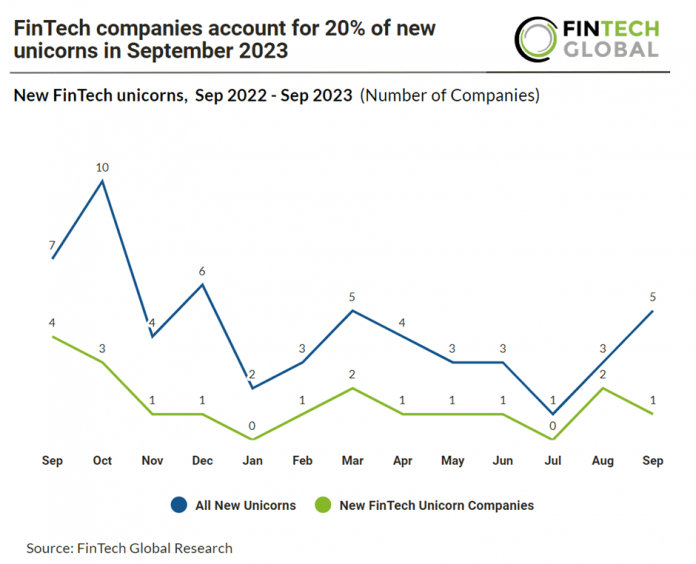

Overall there were five new unicorns announced across all sectors in September 2023 with one being FinTech, a 20% share of new unicorns.

Kin Insurance, a direct-to-consumer digital insurer, was the only new FinTech unicorn in September 2023 after raising $33m in their latest Series D extension funding round, bringing its valuation to more than $1bn. The company intends to use the funds to consolidate its market position and accelerate its growth. The extension brought the Series D funding total to $142m, bringing the total funding received to date to $265m. The round was spearheaded by QED Investors, with contributions from existing investors including Geodesic Capital, Allegis Capital, Hudson Structured Capital Management Ltd. (operating under the reinsurance business name HSCM Bermuda), and Alpha Edison. Under the leadership of CEO Sean Harper, Kin is a dedicated direct-to-consumer digital insurance company that specializes in the homeowners insurance market, effectively removing the necessity for external agents. Kin utilizes advanced technology to comprehensively assess the structural attributes of buildings. Simultaneously, the company’s policy platform offers tailored coverage options and streamlined claims services.

Possible FinTech Soonicorns:Curve, a banking platform, is poised to become a unicorn with its innovative approach to simplifying money management and their latest valuation was $612m in 2023. The company’s technology allows users to consolidate multiple debit and credit cards into a single card and mobile app, similar to Klarna’s “buy now, pay later” service called Curve Flex. Curve has successfully raised £159 million across ten equity fundraising rounds, attracting support from private equity and venture capital firms like Fuel Ventures, Outward VC, and Seedcamp, as well as crowdfunding through Crowdcube. Its valuation has steadily risen from £37.9 million in July 2017 to £612 million in April 2022, reflecting a remarkable 23% increase in just seven months.

10x Banking, a cloud-native core banking platform, specializes in developing an open banking platform for the financial services sector and their latest valuation was £491m in 2021. Founded in 2016, the company has experienced substantial valuation growth, surging by 215% in just two years, from £156m in March 2019 to £491m in June 2021. It has also been actively engaged with initiatives such as the Mayor’s International Business Programme and earned recognition by being featured on the Lazard T100 European Venture Growth Index in 2021. To support its international expansion efforts, 10x Banking has successfully conducted four equity fundraisings, accumulating a total investment of £223m. The company boasts an impressive list of backers, including prominent names like Nationwide, BlackRock, CPP Investments, JPMorgan Chase & Co, Ping An Ventures from China, and Australian bank Westpac.