Having recently announced that it had trebled its losses in the last year, Revolut is now celebrating that 500,000 customers have signed up to its business offering by adding new features to it.

Revolut Business launched in July 2017 with the stated aim of helping businesses of all sizes, across a number of industries around the world, to get more from their business account.

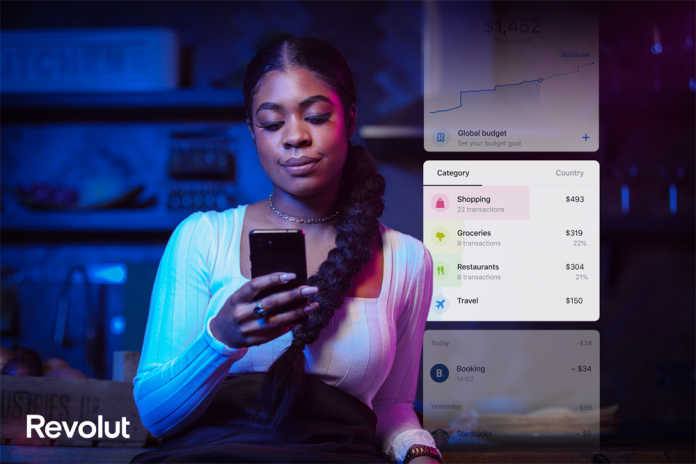

On the back of passing the milestone, Revolut Business has launched several new products, updated their interface and navigation, added more mobile functionality, and launched dark mode for mobile apps. Revolut Business is also looking to expand into US and Australian markets, making it easy for businesses to move money between continents without the hassle.

Over the past six months, Revolut Business has rolled out a suite of new products including debit cards, instant euro payments, INR transfers, direct debits, expense management, open banking so businesses can link their other accounts, and rewards to give them discounts on key services and integrations with a number of tech solution providers.

“We’re delighted to be helping businesses save money and time – and we felt that the milestone called for us to celebrate with a fresh look,” said Nik Storonsky, CEO and founder of Revolu. “The new structure of our Revolut Business web and mobile apps paves the way for some really exciting products we have in the pipeline. We can’t wait to take business accounts to the next level.”

At the beginning of August, Revolut revealed that its annual losses jumped from £32.8m in 2018 to £107.4m in 2019, but the neobank is still hoping to break even by 2021.

Copyright © 2020 FinTech Global