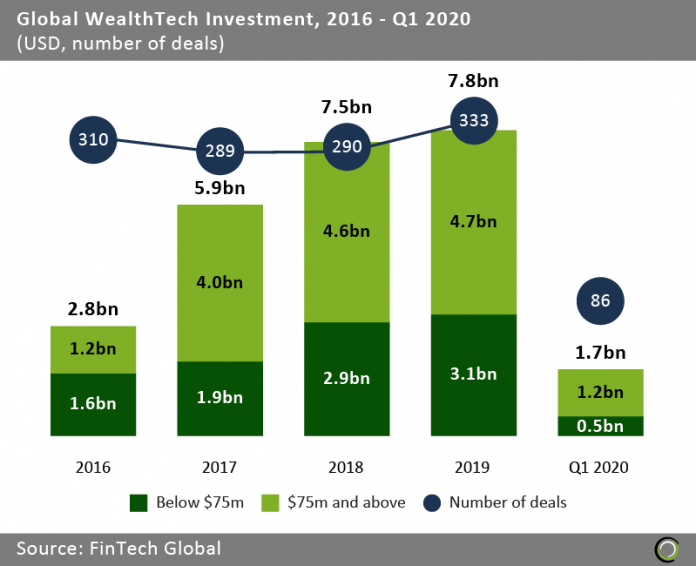

WealthTech companies raised $1.7bn across 86 deals in Q1 2020 as challenger banks in Europe and Australia raise record amounts of capital

- The global WealthTech industry saw strong growth in investment between 2016 and 2019 as investors backed new digital services to manage personal finances, open online bank accounts and invest money with low fees. Total funding grew at a CAGR of 40.7% from $2.8bn to over $7.8bn at the end of last year.

- Increased share of total funding came from deals over $75m reaching 60.3% in 2019. However, if we exclude the lumpy over time large deals, capital invested and deal numbers also grew for transactions under that threshold. In fact, last year more than $3.1bn was invested in funding rounds under $75m as WealthTech innovation spread to developed markets and new areas of the investment and banking value chain were disrupted by new startups.

- Deal activity was relatively stable during the period and fluctuated between 289 and 333 transactions with the peak reached last year. The 86 deals recorded in Q1 are 6.2% higher than the deals recorded in the opening quarter of 2019, setting strong expectations for the sector in 2020. However, it is still to be seen the impact the COVID-19 pandemic will have on investment activity.

- Investment in the sector had a strong start to 2020 with $1.7bn. The funding was driven by large deals over $75m which made up 70.6% of the total capital raised during the quarter.

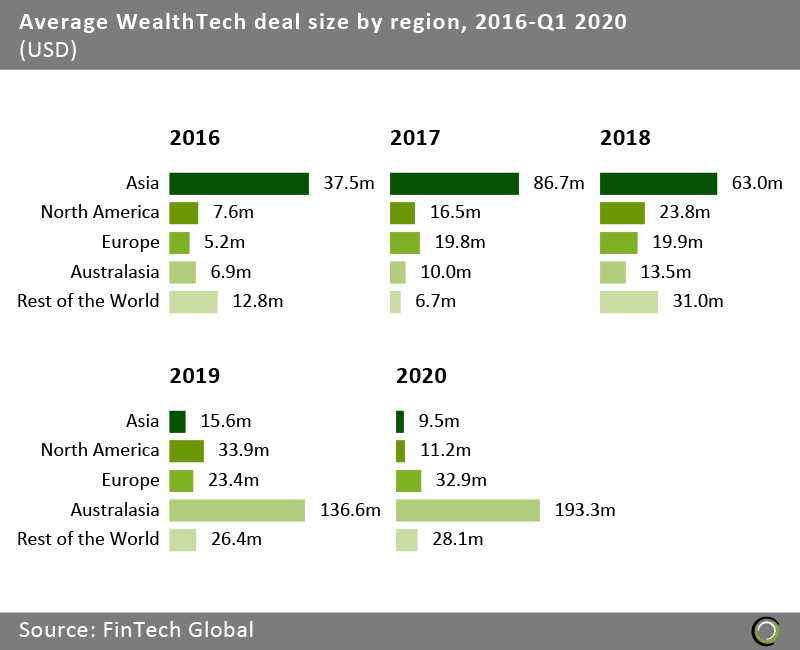

Europe and Australia see a surge in the average WealthTech deal size in Q1 2020

- WealthTech funding has been growing year on year with the number of transactions remaining relatively stable. As a result, the average deal sizes have trended higher globally since 2016.

- Asia had the highest average deal size between 2016 and 2018, increasing from $37.5m to $63.0m as companies in the sector raised large amounts of capital to offer financial services to the underbanked population in the region.

- Europe and Australia saw the highest growth in average transaction sizes in Q1 2020 as several challenger banks in the regions closed large transactions. UK-based Revolut raised $500m in a Series D round in February, while Melbourne-based Judo Bank completed a $350m funding in March.

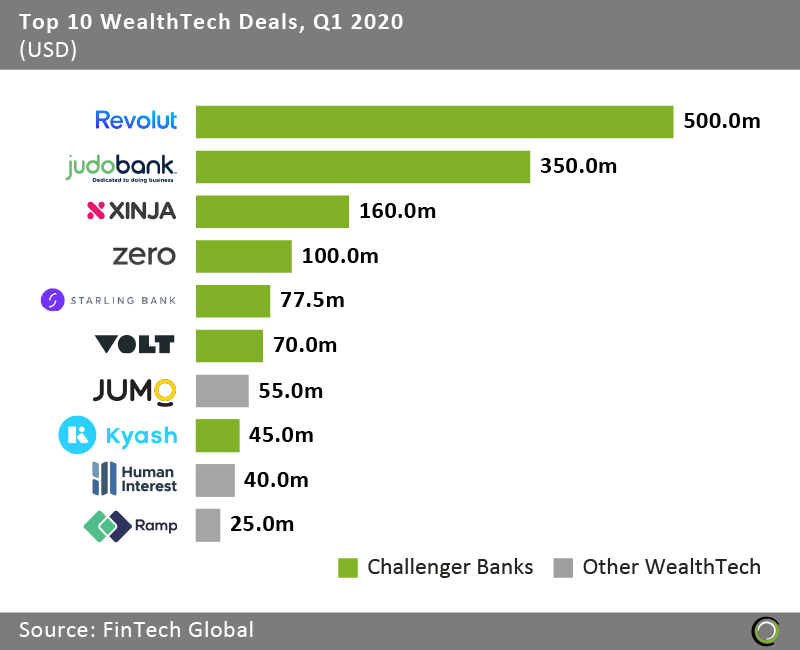

Challenger banks completed seven of the top ten WealthTech deals in the first quarter of 2020

- The top ten WealthTech deals in the first three months of the year collectively raised just over $1.4bn, making up 81.9% of the overall investment in the sector during the quarter. The ratio is much higher than the one recorded in Q1 2019 when 64.8% of total funding came from the largest ten transactions. This is mainly due to the two massive rounds raised by Revolut and Judo Bank mentioned earlier.

- Neo-banks dominate the list of top transactions as investors back the next phase of growth in digital challenger and their expansion plans to other countries. The largest deal in the segment outside of Europe and Australia was raised by Zero, a cashback digital only debit card, which secured a $100m credit facility from Neuberger Berman to “drive value” to its customers by creating a more transparent banking experience.

- The largest non-challenger bank deal of the period was raised by JUMO, a technology platform for building and running financial services. The company raised $55m in a funding round from Goldman Sachs, LeapFrog Investments and Odey Asset Management. With the new capital, the company is looking to expand to Cote d’Ivoire and India later in the year.

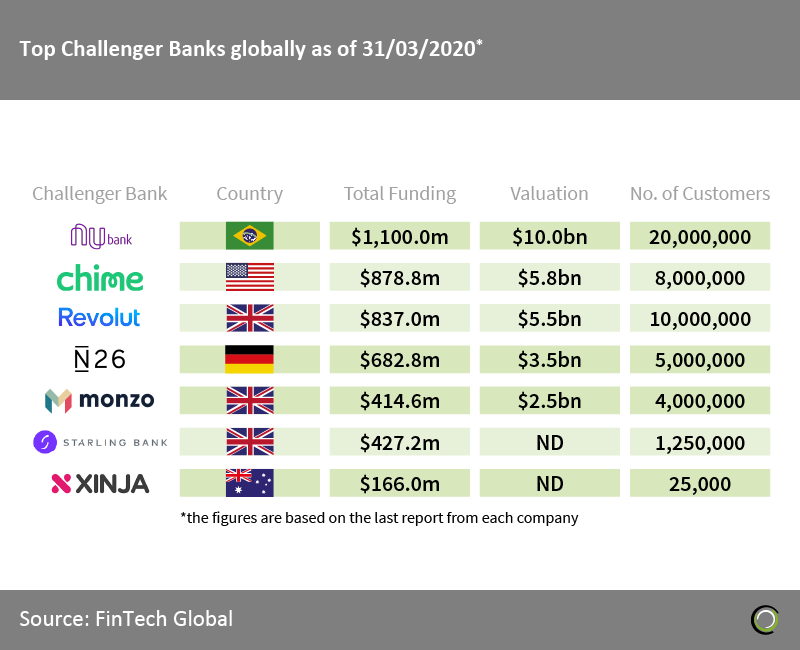

NuBank is the most valuable Challenger Bank globally

- The Challenger Banks sector has seen the highest growth across the WealthTech industry in recent years. The digital-only banks have been increasingly popular with millennials and investors have been quick to back them as they stay ahead of the trend and centre of wealth distribution moving to the new generation.

- NuBank has raised $1.1bn in funding, the most of any other neo-bank, and is currently the most valuable challenger bank globally. However, the company has been extremely efficient in acquiring customers with amount of funding per new account of just $55, the lowest among its peers on the list.

- The UK has seen the fastest growth rate of challenger banks across Europe, with three challengers on the list. This is driven by the fact that Britain is not as saturated with banks like other countries on the continent such as Germany, and UK consumers have also been early adopter of digital banking. Revolut leads the way with a valuation of $5.5bn and 10 million customers, as the company is pushing its expansion plans into the United States.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2020 FinTech Global