Key European AI investment stats in Q2 2023:

• European AI FinTech deal activity increased 6% to 38 deals in Q2 2023 from the previous quarter

• European AI FinTech companies raised a combined $183m in Q2 2023, no change from Q1 2023

• The UK was the most active European AI FinTech country with a 34% share of deals in Q2 2023

In Q2 2023, there was a slight 6% increase in European AI FinTech deal activity, with a total of 38 deals, marking an increase from the previous quarter. In Q2 2023, European AI FinTech companies successfully secured a combined funding of $183m, which remained unchanged from the funding raised in Q1 2023.

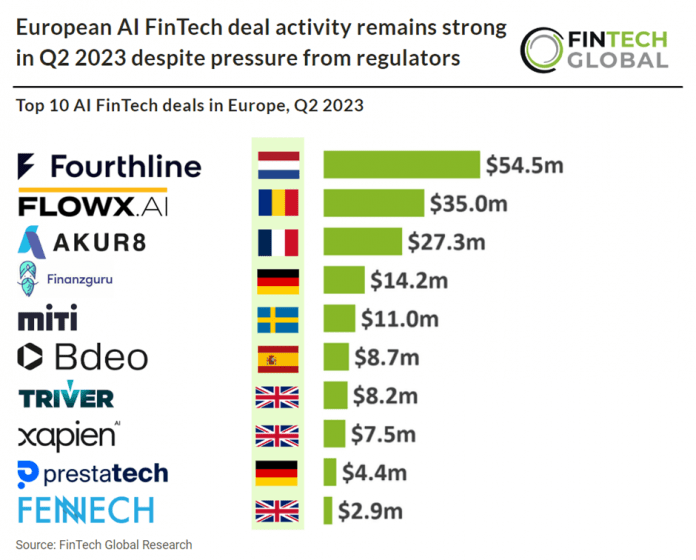

Fourthline, an end-to-end KYC and AML compliance solution, had the largest AI FinTech deal in Q2 2023, raising $55m in their latest Series B funding round, led by Finch Capital. The company intends to use the funds to accelerate growth and expand operations. Fourthline now “employs over 270 people across The Netherlands, France, Spain and The UK; and works with European fintech leaders including N26, Trade Republic, Qonto and Scalable Capital; and other regulated financial institutions such as NN, Solaris and Western Union.” Krik Gunning, co-founder and CEO, says: “We are on a mission to help regulated entities fight ever more complex financial crime. The huge leaps forward in technology over the last decade have been a double-edged sword: while consumers benefit from easier and quicker access to banking products, the nefarious actors have leveraged technologies such as deepfakes and social engineering such as money mules to increase the sophistication of their fraudulence. At present, approximately €1.8trillion dollars are laundered every year.”

According to research conducted by Pitchbook the AI startup landscape is witnessing a surge in funding, with even early-stage companies attracting significant investments.

Despite a decline in overall venture capital (VC) funding over the past 18 months, AI startups have collectively raised $15.5 billion in 2023, surpassing last year’s total and approaching the peak of $9.1 billion seen in 2021. This however has not been seen in the FinTech market, our analysis puts European AI FinTech on track to drop in 2023 by 39% compared to 2022. It is likely that regulators are the worry for investors and AI the FinTech market is lagging behind with funding. The EU’s AI Act introduces differentiated regulations based on the level of risk posed by artificial intelligence (AI) systems. Unacceptable risk AI systems, such as those manipulating behaviour or conducting real-time biometric identification, will be banned, with some exceptions allowed for post-identification in serious criminal cases with court approval. High-risk AI systems, affecting safety or fundamental rights, will be categorized based on product safety legislation and specific areas like critical infrastructure and law enforcement, requiring assessment before market entry and ongoing monitoring. Generative AI, like ChatGPT, must comply with transparency requirements regarding disclosure, illegal content prevention, and publishing summaries of copyrighted data. Limited-risk AI systems, including those generating manipulated media content like deepfakes, need to meet minimal transparency requirements, allowing users to make informed decisions about their interaction.

The UK was the most active European AI FinTech country with 13 deals, a 34% share of deals. Spain was the second most active European AI FinTech country with seven deals, an 18% share of total deals and Switzerland was third with six deals.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global