From: RegTech Analyst

Even though the global pandemic will have an impact on the financial industry as a whole, the value of the global RegTech market is expected to reach $21.73bn by 2027, according to a new report by Reports and Data.

As skyrocketing value of the market is driven by the growing regulatory burden businesses face, which increase the demand for compliance solutions.

The researchers estimated that the cost of compliance across all banks from 2014 to 2016 averaged approximately 7.0% of their non-interest expenses. This regulatory burden was much larger for smaller banks with assets below $100m where the cost of compliance averaged about 10%. In contrast, expenses for banks with assets of $1bn to $10bn averaged a little above 5%.

The news comes after RegTech Analyst’s research revealed that there had been nearly 950 RegTech deals completed globally between 2015 and 2019, with over $17.1bn raised across these transactions.

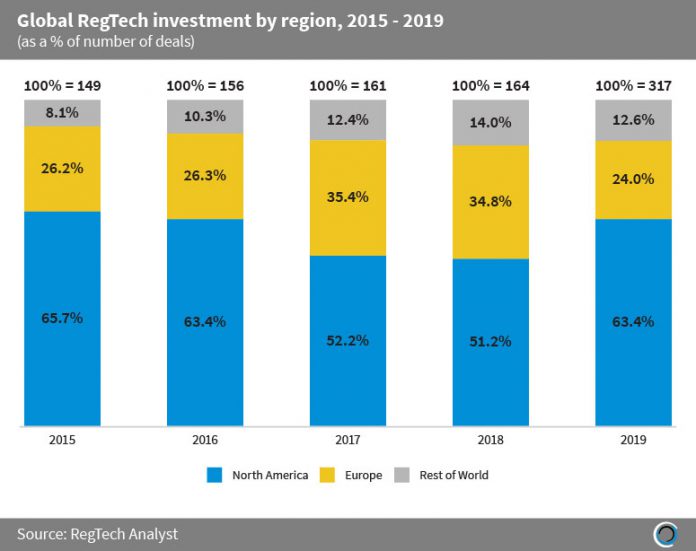

The North American RegTech industry dominated the field in terms of the investment attracted during that period. North American ventures completed 59.8% of the global total of deals. However, between 2015 and 2018 there was a shift in RegTech deal activity away from North America towards other regions of the world.

In 2018, Europe accounted for 34.8% of deals, an increase of 8.6 percentage points (pp) from 2015, while North America’s deal share dropped by 14.5pp from 65.7% in 2015 to 51.2% in 2018. This comes as investors prepared for Eurocentric regulations such as GDPR and MiFID II which were enforced in May and January 2018, respectively.

Copyright © 2020 FinTech Global