Coincover has just secured new investment to fuel its endeavour to help cryptocurrency companies secure their digital assets.

Cryptocurrencies are nothing new. It has been over a decade since the unknown bitcoin founder using the soubriquet Satoshi Nakamoto invented the now infamous digital currency. Since then the worth of bitcoin has fluctuated considerably. Still, the popularity of the blockchain-powered currency has also motivated the launch of several other initatives such as ethereum and litecoin.

And the cryptocurrency market is growing. Facebook announced in 2019 that it would lead the Libra Association as the group of members collaborated to launch a digital ledger-based currency called Libra. It was planned to be launched in 2020, but the launch has yet to manifest. The delay could be attributed to the intense scrutiny from regulators and lawmakers.

Moreover, Central banks around the world have started to investigate whether they should create digital money of their own. Several celebrities, such as singer Akon and ex-footballer Michael Owen, have even launched their own cryptocurrencies.

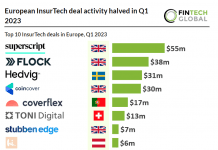

It is against this background that InsurTech Coincover has announced its most recent funding round. The round was led by Insurtech Gateway with participation from the Welsh Development Bank Technology fund and saw an undisclosed amount of money being injected into the startup.

The crypto security venture specialises in protecting cryptocurrencies held online. Founded in 2018, Coincover will use the money to meet the growing demand from the nascent digital asset insurance sector that is already estimated to be worth up to $3bn annually.

“Coincover helps crypto businesses to address the security concerns of the cautious investor and delivers the trust mark they need to stand out in a crowded and wary market,” said David Janczewski, founder of Cryptocover.

“We are the only company in the world with a security product that is backed by Lloyds of London, providing protection from cryptocurrency theft at the individual level and an opportunity to maximise business revenue by enabling our partners to build systems that creates strong trust with their clients.”

Before launching the company, Janczewski clocked up several years of experience leading The UK Royal Mint’s blockchain-enabled digital gold initiative and providing advice to other blockchain projects.

“Coincover is removing the last major barrier to the mass- market adoption of cryptocurrencies,” said Janczewski. “We are already partnering with the world’s leading cryptocurrency solution providers to deliver the safest way into cryptocurrency.

“In the age of cryptocurrency vulnerability, businesses have to deal with people’s fear of lost or stolen funds. The platforms and products that offer the strongest safety guarantees and can ensure the security of their users’ funds are the ones that will come out on top in the next few years. Our partners can build a trusted brand as they can offer complete assurance to their customers. We have seen a huge growth in enquiries since Covid-19 lockdowns began around the world. This investment will allow us to meet this demand and fuel exponential growth.”

Richard Chattock, CEO of Insurtech Gateway, added, “Digital assets are growing at an exponential rate globally, and represent the next ‘blue ocean’ for insurance and protection. Innovative solutions like those offered by Coincover are reducing the risks and barriers to digital asset adoption, and we were delighted to continue our support.”

Copyright © 2020 FinTech Global