seemed to fit the bill. An insurance veteran, he has over three decades’ worth of experience in the industry, specialising in niche products. He is the former chairman of Lumley Jacobs, the company helping insurers boost their revenues, and the founder of Rent and Legal Protection and let insurer Letsure.

The mutual acquaintance made the introductions and the future Insurtech Gateway co-founders met in St James’s Park. “There’s a nice wooden bench, where you can just watch the pelicans, sit and have your lunch amongst tourists, pigeons and various Secret Service agents who are hiding in the park,” Brittain quips. “And amongst that we hatched our plan.”

As they talked, the duo agreed that innovative entrepreneurs had too many regulatory hoops to jump through. Someone had to remove them. “It was as simple as that because people with great ideas, creative people who reinvent markets, [they] don’t wait 18 months to get to market,” Brittain says. “They don’t raise £1m and mortgage their houses and tell their wives, ‘I’ll have a job in a year, I promise darling’ and then go through all that paperwork for a year before they can start. They just don’t do it. So that meant that one of two things was going to happen. It meant that either there would be no innovation in insurance.” He pauses. “Or it meant that someone was going to change the rules.”

At the end of their walk around the London park, Brittain and Lumley decided that they were going to break the status quo. “People thought we were crazy,” he recalls. “You are not the regulator and you’re not an investor and although you have small amounts of capital, it’s not enough.” But they decided to “build a gateway for really talented founders to come to market.”

However, creating Insurtech Gateway would end up trying Brittain’s patience. “It’s been feeling glacially slow,” he confesses. In the startup world he came from, he was used to quick turnarounds. “Now the best idea I had was in November 2016 and the first startup went to market in May 2018,” he says. “That felt like a prison term in my world. I used to say my personal biggest challenge was not to go crazy with the time it’s taken.”

Still, they kept at it. It took the whole of the next year to realise their vision. Firstly, they became authorised by the British FCA, which enabled them to help remove the regulatory roadblocks preventing founders from launching what Brittain described as “the Uber of insurance.”

To remove further hurdles, Brittain and Lumley recruited a team of compliance experts to help bring them to their first milestone; to become the World’s first FCA authorised incubator/investor. To remove this mammoth task for founders.

They also reached out to ten high net-worth individuals to raise seed money. Their pitch was that “[if] you want to see the Uber of insurance, you’ll have to attract the kind of talent that would start an Uber.” This was swiftly followed by the appointment of veteran insurance CEO Richard Chattock, who joined to turbo charge Insurtech Gateway and it’s plans to scale.

Brittain and Lumley argued that these potential entrepreneurial superstars needed someone to remove the red tape, a guiding hand and financial backing. If they could get that, the wins could potentially be massive. That convinced ten angel investors to back the fledging incubator with a small fund. “With that rebellious group, we started the Gateway,” Brittain says.

The backing and the regulatory authorisation enabled the founders to convince insurers to give them the pen, the ability to pilot insurance solutions to prove the startups that would soon be on Insurtech Gateway’s books had wings. “It was like taking the fear out of these new little monsters that we were building,” says Brittain. “Nobody minds monsters when they’re little. It’s big monsters they get really worried about. ‘So,’ we said, ‘Let us make little monsters and we’ll show you that they’re nice.’”

In June 2017, Insurtech Gateway backed its first startup: the telematics company By Miles. The startup differed from other telematics insurance solutions because it measured how many miles the driver drove, not how. “That’s a very important differentiator in the market,” Brittain says. “Because people don’t like [a] Big Brother insurer [watching] how they’re driving. They like the idea of paying for what they use.”

Although, By Miles had originally pitched another idea. “By Miles came in with an Airbnb insurance idea,” Brittain said. While he and Lumley were hesitant about the concept, they liked the founders. That was enough to give them the chance to explore and evolve into their telematics idea, which eventually resulted in Insurtech Gateway and InMotion Ventures leading By Miles’ £274,000 seed round in June 2017.

The story highlights how important is to the Gateway that they click with the entrepreneurs who tap them for support. Essentially, founders must pass the Insurtech Gateway train test. “It started as a joke, but it’s completely true,” Brittain explains. “We sit there and say, ‘Could we sit on a train with this person, all these people for four hours.’ Because the amount of time we give these founders when they join us, if we don’t like them, if we can’t have a rapport with them, we’re just not going to do it.”

Nevertheless, ideas are still important. Ideally, Brittain and Lumley look for customer-centric ideas that can scale. “Businesses that scale like tech, not businesses that scale like insurance,” Brittain says. He adds that he and his partners search for ideas that, by definition, the insurance industry can’t do for itself. The example Brittain uses is a solution using technology that can insurance papers in one country and then expand it to 120 countries within a year. “That’s scaling like tech,” he says.

Nowadays, the incubator sees about 600 startups per year. Of those, a lot of companies come to them as a last hail Mary. However, lots of these companies are often over-invested and have wasted time speaking to the wrong insurers or tramping around the event circuit. “Basically, [they] spent a lot of money going around in circles talking to the industry,” says Brittain. “That’s really sad. There’s a lot of those.”

Instead, what he wants to see are startups that know they need investment, paper and authorisation, all the things that Insurtech Gateway can help with. “An 18-month business that still own their company,” he says. “They’ve got a huge amount of equity in their business. They got all the things they need and they’re fresh. They’re the ones that [hit the] sweet spot. They understand what we do. They understand we’re here to shepherd them into the insurance and regulatory market.”

Once selected to be backed, startups can leverage the fact that the Gateway is FCA authorised in it’s own right, which allows theirs insurtech startups to sell their products as an Appointed Representative of the Gateway, under their license. This was something that amazed Humn, the InsurTech company on a mission to provide modern fleet insurance solutions, when it joined Insurtech Gateway’s programme. “Humn came in the door and said, ‘We spent 14 months with a leading global insurer who have messed us around from meeting to meeting, we’ve had 26 meetings and we still haven’t got paper.’ They came here [and] 12 weeks later they [were] live in market,” Brittain recalls. “We were really excited about that. They couldn’t believe it.”

Brittain says the same story has been repeated many times since. “They all say, ‘Why the hell didn’t we find you earlier?’” he says.

Insurtech Gateway has also set itself apart from many other incubators by only focusing on one or two businesses at the time and not to do huge batches. “It’s a very personal engagement we have here,” he says. “It’s small numbers. That’s our ambition. We’re not trying to do 500 startups. We’re trying to do ten a year. That’s enough.”

The incubator’s current goal is to support 30 InsurTech startups by 2022. An investment from Moxley Holdings, the venture capital firm, as part of the £2.5m injection into Insurtech Gateway in November is going towards this end.

Insurtech Gateway’s recent launch in Australia followed a similar trajectory to how it vents startups – the founders found an executive they liked. “We met a guy who was super committed to early stage businesses from Australia, Simon O’Dell,” Brittain recalls.

When they met O’Dell, he had been working for Insurtech Australia, the community hub for the Australian InsurTech industry, but was searching for the next step to support the market. Then he met the Insurtech Gateway founders and realised the impact the incubator could have in Australia. “We really liked him and we loved his drive and [that] he [was] already committed to the space,” Brittain said.

Not only was he already swimming in the waters, but also had unique insights about the domestic InsurTech space. “[When] we spoke to him about Australia [he said] that we would be [making] a mistake to think of Australia as just a little Britain somewhere, a smaller market of people who are like minded the European mindset,” he recalls. “They’re not like that at all. This is a group of people who think globally, [that] have to think globally from day one. The whole market is small and their ambition is big.” This convinced them that O’Dell was the guy to spearhead their venture Down Under. Insurtech Gateway Australia was opened in July 2019.

Looking to the future, he concludes, “I think we’re really enjoying getting better at what we do. I think it’s very important for us. It’s very important to the team to be world class in what we’re doing. We’re looking for quality and we aim to be the best to help the best.”

Copyright © 2020 FinTech Global