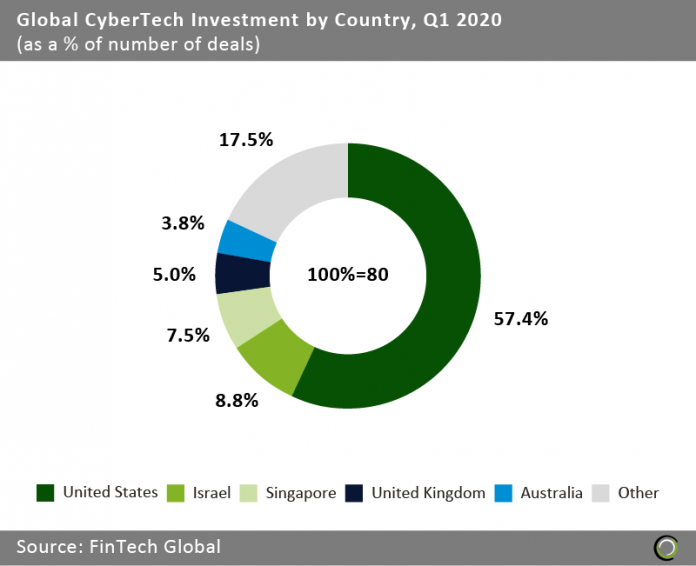

US companies raised 57% of all CyberTech transactions as deal activity nearly doubled compared to the opening quarter of last year

- CyberTech companies offering services to financial institutions completed 80 transactions globally in the first three months of 2020 with US, Israeli and Singaporean companies capturing nearly three-quarters of deal activity.

- Companies based in the United States have dominated global CyberTech deal activity having captured 57.4% of all transactions in the sector since 2016. As the US is largest economy in the world, the nation is prominently threatened by attackers. Around $15bn is spent annually by organizations in the country to provide security for communications and information systems. Coupled with the well-established tech sector in Silicon Valley and support from the government’s National Cyber Strategy unveiled in 2018, it is unsurprising that American companies are attracting the lion’s share of deal activity.

- Israeli companies completed the second highest number of deals in the first quarter, taking an 8.8% deal share. The Israeli cybersecurity industry has long been recognized as a hotbed for innovative solutions drawing from its strong military capabilities and cybersecurity education which starts as early as middle school.

- The only European country to make the top five was the UK with British companies completing 5% of CyberTech deals in the first quarter.

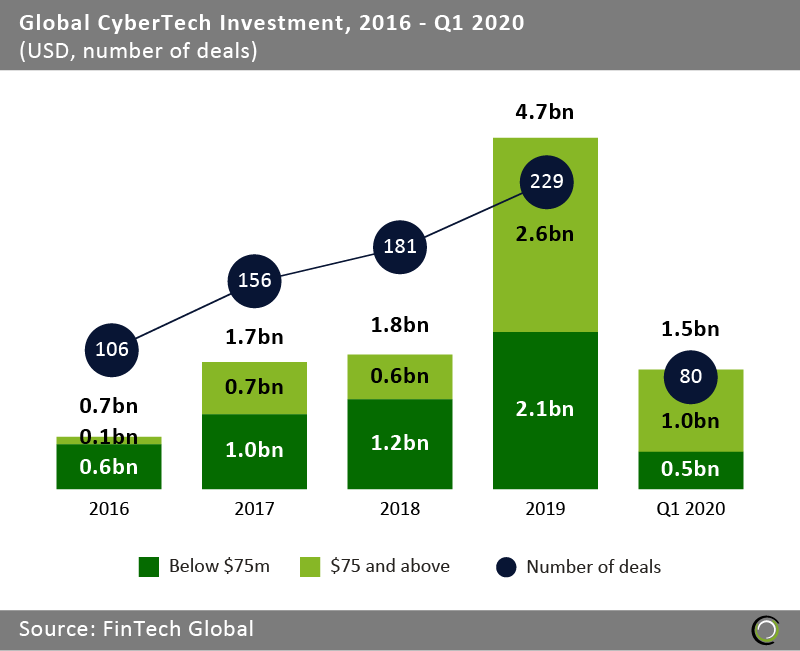

CyberTech companies raised $1.5bn across 80 transactions in Q1 2020

- The global CyberTech industry experienced tremendous growth between 2016 and 2019 as investors poured money into companies battling the increased threat of cyber attacks and data leak in financial services. Total funding grew at a CAGR of 91.6% from $666.1m to nearly $4.7bn at the end of last year.

- Increased share of total funding came from deals over $75m hitting 55.3% in 2019. However, capital invested and deal numbers also grew for transactions under that threshold. This demonstrates that the sector experienced healthy growth not just fuelled by larger cheques written by investors.

- Deal activity also increased during the period from 106 transactions in 2016 to 229 funding rounds in 2019 as innovation in the sector spread to other regions in the world and new cybersecurity threats emerged.

- CyberTech investment had a strong start to 2020 with $1.5bn worth of funding raised across 80 deals. The funding was driven by large deals over $75m which made up 73.3% of the total capital raised during the quarter. Deal activity grew 90.4% compared to Q1 2019 putting CyberTech funding on track for a record year, depending on the impact of the Covid-19 pandemic.

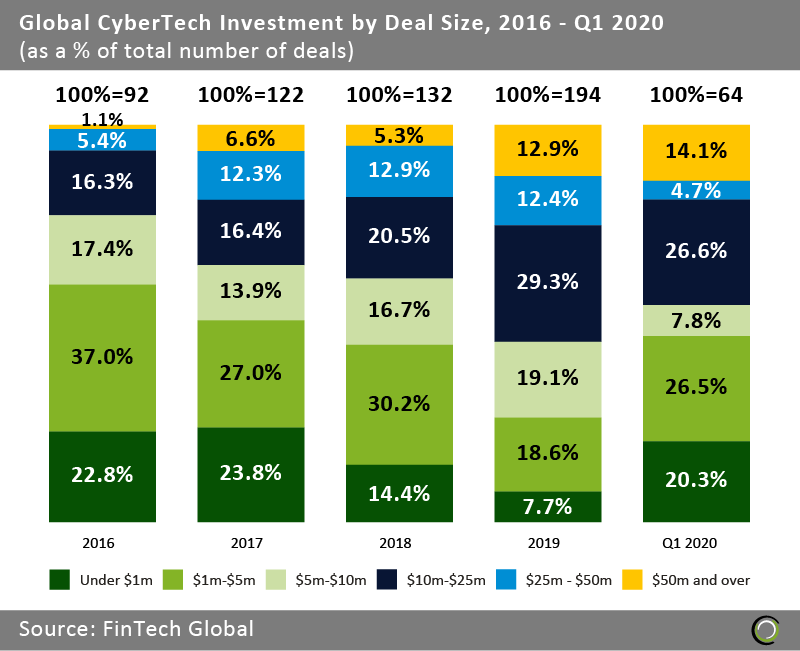

A resurgence in deals under $1m in the first quarter of 2020 fuels new wave of innovation in the CyberTech sector

- As the global CyberTech industry matured, the share for deals valued at $50m and over increased from 1.1% in 2016 to 12.9% in 2019. That share increased even further in the opening quarter of this year to 14.1% with nine deals of this size being recorded.

- On the flip side the share of deals valued under $5m decreased by 33.5 percentage points (pp) between 2016 and 2019. However, that share rebounded to 46.9% at the start of 2020 suggesting that investors are showing renewed appetite for early stage deals and looking to back the next wave of disruptive innovation in the sector.

- However, it is likely that we will see reversal of that trend in the second quarter based on observations of the investment landscape in countries hit earlier by the coronavirus pandemic, where investors stay away from riskier early stage deals due to the uncertainty caused by the virus and the expected economic downturn.

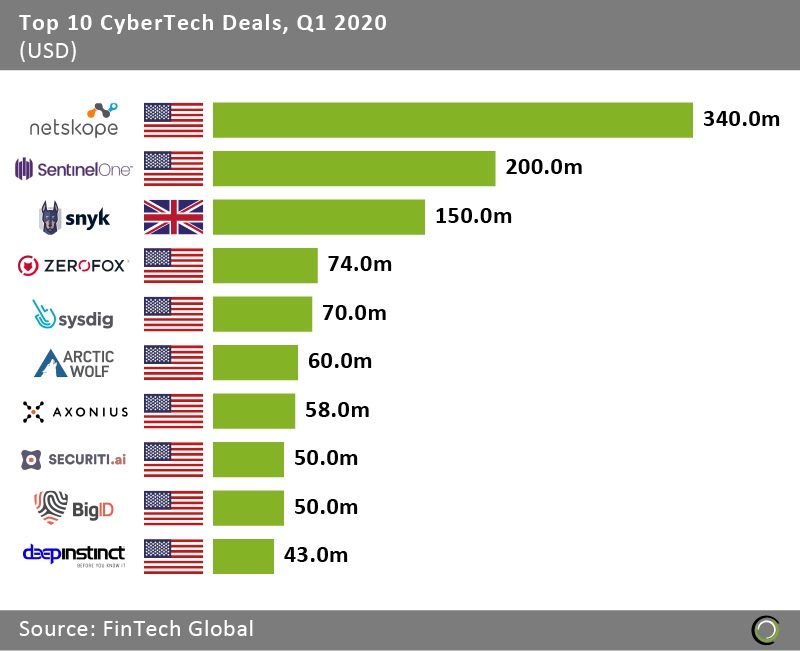

US Companies raised nine of the top ten CyberTech deals in the first quarter of 2020

- The top ten CyberTech deals in the first three months of the year collectively raised nearly $1.1bn, making up 72.5% of the overall investment in the sector during the quarter. The ratio is higher than the one recorded in Q1 2019 when 64.3% of total funding came from the largest ten transactions. This is to be expected given we are seeing increased share of deals at both ends of the deal size spectrum – for deals over $50m and under $5m.

- As discussed earlier, US companies are leading CyberTech investment and they also dominate the top ten transactions list in Q1 taking nine spots. The only company to break the country’s dominance was UK-based Snyk, a digital security company for open source development, which raised $150m in a Series C round in January.

- The largest deal of the period was raised by Netskope, a software provider helping companies secure data and protect against threats in cloud applications. The company raised $340m in a Series G round led by Sequoia Capital in February. With the new funding the company tripled its valuation and is now valued at $3bn.

We recently announced the CyberTech100 list for 2020. If you want to learn more about the most innovative companies bolstering the defenses of financial institutions download our report at www.CyberTech100.com

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2020 FinTech Global