From: RegTech Analyst

Israel has a well-deserved reputation for churning out advanced cybersecurity startups and Hub Security, which just raised a $5m Series A round, is no exception.

The Tel Aviv-based venture secured the funding in a round led by AXA Venture Partners. The investment also saw participation from Jerusalem-based OurCrowd.

Hub Security will use the money to strengthen its team, expand its technology and offer enhanced products to FinTech companies. Particularly, it will focus on enabling access to credit, corporate banking solutions, cross-border payments and providing ultra-secure banking solutions.

“We believe this round of funding is crucial to helping us continue our mission of providing military-grade level cybersecurity solutions to top cloud, finance and digital asset management providers,” said Eyal Moshe, CEO of Hub Security.

He added that this round will help it help businesses struggling because of the coronavirus. “Hub Security’s end-to-end approach to the development and delivery of its hardware and software components ensures the highest level of security throughout the entire product lifecycle – something that’s critical now more than ever in the era of COVID-19,” Moshe said. “We don’t take for granted the trust we’ve seen from investors, especially in the current financial climate.”

The startup is created to meet the demand for cybersecurity solutions in a world where more companies – such as FinTech and insurance businesses – use cloud solutions. It achieves this by leveraging military-grade cybersecurity tactics for its HSM architecture that is designed for FIPS140-2 Level 4 protection, boasting it’s the highest protection level available for mobile cryptographic security solutions on the market to date.

“Hub Security’s miniHSM is the first of its kind to offer a pocket-sized HSM solution, which provides an ultra-secure HSM-to-HSM communication layer built uniquely for cloud, banking, healthcare, and government enterprises with scalable, air-tight security that can support any cloud-based or digital asset,” said Moshe.

Cybersecurity has long driven the growth of FinTech activity in Israel. Over the years, the Israeli cybersecurity industry has only been second to the US in terms of funding, according to FinTech Global’s research.

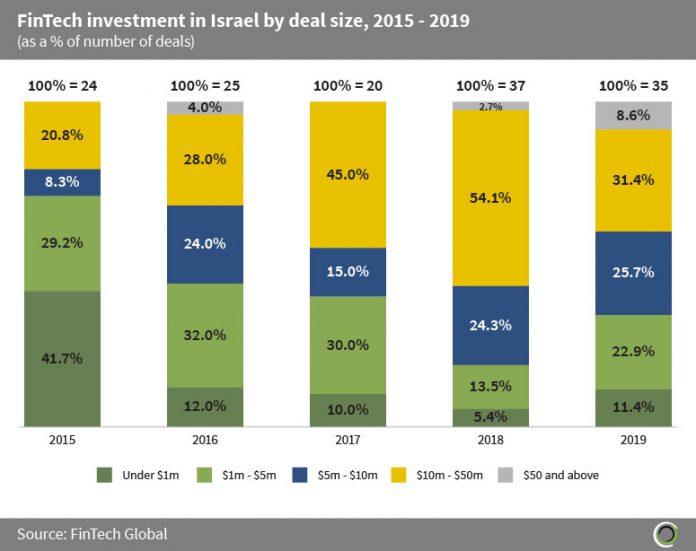

Overall, Israeli FinTech companies raised more than $1.7bn across 142 transactions between 2015 and 2019. The same period saw the money raked in from backers jump from $118m in 2015 to $555.5m in 2019. The growth in the Isreali FinTech ecosystem is most noticeable in the increased share of deals valued at $5m and higher which jumped by 36.6pp between 2015 and 2019.

Copyright © 2020 FinTech Global