Pulley, which enables employees to better understand the value of their equity, has bagged $10m in a Series A round led by FinTech giant Stripe.

Many startup offer their employees equity to attract talent that they would otherwise not be able to afford. The idea is that these staff members would be motivated to work even harder to realise the value of their stake in the business.

However, keeping track of the value of equity they hold is far from easy, especially as most startups are prone to go through several funding rounds through their journeys.

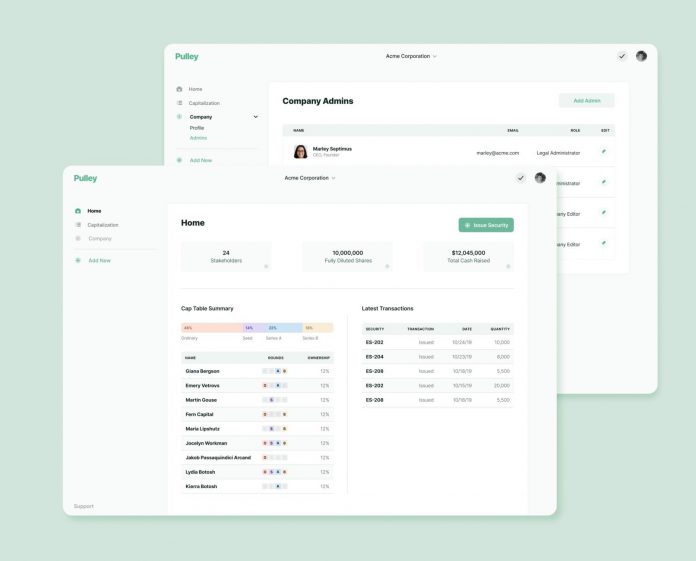

That’s where Pulley comes in. The company has developed a platform that helps companies model dilution on future rounds, employees understand how much their equity is worth as the venture grows and makes it easier to maintain equity plans.

Pulley enjoyed a soft launch in January 2020 and has so far had her 500 startups sign up to use its services.

On the back of the new cash injection, Pulley will fund the growth of its own workforce and endeavour to better meet the demand for its services.

“It was only after selling my startup to Microsoft that I actually understood all of the nuances with a company’s cap table,” said Yin Wu. “Pulley helps founders understand and optimize their shares, options, and fundraising from formation to IPO. We believe that more startups should be created and that founder-led companies are more successful in the long term.

“We are excited to build tools that empower more founders to start companies. We want founders and employees to use Pulley to make informed decisions around their equity by better understanding their company’s ownership structure. We are excited to partner with Stripe and to grow our team.”

Jordan Angelos, head of corporate development for Stripe, added, “Stripe’s mission is to increase the GDP of the internet, and we want to make it as easy as possible to start and scale internet businesses. We are excited to partner with Pulley and help founders manage their cap table so they can stay focused on building transformative companies.”

Copyright © 2020 FinTech Global