CyberTech companies raised only $700m in the second quarter, a more that 60% decline from the first three months of 2020

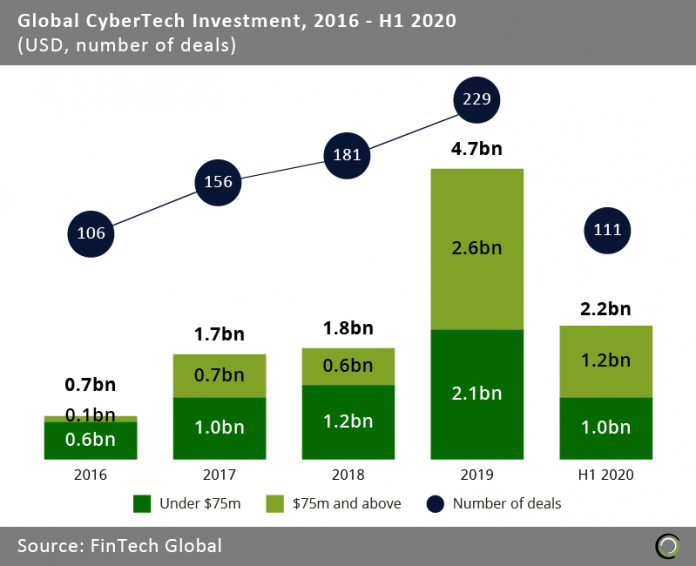

- The global CyberTech industry saw exponential growth between 2016 to 2019. The desire for better security as the number of cyber-attacks and scale of breaches escalated pathed the way for the sector to grow. Total funding grew at a CAGR of 91.6% from $666.1m in 2016 to nearly $4.7bn at the end of last year.

- CyberTech’s peak came last year with a 1.6x increase in total funding from 2018 coupled with a 26.5% increase in the number of deals completed. The massive surge in funding came from deals over $75m which grew 55.3% YoY in 2019. Furthermore, the 75% increase in funding from deals below $75m signaled that there was strong investor appetite for start-up cybersecurity firms battling new threats.

- CyberTech investment started 2020 strong with $1.5bn capital raised in the first three months. Compared to Q1 2019, deal activity grew 90.4%. However, Q2 2020 told a much different story with a 61.3% decline in completed transactions and more than a two-fold drop in total funding compared to the opening quarter of the year.

- The strong Q1 2020 funding figures stem from a rollover from Q4 2019. Deals that were initiated at the end of last year on the back off the strong momentum in the sector rolled over into Q1 2020 to be finalized. Furthermore, companies desired to up their security as their workers entered into a virtual work environment. The change in the need in security and the type required has sparked investor interest as companies like Facebook and Google have announced that employees may work from home for much longer than expected. The introduction to virtual work has triggered a new type of demand for security which made investors pause in Q2 to reassess the marketplace.

The CyberTech industry sees readjustment due to shifting threats as deals under $1m skyrocket

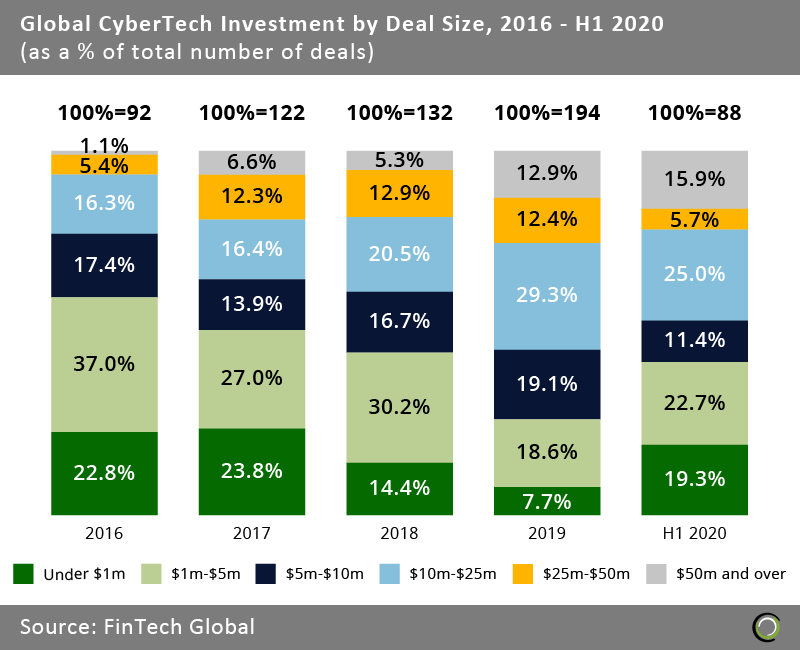

- The global CyberTech industry has matured at an exponential rate with the share of deals sized $50m and over increasing 11.8 percentage points (pp) in just three years. That increase has gone up even further in H1 2020 as the proportion of deals sized over $50m reached 15.9%.

- Despite the increase of large deals in H1 2020, the number of deals sized between $5m-$50m all fell dramatically. The share of transactions sized between $5m-10m dropped 7.7pp while the proportion of deals sized between $25m-$50m was cut in half. The drop may signify investors are showing renewed interest for early stage deals as companies have moved their workers virtually. The move increases demand for new types of security as employees work in unmonitored environments.

- The surge in interest is backed by the 11.6pp increase in the share of deals under $1m as investors have fueled demand for new innovation in the CyberTech sector. From 2016 to 2019, deals valued under $5m decreased by 33.5pp. However, that share flared to 22.7% in H1 2020 confirming that investors are on the hunt for new companies that solve a new wave of security threats.

Asia sees boom in CyberTech as the country more than tripled its share of all deals in the sector in the last year

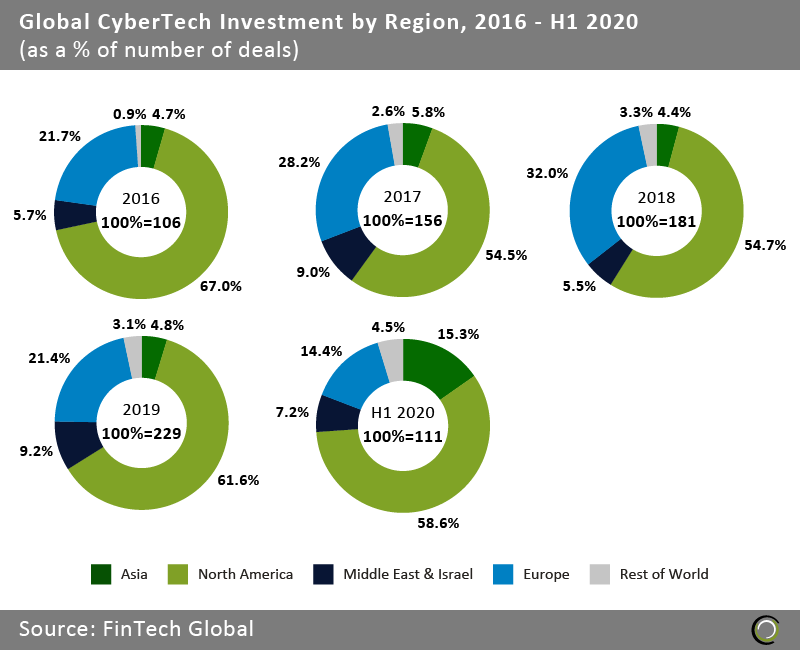

- CyberTech companies that offer cybersecurity solutions as it pertains to financial services completed 111 transaction globally in H1 2020 with companies based in North America, Asia, and Europe capturing nearly 88% of deal activity.

- US-based companies have dominated global CyberTech deal activity since its birth. In 2016, the US was home to 67% of all deals completed. This is to be expected as United States has the largest economy and has been the target for cyber-attacks for years. Around $15bn is spent annually by the US government for cybersecurity-related activities. With the US being the largest spender in the sector, it comes as no surprise that the country still controls 58.6% deal share globally.

- Asia saw an enormous surge in deal activity, tripling their position to 15.3% deal share in the sector in less than one year. The surge in growth is likely due to Asian companies being technologically behind in CyberTech. Asia-Pacific companies have been plagued by government inefficiencies pertaining to cyber laws and a lack of cybersecurity awareness leading to an increase in investment in the sector as the global lockdown ensued from COVID-19. The increasing severity of attacks on Asian countries and stringent government regulations are contributing to the growth in the cybersecurity market in the Asia-Pacific region. According to the 2017 Telstra Cyber Security Report, 59% of all organizations surveyed reported security breaches at least once a month. Indian companies were the most at risk with 14.8% of businesses experiencing weekly security incidences. Cyber security experts claim the increase in cyber-attacks by China stems from Beijing’s 2015 deal with the United States to halt cyber espionage. Since then, cyber security experts have seen a redirection of cyber threats originating from China that is aimed towards other regions in Asia.

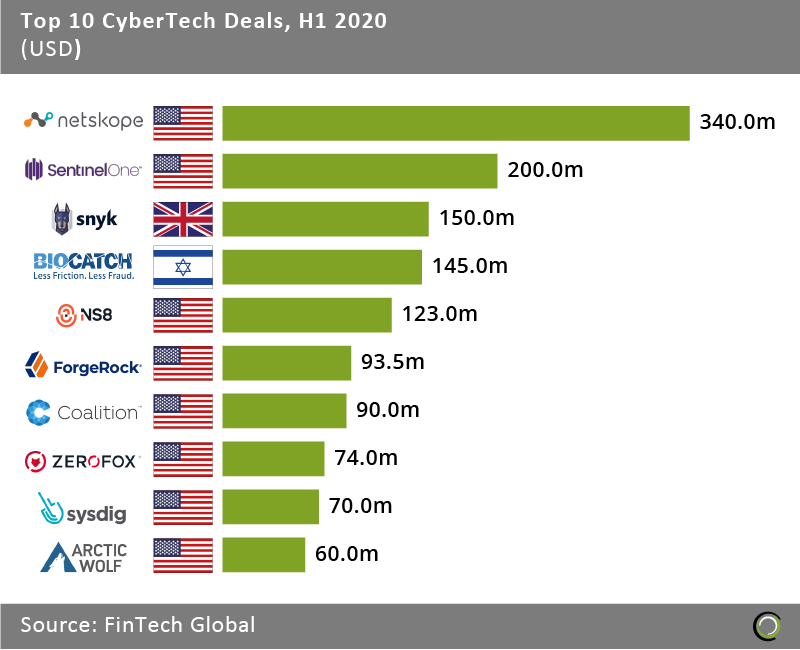

The top ten CyberTech deals, made up more than two-thirds of the funding for H1 2020

- The top ten CyberTech deals in H1 2020 collectively raised $1.3bn, accounting for 61.2% of the overall investment in the sector during the period. The percentage is much higher compared to that of H1 2019 when the top ten deals only accounted for 44% of total funding for the period. The increase comes as the share of deals at both ends of the spectrum have surged in transactions sized over $50m and under $1m.

- US companies captured eight out of the top ten deals as the US continued to dominate the CyberTech sector. Snyk, of the two companies to break the US’s dominance, is a UK-based digital security company for open source development which raised $150m in a Series C round.

- The largest deal of the period was raised by Netskope, a software provider helping companies secure data and protect against threats in cloud applications. The company raised $340m in a Series G round led by Sequoia Capital in February. With the new funding the company tripled its valuation and is now valued at $3bn.

- BioCatch, the biometrics cybersecurity firm, was the only other non-US based company that completed a deal. The Israeli company raised $145m in a Series C round.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global