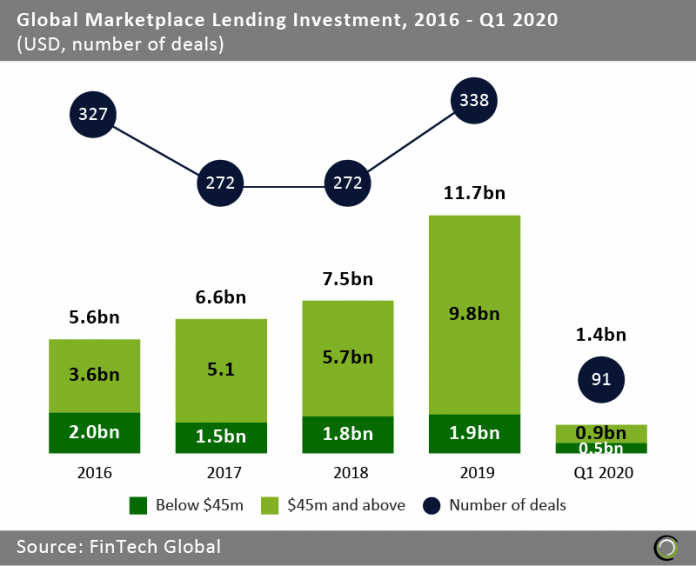

Marketplace Lending companies raised $1.4bn in the first three months of 2020, a decline of 35% compared to Q1 last year

- Total Marketplace Lending funding more than doubled from 2016 to 2019 to reach $11.7bn last year. The record funding levels were mainly driven by large deals over $45m which raised in aggregate $9.8bn of the total for the year.

- There has been a 24% increase in the number of deals completed from 2017 to reach a high of 338 transactions last year.

- Due to Covid-19 and the following economic downturn, Q1 2020 is off to a slow start with $1.5bn in total funding. This is a 35% decrease in total capital invested compared to Q1 2019. Despite early hope of a quick economic recovery, the Marketplace Lending sector is on track to have a down year based off the relatively low level of investment compared to historical standards and continued lockdown of both businesses and wallets in Q2 2020.

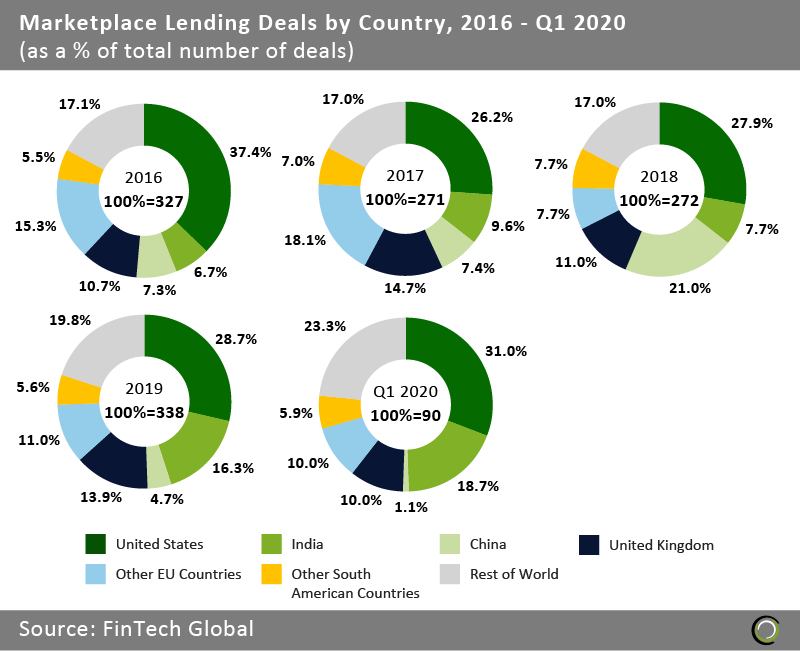

India saw continued growth in Marketplace Lending investment despite COVID-19 uncertainty

- Marketplace Lending investment in India experienced high growth rates in investment since 2016. Despite recording a 19% decrease in the total number of deals in the country from 2017 to 2018, investment activity in India rebounded by 8.6 percentage points (pp) in deal share from 2018 to 2019. This trend continued into Q1 2020 as the country’s deal share increased by 2.4pp to 18.7%. The rise in investment is mainly due to growth in P2P lending as banks have been reluctant to give out loans, opening a market for small and medium size enterprises to advance the sector.

- The share of deal activity of Chinese companies in Q1 fell 19.9pp from the highs recorded in 2018 as Covid-19 concerns have further dampened activity in the sector. This is after China placed heavy regulations in late 2017 on lending due to high levels of debt. As part of the regulations, China placed a lending cap for consumers and lenders, banned pooling investor money, and with dwindling economic growth, the combination has led to China nearly pulling out of marketplace lending all together.

- The United States is regaining foothold after a 9.5pp decline in deal share between 2016 and 2018 to take 31% of all deals in the sector in Q1 2020, consolidating its position as the leading country for Marketplace Lending investment.

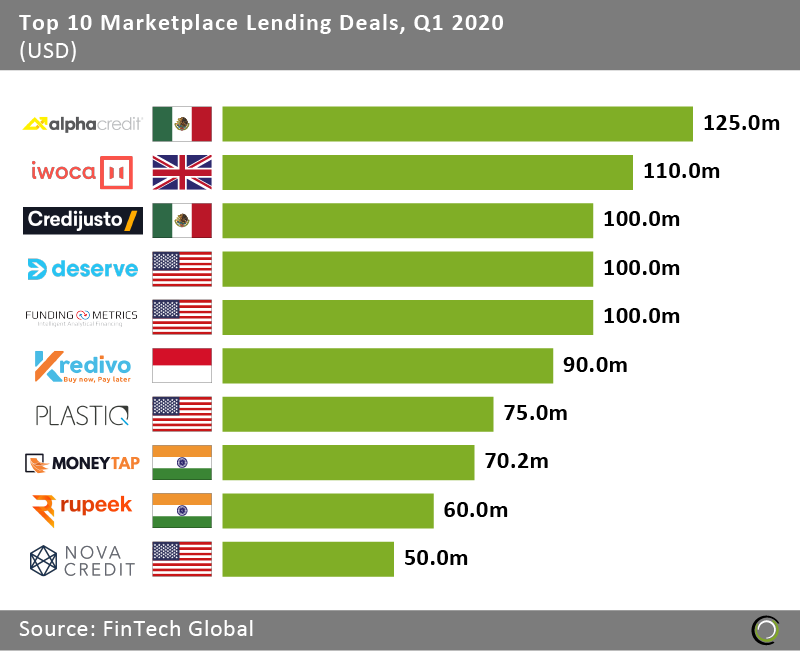

The top ten Marketplace Lending deals in the first three months raised 40% of the levels recorded in Q1 2019

- The top ten Marketplace Lending deals in the opening quarter of the year raised in aggregate $880.2m, making up 62.2% of the total funding for the period. In Q1 2019, the top ten deals totalled just over $2.4bn, highlighting a slow start in Q1 2020 due to Covid-19 and rising economic concerns.

- The United States continues to be a hotspot for marketplace lending deals, capturing four out of the top ten transactions. The largest deal in the US was completed by Deserve, the FinTech credit card startup, which announced a $100m credit facility in Q1 2020 with Credit Suisse to meet demand for their highly configurable credit card program.

- AlphaCredit, a lending startup that provides loans to individuals and SMEs, struck the largest deal in Q1 2020 in a Series B round of $125m with SoftBank, SOFTBANK Latin America Ventures to continue to expand and leverage the advantages their business model has proven.

- India, a country that has seen significant growth in investments in Marketplace Lending, was home to two of the top ten deals in the sector. MoneyTap, a consumer lending startup, raised $70.2m in a Series B funding round led by Aquiline Technology Growth and four other investors to grow their loan book from a range of ₹3,000 all the way to ₹5,000.

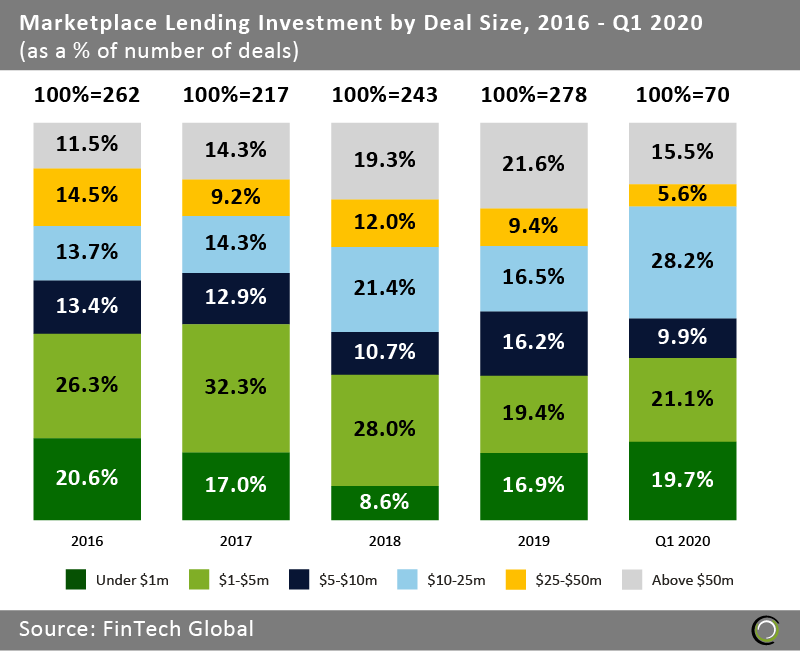

The share of deals over $50m recorded first decline in Q1 2020 since 2016

- The opening quarter this year marks the first time that the share of deals over $50m has decreased in the period 2016-Q1 2020. The 6pp decline in Q1 2020 is a combination of both Covid-19 affecting businesses and investors predicting economic uncertainty with higher default rates in the coming months.

- Due to China’s regulations and their falling presence in the sector investors have looked to other regions to grow lending companies. This may account for the 2.8pp increase in the share of deals under $1m and the 1.7pp rise in the share of transactions between $1m and $5m.

- Deals in the range $10m-25m grew 11.7pp, indicating a downscale from high value deals by investors. The combined 10% drop in deals sized from $25m-$50m and above further signals the conservative stance taken by investors as they look to scale back investment.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2020 FinTech Global