Specialist research firm FinTech Global has for the third time unveiled the world’s most innovative InsurTech companies in the world.

The ventures to successfully grab a coveted position on the prestigious InsurTech100 list have been picked for their exemplary ability to transform digital insurance. But selecting them is no easy task, considering how fast the industry is growing.

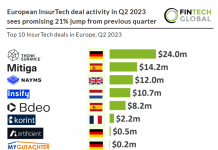

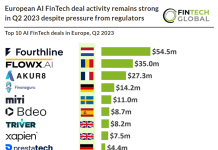

Indeed, nearly $17bn has been invested in InsurTech companies since the beginning of 2017, according to FinTech Global’s research. As a result, this year’s process to identify the leading 100 companies in the InsurTech space was more competitive than ever.

A panel of analysts and industry experts voted from a longlist of over 1,200 companies produced by FinTech Global. The finalists were recognised for their innovative use of technology to solve a significant industry problem, or to generate cost savings or efficiency improvements across the insurance value chain.

“Established insurance companies need to be aware of the latest innovation in the market in order to remain competitive in the market post Covid-19 which is heavily focused on digital distribution and increased use of customer data,” said Richard Sachar, director of FinTech Global.

“The InsurTech100 list helps senior management filter through all the vendors in the market by highlighting the leading companies in sectors such as underwriting, pricing, IoT devices, customer experience and data and analytics.”

The leading companies that were awarded a place on the list include Anorak:, the world’s first fully automated life insurance advice platform authorised by the Financial Conduct Authority; Bdeo, creating a fully automated, instant, and seamless underwriting & claims management process based on artificial intelligence to transform the industry; and ClaimVantage, the global InsurTech vendor providing cloud-native, life, health, and absence claim management solutions.

Other companies selected on the list include EIP, the InsurTech software business enabling device and lifestyle insurance providers to reduce costs, maximise profits and upgrade their digital customer experience; Humn.ai, the deep-tech MGA using streaming data, neural networks and real-time geospatial risk modelling to modernise commercial fleet insurance; Jooycar, the Latin American auto InsurTech car insurace company that’s gearing up to take the US market by storm; and Life.io, the leading customer engagement technology firm that helps insurers accelerate the development of their end- to-end digital client experience.

Also included among the InsurTech100 companies selected this year were Maptycs, the advanced risk data analytics venture; Medallia, the experience management cloud technology company enabling insurers to engage with customers across the entire customer journey; NeuralMetrics, which offers underwriting solutions; Omniscience, which powers insurers’ multidecade compounding advantage through better risk selection; and Planck, the artificial intelligence data platform that provides real-time risk and underwriting insights for commercial insurance.

Other solutions on the list include cloud-native risk management company QOMPLX, applied AI enterprise Quantiphi, the subscription-based risk placement platform Relay, car InsurTech ThingCo, and the digital B2B insurer Wakam.

A full list of the InsurTech100 can be found at www.TheInsurTech100.com. More detailed information about the companies is available to download for free on the website.

Copyright © 2020 FinTech Global