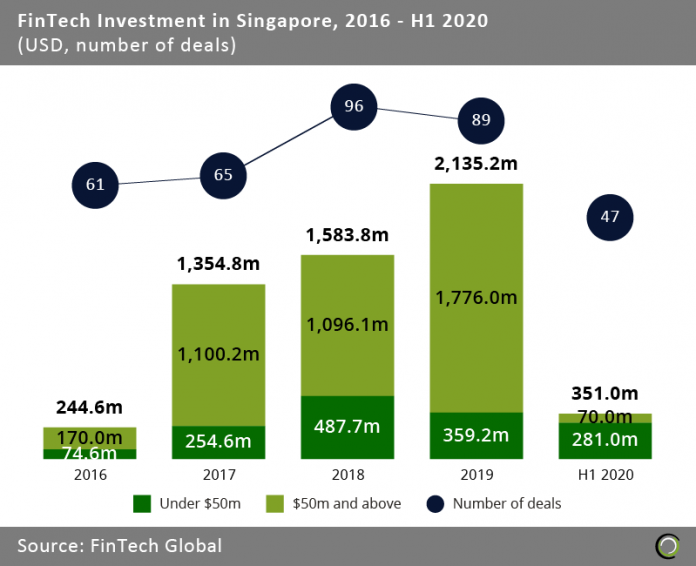

FinTech companies in the country recorded only a single deal over $50m so far this year compared to six in 2019

- While last year the FinTech sector in Singapore set a funding record, so far in 2020 the industry is set to have its worst year since 2017. Despite a 54.3% rally in total investment in Q2 2020 compared to the opening quarter, total investment in the first half of the year added to just over $350m via 47 completed deals, a three-year low in in terms of capital invested for a half-year period. The decline in funding was brought on by a lack of deals over $50m.

- The huge drop in investment from the start of year was primarily caused by Covid-19 and the economic uncertainty that followed. Total investment in H1 2020 was down 78% from the same period last year. Just over 19.9% of total investment for H1 2020 stemmed from deals sized over $50m. This is compared to H1 2019 where deals above $50m made up 92.5% of total investment for the period.

- The growth in FinTech funding in Singapore has been exponential with total capital invested growing at a CAGR of 105.9% from 2016 to 2019. The local FinTech ecosystem has boomed from a culture of innovation and support from both public and private initiatives. For example, the ASEAN Financial Innovation Network established the world’s first cross-border FinTech marketplace and sandbox. This innovative platform allowed financial institutions and FinTech companies to connect more efficiently via a curated marketplace. Paired with a growing ultra-high-speed internet infrastructure, a high concentration of banking, and an abundance of financial institutions, Singapore is home to a vibrant FinTech ecosystem.

The share of deals over $50m declined threefold triggering decline in funding in H1 2020

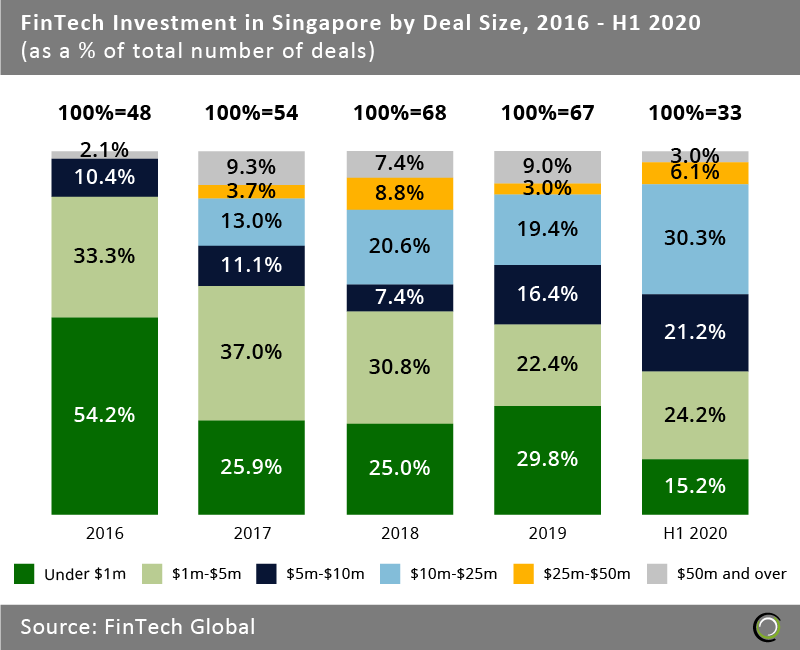

- In H1 2020, the share of deals sized $50m and over declined 6 percentage points (pp) to just 3%, the lowest share in three years for the sector. From 2016 to 2017, the share of deals sized over $50m rose nine-fold. Paired with a sizeable decline in the proportion of transactions under $1m, Singapore was soaking up FinTech capital. However, that all came to a halt when total funding for H1 2020 dropped 78%.

- Along with the decrease of the number of deals over $50m, the share of deals under $1m nearly halved. Traditionally, a decrease in the number of small deals signals maturity of the sector. However, in Singapore’s case, the significant drop is simply a lack of deals done caused from Covid-19’s effect on business. In Q1 2020, deals completed under $1m accounted for 25% of total funding where in Q2 that percentage dropped to 5.8%. The shift exemplifies the inability to close deals as Covid-19 affected Singapore heavily in Q1 2020 and the reduction of appetite among investors for riskier early stage deals.

- Surprisingly, there was a rise in deals towards the median of the scale. Deals sized between $10m and $25m increased 10.9pp while deals sized between $5m and $10m rose 4.8pp. The increase in these ranges signals that investors stayed their course with their current investments but refrained from investing in larger companies or taking companies to further funding rounds.

RegTech heads Singapore’s rocky H1 2020 as the sector sees a surge in deal activity

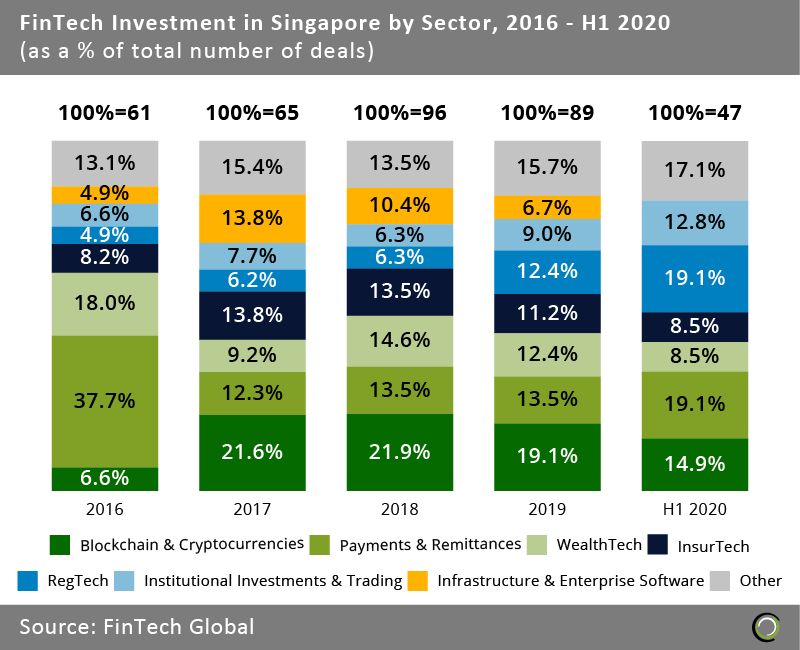

- While the Singaporean FinTech industry saw its worst funding period to date since 2016, several sectors grew intensively as Covid-19 created a new demand for certain digital services.

- The area that saw the most growth was RegTech, with its deal share growing 6.7pp to reach an all-time high of 19.1%. Singapore has been committed to RegTech growth since early 2016 with the government proactively utilising RegTech developments in their regulatory capacity. The growth follows efforts by The Monetary Authority of Singapore (MAS) to merge money exchange and remittance systems law into one legislation. Additionally, Singapore is increasingly becoming a hub for blockchain innovation with an abundance of companies creating successful digital identity, mobility, trading and more.

- Following on the heels of RegTech, Payments & Remittances companies saw increased interest from investors. Despite the lack of funding, the global economy continues to look for virtual payments, remittances, and no contact POS. The surge follows Covid-19’s effect on cash payments, physical banking, and POS systems. The move to digital banking and contactless payments fuelled the demand despite lack of deals and funding.

- The hardest hit sector by the economic downturn was Infrastructure & Enterprise Software. The FinTech subsector had zero deals completed in H1 2020, an unsurprising trend as the sector has been in decline for three years.

Singapore counts only one deal above $50m in dramatic fall in funding

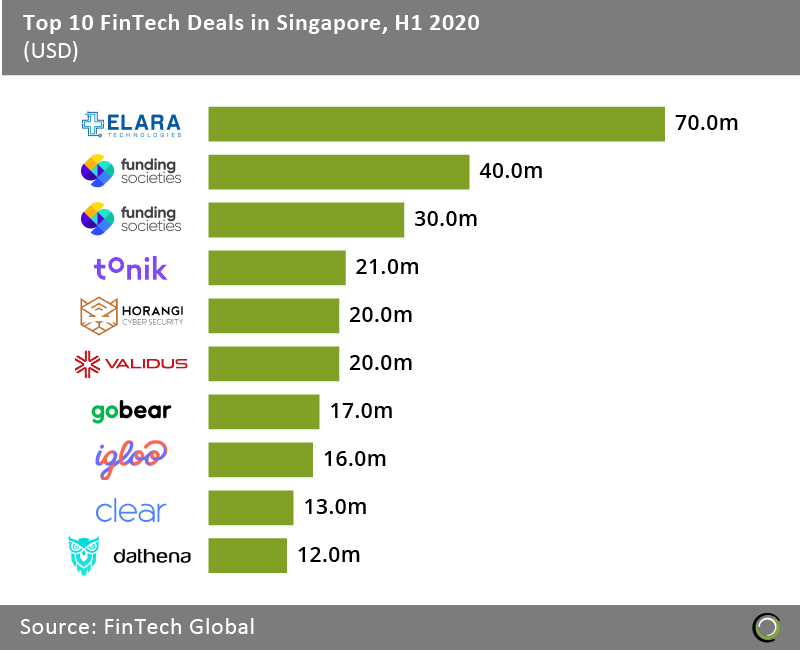

- The top ten FinTech deals in Singapore raised in aggregate $259m, making up 73.8% of the overall investment in the country during H1 2020.

- Elara Technologies, a tech-powered real estate advisory company, raised the largest deal of the period after closing a $70m venture round led by NewsCorp and REA group. With the new funds, Elara Technologies has raised $175m to date. The company announced it will use the funds to accelerate growth, continue to expand their brand, and boost its product, technology and sales teams.

- Out of the top ten deals in Singapore, two deals were completed by Funding Societies. Funding Societies, an online platform for SMEs to acquire loans, raised $70m in Series C funding rounds. Both deals were completed in Q2 2020, bringing the company’s total funding to $112.5m.

- The abysmal H1 2020, triggered by Covid-19, was brought on by a lack of large deals. From H1 2019 to H1 2020, the total funding from the top ten deals dropped 83.7%. In H1 2019, a majority of funding stemmed from a $1.4bn deal from Sea Limited in a post-IPO. Singapore was hit heavily in Q1 2020, with a small resurgence in Q2 2020

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global