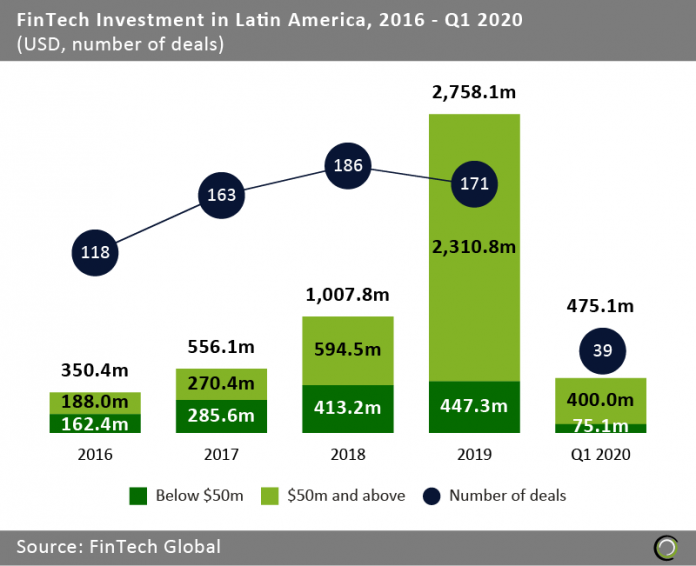

Companies in the region raised over $475m in Q1 2020 driven by large deals in Mexico and Brazil.

- The FinTech industry in Latin America experienced huge growth in funding between 2016 and 2019 as investors backed innovative startups making financial services more accessible for the large unbanked population in the region. Total capital invested grew at a CAGR of 98.9% from $350.4m in 2016 to over $2.7bn at the end of last year.

- Deal activity also increased during the period, peaking at 186 transactions in 2018 before dropping slightly to 171 in 2019. Despite that small drop, last year saw a record amount of funding mainly driven by ten deals over $100m, including a mammoth $400m Series F round raised by Nubank, a Brazilian challenger bank. As a side-note, the round saw Nubank join the coveted decacorn club consisting of companies with a valuation over $10bn, which made it one of the most valuable neobanks in the world. You can read more about our research about the topic and other challenger banks here.

- Investment in the region had a strong start to 2020 with $475.1m capital invested, a growth of 93.2% compared to Q1 2019. However, 84.2% of that funding came from three deals over $50m. If we exclude these large transactions funding in the first three months of the year is very similar to the one recorded at the start of 2019 when $75.9m was raised in deals under that threshold.

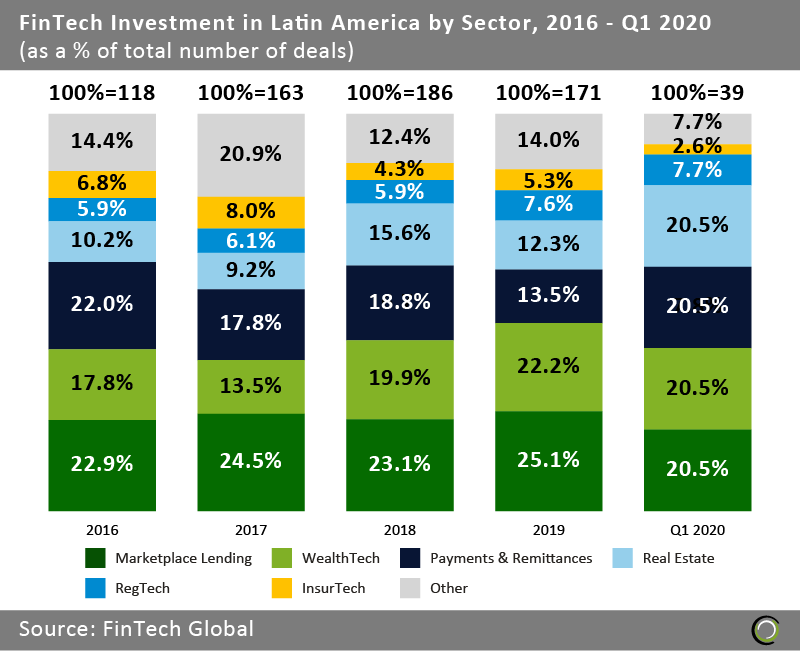

Real Estate and Payments & Remittances investment in the region saw a resurgence in Q1 2020

- Marketplace Lending, Payments & Remittances and WealthTech companies completed 60.3% of FinTech deals in Latin America since 2016. Regulators across the region played a major role in promoting innovation in these sectors by using open banking legislation to increase financial inclusion and break up incumbent bank monopolies. For instance, in Mexico and Brazil, two of the leading countries for FinTech investment in Latin America, new regulations aim to lower barriers to entry for new tech entrants to apply for and receive regulatory approval for lending licenses and bank charters.

- The share of Payments & Remittances deals shrank during the period from 22% in 2016 to 13.5% last year as investors looked for opportunities in other areas. However, the first three months of 2020 saw a resurgence in interest in the sector with eight deals completed or 20.5% of all FinTech transactions.

- Real Estate technology has been a main area for investment in Latin America with companies in the sector completing over 10% of deals each year since 2016. That share jumped above 20% in Q1 as technology innovation in the PropTech market accelerates and more companies redefine the property purchase, management and investment process for the population in the region that has huge appetite for tangible and fixed assets.

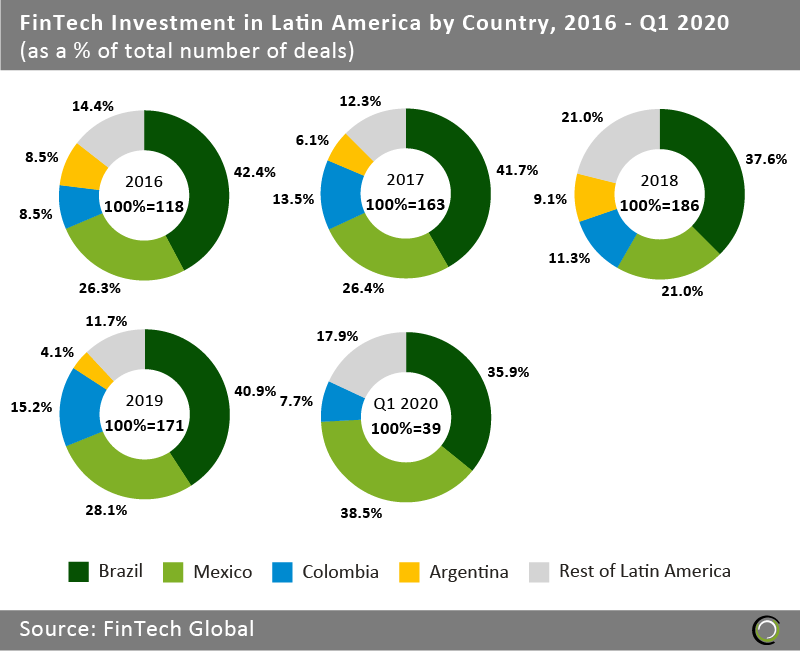

Mexico is challenging Brazil for the FinTech leader title in Latin America

- Companies based in Brazil completed 40.2% of the 677 deals completed by FinTech companies in Latin America between 2016 and Q1 2020. With 64% of the Brazilian consumers adopting FinTech services according to EY, young tech-savvy population with average age of just 32, high fees charged by incumbent financial institutions and supportive regulator, the country has established itself as a fertile ground for FinTech innovation and investment.

- However, the country’s share of deal activity has declined over recent years as other countries in Latin America are fostering strong FinTech ecosystems attracting new capital from investors. Brazil’s share of deal activity in the region has steadily declined from its peak of 42.4% in 2016 to 35.9% in the first quarter of 2020.

- The country that saw the biggest growth in deal activity was Mexico. Companies in the country completed 38.5% of all FinTech deals in the region during Q1 2020, a growth of 10.4 percentage points from 2019. In 2018, Mexico became one of the first countries in Latin America to pass a law regulating the services provided by financial institutions through technological means. The so called ‘FinTech Law’ aims promote financial inclusivity and technological innovation through collaboration between Mexican regulators, legislators, and important private actors in the field.

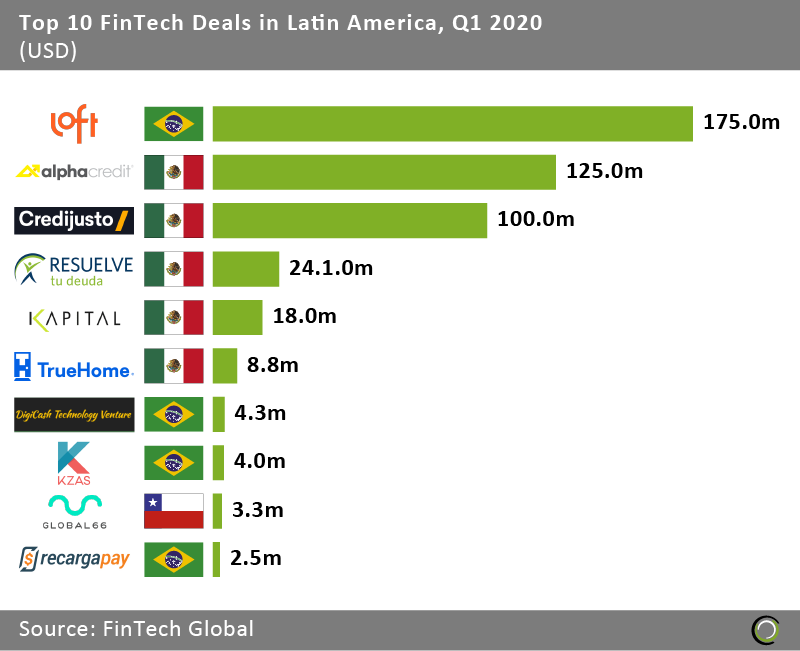

Mexican companies raised half of the top ten FinTech deals in Latin America in Q1 2020

- The top ten FinTech deals in Latin America completed in the first three months of 2020 raised in aggregate 464.9m, making up 97.9% of the overall investment in the region during the quarter. The high concentration of capital in large deals can be explained by the huge disparity in deal size distribution with three deals recorded over $100m and all remaining funding rounds under $25m.

- Mexican companies took five spots on the list with all transactions placing in the top six FinTech deals in Q1. The largest deal in the country was completed by AlphaCredit, an online provider of credit lines to individuals and SMEs, which raised $125m in a Series B round led by SoftBank. The company plans to use the capital to further consolidate its market position on Latin America.

- The biggest deal in Latin America in Q1 2020 was raised by Loft, a Brazilian real estate platform to buy, sell and rent residential and commercial properties, which raised $175m in a Series C round co-led by Vulcan Capital and Andreesen Horowitz. Loft has undergone rapid growth and expansion, saying that it has grown ten times year-on-year to notch “over $150 million in annualized revenues in its first full year of operation” completing more than 1,000 transactions in the process.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2020 FinTech Global