Customers are demanding better customer experiences from insurers. Fortunately, technology could help.

Insurance is changing. Over the years, the sector has adopted everything from wearable technology to chatbots to bolster its services as well as its bottom line. But the evolution of the industry could be about to pick up speed even more due to Covid-19 demonstrating the need to change. Legacy systems have proven inadequate, slow, replaceable. So change is brewing, coming. And when it does, the industry’s stakeholders may need to start looking at how to improve the customer experience on offer.

That is one of the conclusions from a panel held at the Virtual InsurTech Forum 2020. David Clamp, founder and managing director at the consultancy Merlin Digital Consulting, started the conversation by asking why it was so important to improve the customer experience.

David Priestley, chief digital officer at Vitality, the health insurance company, replied that part of the reason was that it had been neglected for a long time. “[Traditional insurers used to] kind of almost not want to engage [with] customers too frequently because that generally meant a claim or some kind of administration process which, as you know, was a kind of overhead,” said Priestley.

But this attitude is rapidly being turned on its head. Key to understand this shift in focus on customer experience is the realisation that many people don’t like how they have interacted with their insurers in the past. “Everybody [needs] insurance, but it’s always at the bottom of the to do list,” said Pravina Ladva, group digital transformation officer and life chief technology and operations officers at Swiss Re, the insurer.

Instead, she argued, most people tend to only think about insurance in those moments when they fear for themselves, their loved ones and their home in the event of an accident. “So they actually look at it from more of an emotional perspective, as opposed to getting up in the morning and go, ‘yay, let’s go and buy insurance,'” Ladva continued.

She therefore suggested that insurers must make the process of getting insurance more seamless for their customers. “[The] experience of buying insurance has to be simple [and] something that’s relatable to everybody’s daily life,” she said.

Ladva suggested that insurers need three things to level up their customer experiences. Firstly, the insurers must be available when their customers need them. “It’s about being there at that moment of truth,” Ladva said.

Secondly, insurers must have a human touch in order to successfully engage and empathise with their customers.

That human touch can be driven by insights gathered from the third factor needed to bolster their customer experience: data.

Each company today has access to massive data points that could help them understand their users. By harvesting the data, insurers can provide a better experience.

But having access to this data is not the same as being able to leverage it. “There’s so much data to sift through, but humans really can’t do that without technology any more,” said Mark Dunlap, global solutions director at Medallia, the customer experience improving company.

He argued that insurance companies can leverage clever innovation to harvest big data insights from the data from contact centres, from the millions of messages they get through their sites, through ratings on sites like Trustpilot, and many other sources. “[That data] can really easily be tackled with technology,” Dunlap added.

In other words, if insurers can combine a human touch with the insights provided from big data and be available when users need them, then they could truly start to provide a great customer experience.

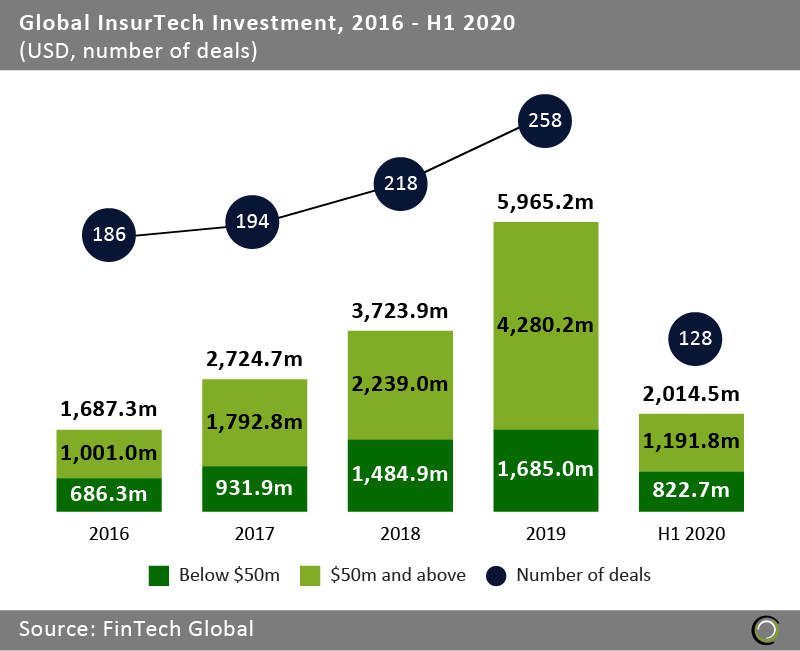

The ideas about how to improve customer experiences in the insurance space come after a period of rapid growth of the InsurTech industry. FinTech Global’s data shows that investors have increased their investment into the sector from $1.68bn in 2016 to reach $5.96bn in 2019. There seems to have been a slight slowdown in the first half of 2020, with the sector only attracting $2.01bn in investment during that period.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global