Finch, a digital checking and investing platform, has scored $1.8m in its seed funding round to help it launch its platform.

Mendoza Ventures led the investment round, with contributions also coming from Barclays, Techstars Investors, and Draper Frontier.

The FinTech democratises investment access to enable millennials to get more involved with the ecosystem. Customers can earn investment returns by automatically investing their checking balance into a portfolio that meets their specific risk profile.

Founded in New York, the platform aims to make bank accounts to help people earn money, rather than just sit there. Finch claims that 86% of Americans do not invest outside of their retirement accounts.

Finch founder Neel Ganu said, “I always felt I could have done more with my money – but didn’t and ended up holding my balance in cash. Having discovered that in the US, a staggering three in five Millennials currently do not invest at all, I realized I was not alone.

“Compounding this with the growing financial debt among Millennials today, with 62% living paycheck to paycheck, opened my eyes to how significant the issue is.”

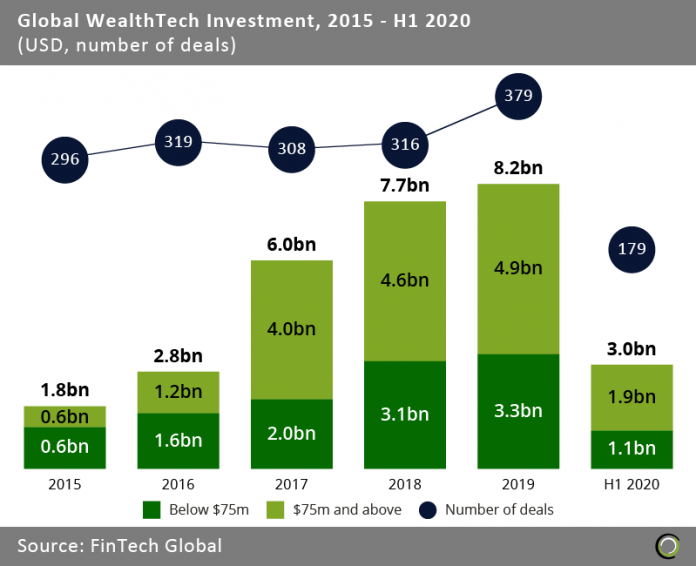

The total amount of capital being invested into the global WealthTech sector, which Finch is a part of, reached new heights in 2019, with $8.2bn invested through 379 deals.

While the sector was flying high last year, the sector could be have felt the pressures of the Covid-19 pandemic. During the first half of 2020 just $3bn was invested through 179 deals.

Copyright © 2020 FinTech Global