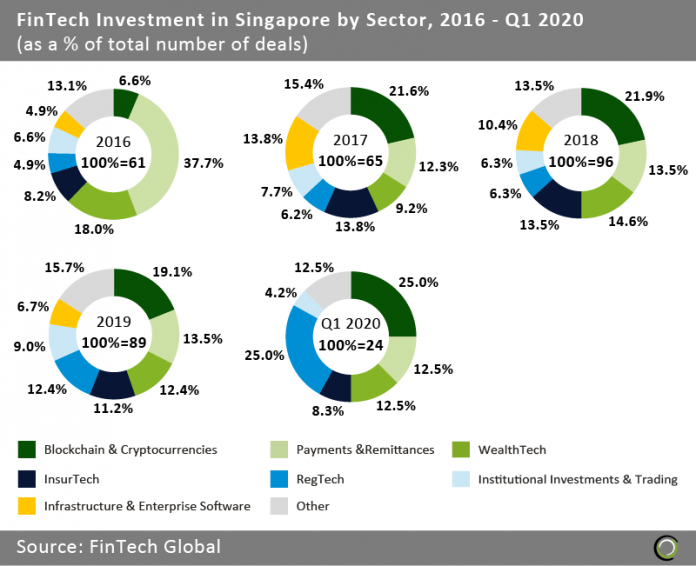

RegTech and Blockchain & Cryptocurrencies companies completed 50% of all FinTech deals in the country during the first quarter.

- FinTech companies in Singapore shrugged off coronavirus concerns in the first three months of the year to complete 24 deals, a 14.3% growth compared to Q1 2019. Half of all deals during the opening quarter were raised by RegTech and Blockchain & Cryptocurrencies businesses.

- Blockchain & Cryptocurrencies deal activity has been a main driver of FinTech investment in the country. Companies in the sector completed the most transactions each year since 2017 and raised a total of 62 deals since 2016. The city-state is home to a healthy blockchain ecosystem comprising numerous players tackling areas ranging from asset tokenisation, trading and custody to insurance, digital identity, and mobility.

- RegTech companies’ share of deal activity saw the biggest growth over the period – more than doubling between 2016 and 2019 before reaching a quarter of all FinTech deals in the first three months of 2020. Back in 2018 the Monetary Authority of Singapore (MAS) laid out six core focus about the development of the FinTech ecosystem in the country and three of them were closely related to RegTech – identity/KYC, data governance and platforms for innovation. Following this MAS launched its e-KYC initiative MyInfo, a digital service that enables citizens to authorize 3rd party access to their data, further supporting RegTech innovation in the country.

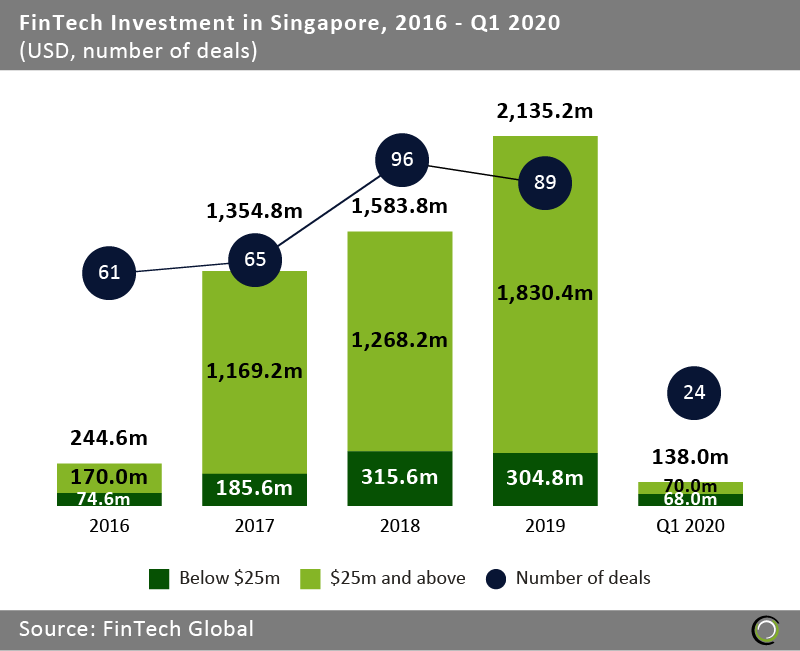

FinTech funding in Singapore is on track to decline this year due to lack of large deals

- FinTech companies in Singapore raised nearly $5.5bn across 335 deals between 2016 and 2019. Funding increased nearly nine times over the period to a record high of $2.1bn last year. The record amount was driven by six deals completed over $50m.

- However, funding to the sector declined during the first three months of 2020 with only $138m capital raised compared to $1.5bn in Q1 2019. Even if we exclude the large deals over $50m from the analysis, funding still declined by nearly 30% and if that rate continues for the rest of the year, then the Singapore’s FinTech sector is on track to record its worst year since 2017 for investment activity.

- The largest deal of the first quarter was completed by Elara Technologies, a digital real estate advisory firm, which raised $70m from News Corp. and REA Group. The company will use the funding to expand its business in India.

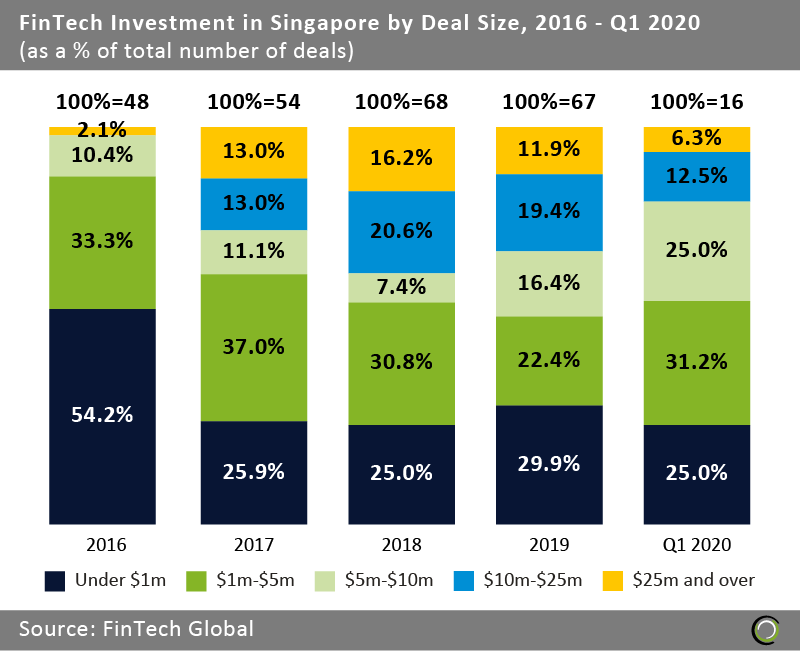

The number of deals over $25m nearly halved in the first quarter of 2020

- As the FinTech industry matured in Singapore, the share of deals valued at $25m and over jumped from 2.1% in 2016 to 16.2% in 2018. Additionally, the share of deals between $10m and $25m also increased to 20.6% during the same period from from no transactions in this size bracket in 2016.

- However, the share of deals over $10m declined by 5.5 percentage points (pp) in 2019 before shrinking further to just 18.8% deal share in Q1 2020. While it is important to note the presence of large deals is volatile over time, given the economic uncertainty caused by coronavirus we could see outflow of foreign investment and reduction in deal sizes in Singapore this year.

- The potential funding gap is being addressed by MAS which announced $70m package to help its financial services industry and FinTech firms boost their digital capabilities and drive their deployment of digital tools. As part of the package all Singapore-based FinTech companies would have six months of free access to an online global marketplace and sandbox for sales and collaboration.

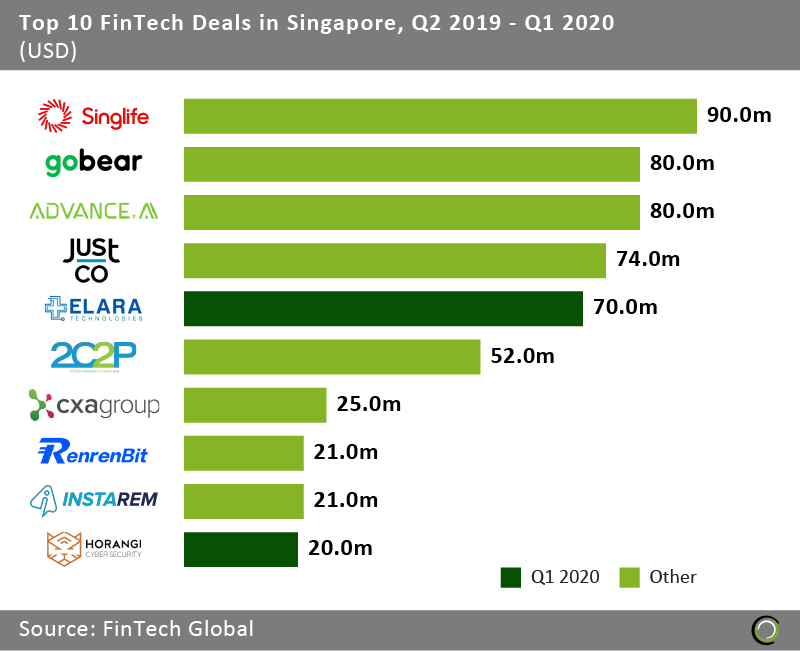

Only two of the top ten FinTech deals in the last 12 months took place in Q1 2020

- The top ten FinTech deals in Singapore in the past 12 months raised in aggregate $533m, which equals to 68.6% of the overall investment in the country during that period. The ratio is much lower when compared to other countries such as Germany (81.1%) and Italy (93.8%) demonstrating that capital flows across the different stages of funding. However, we could see that ration increase as investors pull out of riskier early stage deals amid the economic slump.

- Only two of the deals in the list were completed in the first quarter of 2020. The previously mentioned Elara funding round and Horangi’s $20m Series B round. Horangi is a SaaS cybersecurity company and will use the funding to expand further into Southeast Asia and enhance its cloud security platform.

- The largest deal of the period was raised by Singapore Life, a digital life insurer, which raised $90m in a corporate round from Sumitomo Life Insurance Company. As part of the transaction Sumitomo acquired 25% stake in the company and the funds will be used to accelerate Singlife’s mobile-first insurance capabilities and establish a connected consumer financial journey and interface from life insurance to money and wealth management.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2020 FinTech Global