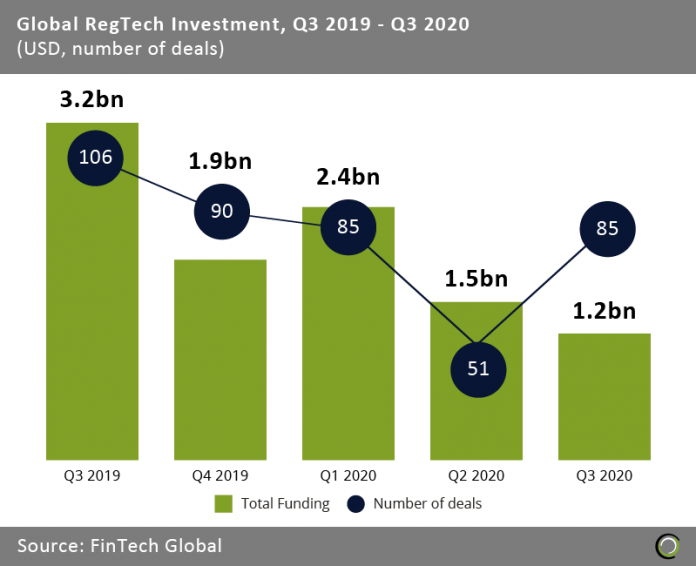

The total funding recorded in Q3 is just half of the total raised in the opening quarter of 2020 as the pandemic leaves investors wary of writing big cheques

- Global RegTech funding recorded its second consecutive quarter of decline in Q3 2020. Companies in the sector raised just $1.2bn, which is equal to only half of the capital raised in the opening quarter of the year and represents a five-quarter low.

- On the other hand, deal activity recovered after a poor second quarter where only 51 transactions were completed. As the strict lockdown measures globally were relaxed investors renewed their interest in the sector with demand for RegTech services increasing given the move to remote work and digital operations in financial services.

- As a result of the decline in funding and new RegTech innovation being funded at the early stage the average RegTech deal has declined from $30.4m in Q3 2019 to $13.9m in Q3 this year. This is a trend that we expect to continue as investors are cautious of writing big cheques and are looking to fund new opportunities brought about by the seismic shift in the sector due to the Coronavirus pandemic.

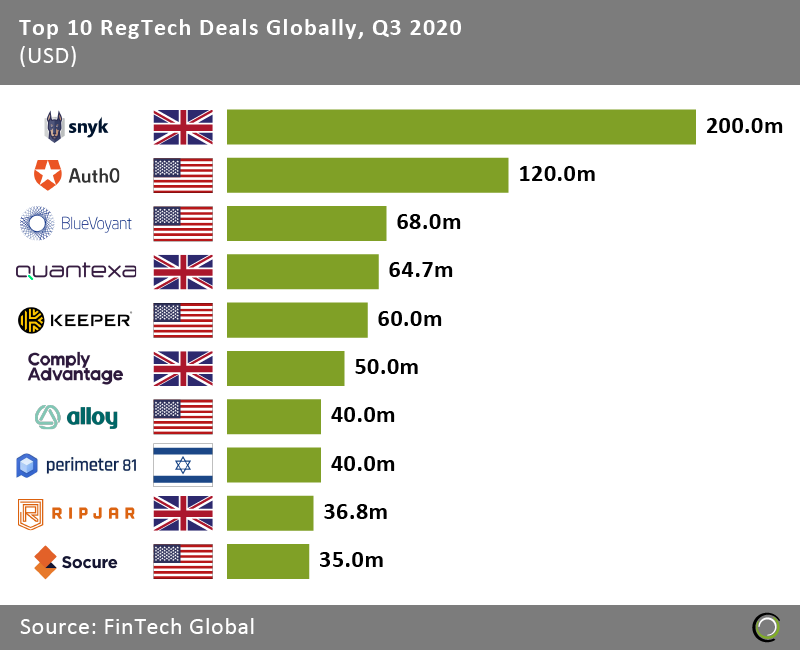

The average size of the top 10 RegTech deals continues to decline in 2020

- The top ten RegTech deals in the third quarter of the year raised $714.5m in aggregate. This is a significant slowdown compared to the $1.7bn and $908m raised in the ten largest transaction during Q1 and Q2, respectively, as the coronavirus uncertainty makes investors cautious of committing to big deals.

- UK companies completed five transactions on the list with Snyk, a company that builds security into the application development process, closing the largest round of the third quarter. The company raised a $200m Series D round led by Addition on the back of a $150m Series C round completed in January which saw the company attain a unicorn status. The latest investment round comes after a year that has seen Snyk grow its revenue by 275% and increased its headcount by 100%. The company currently has 375 employees with plans to add 100 more in the next year.

- The top ten deals list is dominated by companies based in the UK and the United States with only Israeli-based Perimeter81 bucking that trend. The company, which provides secure access to local network, applications and cloud infrastructures, raised $40m Series B round led by Insight Partners. That’s the company’s third capital raise in eight months after seeing recurring revenues quadruple year-over-year. The investment follows a Series A round in November of 2019 and a $5m seed raise in March 2020.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global