Banking platform Curve has created a new subsidiary named Curve Credit and has now opened its waitlist for customers who want early access to its first product when it hits the market later this year.

Curve has also announced that the top 200 customers on the waitlist will get early access to Curve Credit before the product is fully available to customers, subject to eligibility checks.

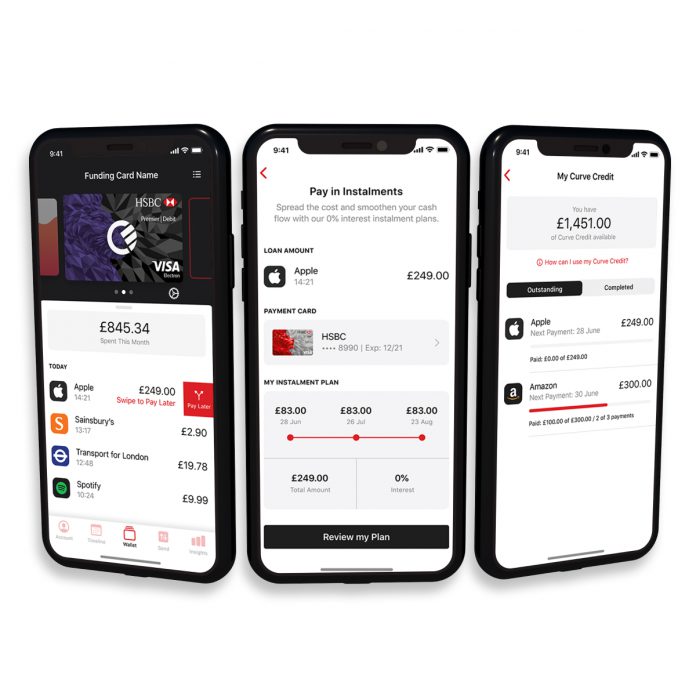

The company’s announced said that Curve Credit will transform consumer credit by enabling customers to pay off their credit card debt and to split transactions into instalments, made on any connected cards, at any merchant, at any time, all effortlessly managed within Curve’s app.

Curve Credit is currently in beta and being tested by Curve employees before being extended to a select community of trusted Curve testers ahead of a full consumer launch later this year.

“Curve Credit will offer our customers a unique combination of capabilities that will generate a truly satisfying experience,” said Paul Harrald, head of Curve Credit. “We’re able to do this because we will be a genuine FinTech lender, using the synergies, the economies of scope, that exist between payments, lending, and a beautiful UX design.

“Customers can shop with any merchant, using any underlying funding card they choose, and we will allow them either immediately or at their leisure to “go back in time” and split the purchase into instalments. So, we’re always available, any-merchant, any card, point-of-sale finance. And, you can change your mind later. This is a truly unique offering that will change the way people manage their cash flow.”

Copyright © 2020 FinTech Global