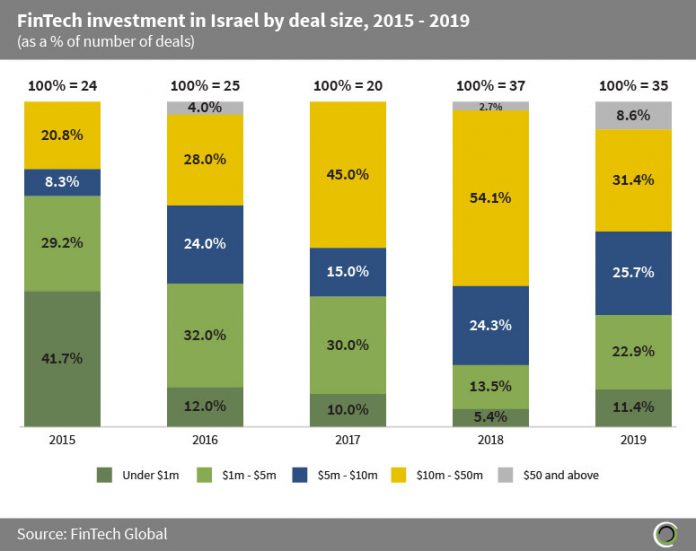

Israeli FinTech companies raised more than $1.7bn across 142 transactions between 2015 and 2019, with a drop in small deals valued less than $1m by 30.3 percentage points (pp) over the period.

Investment in the country has soared in recent years from $118m in 2015 to $555.5m in 2019 with both foreign and local investors funding FinTech companies to fund their competitiveness on a global scale despite the country’s small domestic market. The growth in the Isreali FinTech ecosystem is most noticeable in the increased share of deals valued at $5m and higher which jumped by 36.6pp between 2015 and 2019.

The cybersecurity industry has been the main driver of FinTech activity in Israel, with the subsector being second only to the US capturing around a fifth of global investment in the subsector. The world moving towards a more digital age and as technology improves the exposure to cybersecurity risks increase and Isreali companies are well positioned to take advantage of the opportunity with their strong military and science talent.

In one of the biggest deals in the country Riskified, an Israeli e-commerce fraud prevention company, raised $165m in a series E round led by General Atlantic in November 2019. The company will use the investment to open a new office in Shanghai and to expand their fraud prevention space.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global