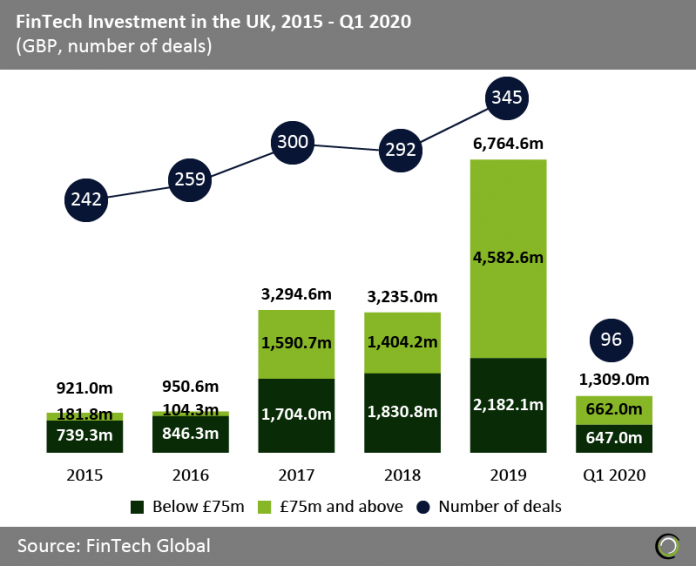

UK FinTech companies raised over £1.3bn across 96 deals in the first three months of 2020

- As London established itself as the FinTech capital of the world, the UK FinTech sector experienced exponential growth in investment between 2015 and 2019. Total funding grew at a CAGR of 64.6% from £921.0m to nearly £6.8bn at the end of last year.

- The growth of the sector has been driven by a combination of factors such as the country’s strong track record for R&D in technology, large pool of talent, access to leading financial institutions, supportive regulatory policies set by the FCA and ample access to funding.

- Deal activity also increased during the period reaching 345 transactions in 2019, which is 42% higher than the number of funding rounds recorded in 2015

- Despite coronavirus concerns in Asia and Italy, FinTech investment in the UK had a strong start to 2020 with £1.3bn capital invested, a sum comparable to the £1.35bn raised in Q1 2019 after which the sector set a funding record that year. Additionally, deal activity increased by 28% compared to the first quarter of 2019 to reach 96 transactions.

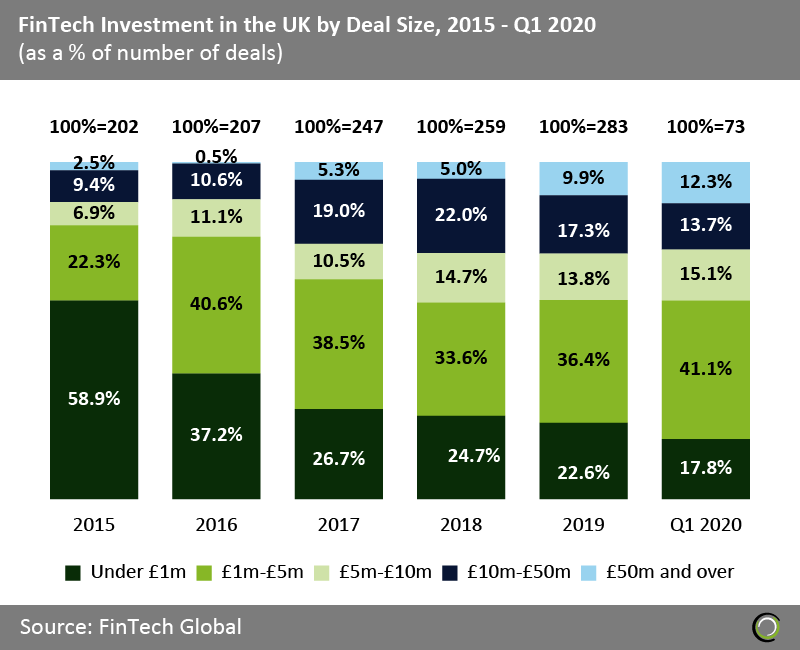

A resurgence in deals between £1m and £5m fuels new wave of innovation in the UK FinTech industry

- As the UK FinTech industry matured, the share for deals valued at £50m and over increased from 2.5% in 2015 to 9.9% in 2019. That share increased even further in the opening quarter of this year to 12.3% with nine deals of this size being recorded.

- Interestingly, the share of deals valued between £1m and £5m increased over the last 15 months. It grew to 36.4% at the end of last year before jumping even further to 41.1% in Q1 2020. This suggest that investors are showing renewed appetite for early stage deals and looking to back the next wave of disruptive innovation in sectors such as Institutional Investments & Trading and InsurTech.

- However, we could see reversal of that trend in the second quarter based on observations of the investment landscape in countries hit earlier by the coronavirus pandemic, where investors stay away from riskier early stage deals due to the uncertainty caused by the virus and the expected economic downturn.

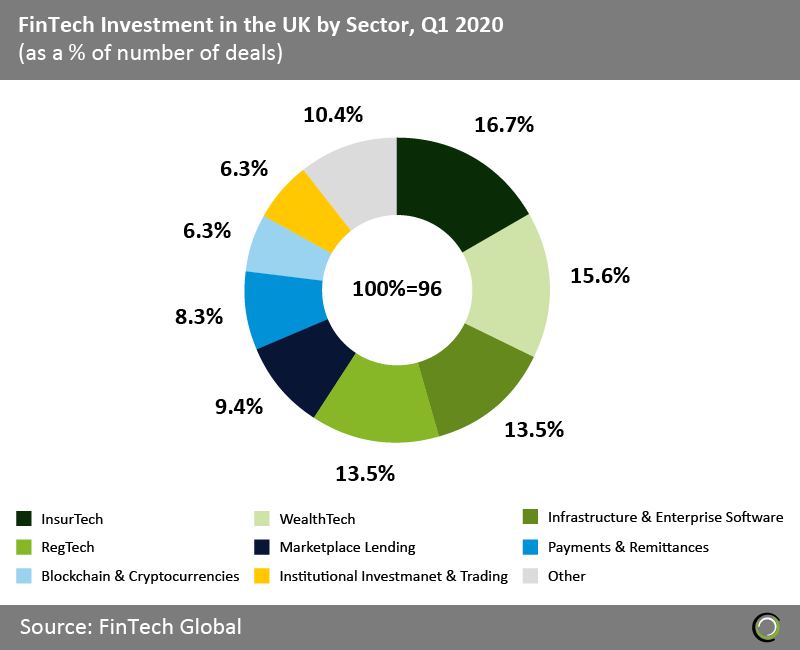

InsurTech and WealthTech companies raised nearly a third of all FinTech deals in the UK in Q1

- InsurTech and WealthTech companies’ fundraising activity was the main driver behind the strong investment levels recorded in the UK during the first quarter of 2020. Companies in these two sectors raised 31 transactions or 32.3% of all FinTech deals.

- InsurTech companies attracted the largest share of funding rounds in the country during Q1 2020, taking 16.7% of all FinTech transactions. Despite initially falling behind countries like Germany where large insurers drove initial investment activity in the sector, the UK is starting to emerge as the key hub for insurance innovation in Europe with support from the regulators, the UK InsurTech association and the Lloyd’s market.

- However, FinTech deal activity in the UK was well represented across all subsectors in the first three months of the year. All areas of the industry attracted over 5% deal share demonstrating the strength and diversity of the UK ecosystem.

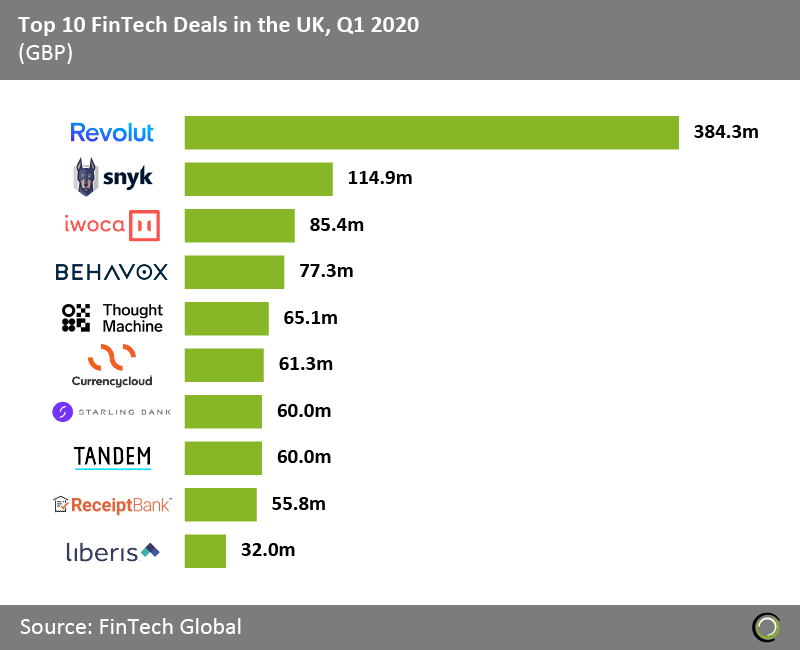

Revolut raised the largest FinTech deal in the UK during Q1 2020

- The top ten FinTech deals in the UK completed during the first three months of 2020 raised in aggregate £996.1m, making up 76.1% of the overall investment in the country during Q1 2020.

- Revolut raised the largest deal of the period after closing a $500m (£384.3m) Series D round led by TCV in February. The deal value the UK challenger bank at $5.5bn and the company now has over 10m active users.

- Interestingly, despite having the largest deal share InsurTech companies are missing from the list. The largest transaction in the sector was completed by Tractable, an AI solution for accident and disaster recovery, which closed a £19.4m Series C round to accelerate its expansion into new markets from the nine markets it currently operates in.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global