Revolut, N26 and Monzo might have entered the US over the years to some extent, but Chime is still dominating the country’s digital bank market.

That’s according to new research from Apptopia, the data management company. It found that while European challenger banks like Monzo, N26 and Revolut have all made bids to cut out a piece of the market for themselves, Chime still runs 60% of the market in the US.

“It’s also averaging more monthly downloads than Bank of America and Wells Fargo over the past six months,” said Adam Blacker, VP of insights at Apptopia. “It is however lagging behind Capital One and Chase.”

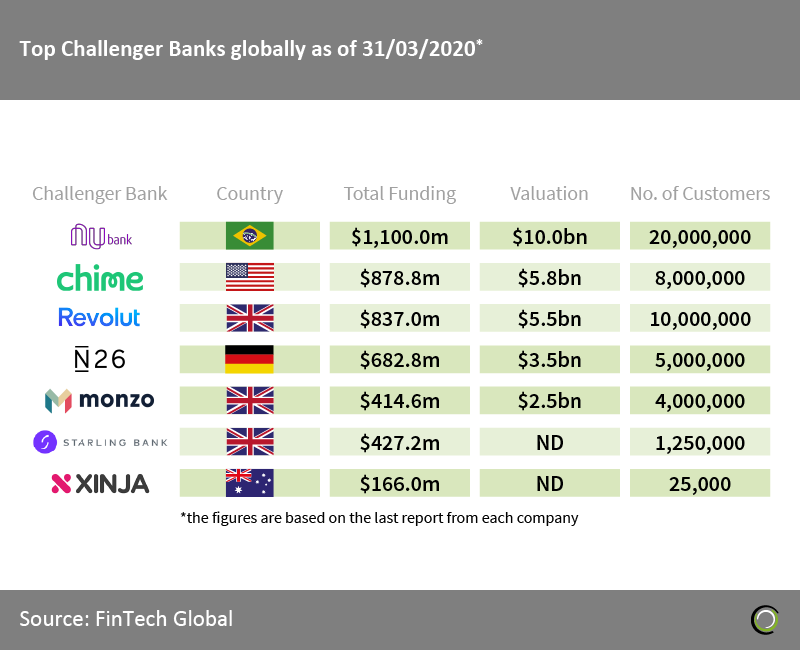

This is consistent with FinTech Global’s own research that placed Chime ahead of Revolut in our worldwide ranking. The former has a valuation of $5.8bn while the latter has one of $5.5bn. Both have some ways to go before they can beat Brazilian challenger bank Nubank, which is arguably the global champion with a valuation over $10bn.

Blacker also noted while Chime is dominating the field, it’s Varo that might be the first FinTech in the sector to pick up a banking charter licence. Although, as FinTech Global has reported in the past Varo Money may have received preliminary approval for a national banking chapter in 2018 but has not yet secured a full licence. Moreover stock-trading app Robinhood withdrew its application in November 2019.

Blacker also noted while Chime is dominating the field, it’s Varo that might be the first FinTech in the sector to pick up a banking charter licence. Although, as FinTech Global has reported in the past Varo Money may have received preliminary approval for a national banking chapter in 2018 but has not yet secured a full licence. Moreover stock-trading app Robinhood withdrew its application in November 2019.

In April, UK rival Monzo applied for a US banking licence at the US Office of the Comptroller of the Currency, which marked a serious effort for the neobank to launch its services in the country.

Revolut launched its services in the US in March 2020. Its US xustomers in the US will have their deposits insured by the Federal Deposit Insurance Corporation (FDIC) via Revolut’s partnership with Metropolitan Commercial Bank

Copyright @ 2020 FinTech Global