COVID-19 has plunged financial markets into chaos, but the pandemic also represents both challenges and opportunities for FinTech companies as they adjust to a whole new reality.

The pandemic started with a cough. On New Years Eve 2019, the government in the Chinese city Wuhan reported dozens of cases of a mysterious flu. Only a few days later, researchers identified a new virus, which would officially be named coronavirus disease 2019, or COVID-19, in February. By then, the World Health Organization had declared a global health emergency, the doctor who first warned about the disease had died from it and the virus was spreading at an alarming rate across the world. By the time of writing, over four million cases of infection have been reported worldwide, having led to over 287,500 deaths, according to the WHO.

As the death toll grew over the following quarter, the world economy went into freefall. “[It’s meant] a return to market chaos; those of us with memories of 2008 had hoped we would never see this again,” says Ronan Brennan, chief product officer at CSS, the RegTech company. “We witnessed everything from outright market meltdown, trading volumes heights and price plummets that had not been seen for over ten years. Fund liquidity, a salient and relatively hot topic prior to COVID-19, is right at the forefront of discussions. We had equity funds that could not value in certain markets due to absence of a market marker to provide a valuation quote. Money market funds, likewise, witnessed carnage we hoped we’d never see again post the GFC.”

FinTech companies have not been left unscathed by the fallout. The stock trading platform Robinhood was one of the companies that was affected in March. Just as the markets were going through a particularly tumultuous time with lockdowns and company shutdowns looming across the globe, a lot of Robinhood’s users wanted to sell their stocks. However, the surge in users caused a system overload and users were shut out of their accounts, unable to make deals. The result was widespread outrage among the traders.

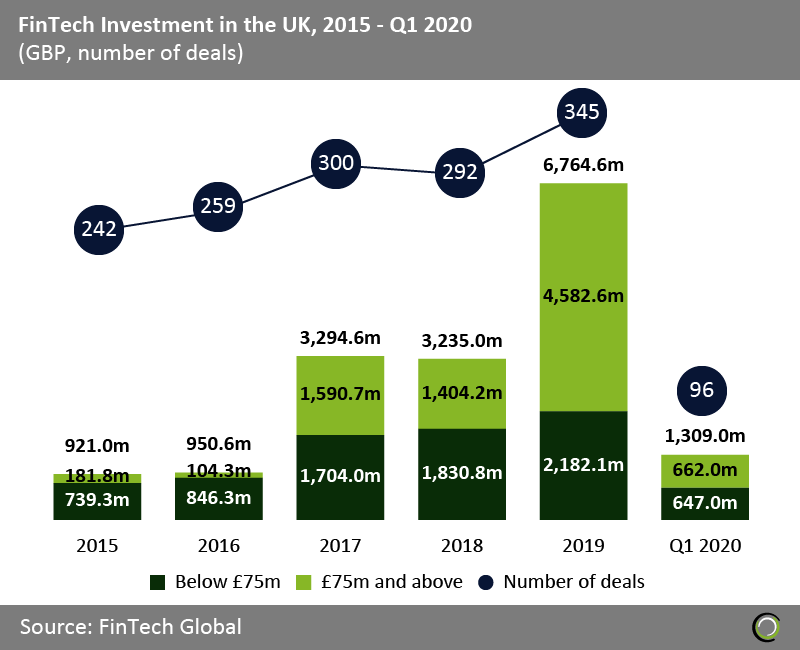

So while the first quarter of 2020 saw massive FinTech investment rounds in places like the UK and the Nordics, the next months could become more troublesome.

For instance, recent research by Rosenblatt Securities warned that challenger banks could face some particularly big hurdles. COVID-19 may cause a decline in business activity, a weakening economy, worsened venture funding conditions and see central banks reduce the benchmark interest rate to zero, which could mean the net interest margins for neobanks get more compressed than those of traditional banks as they rely heavily on transaction revenues. Another aspect to consider is that people tend to be more prone to enlist the services of traditional banks in times of crisis as they are more familiar to them and have more financial muscles to weather the storm.

For instance, recent research by Rosenblatt Securities warned that challenger banks could face some particularly big hurdles. COVID-19 may cause a decline in business activity, a weakening economy, worsened venture funding conditions and see central banks reduce the benchmark interest rate to zero, which could mean the net interest margins for neobanks get more compressed than those of traditional banks as they rely heavily on transaction revenues. Another aspect to consider is that people tend to be more prone to enlist the services of traditional banks in times of crisis as they are more familiar to them and have more financial muscles to weather the storm.

Similar trends to use more traditional service providers can be noted across the entire FinTech spectrum.

Moreover, the point about decreased opportunities to invest isn’t just isolated to challenger banks, with the researchers expecting that venture capital streams could dry out or be offered to FinTech businesses at less than ideal conditions. Similarly, several of the companies in the sector that were looking to go public through an initial public offering could be forced to seek other means to exit.

Australian RegTech Arctic Intelligence is one of the companies that have noticed the shift. “[The] first quarter of the year until the COVID-19 lockdown put the breaks on it, was one of our best months ever, winning two awards including the Australian Founded RegTech of the Year and RegTech Exporter of the year and closing some great deals,” said Anthony Quinn, founder of Arctic Intelligence. ”In the run-up to COVID-19, we were seeing regulators dial-up the pressure on regulated entities including Westpac, which is in the middle of a major court case with AUSTRAC.” Then things started to change.

“Since COVID-19, many businesses, like pubs and clubs have had to shut their doors and AUSTRAC and other international regulators appear to be scaling back some of their expectations for compliance reporting and other obligations during this unprecedented period, which we expect will have some short-term impact on the adoption of RegTech,” Quinn said.

”One positive sign we are seeing from some forward-thinking companies is that they are using the ‘pause-time’ to have a closer look at their enterprise risk assessments and compliance gap assessments and trying to get on top of this. Also, by having consultants and regulated entities alike working from home, elevates the value of digitising risk and compliance through platforms with structured workflows, audit trails and analytical insights, which many companies that may not have considered RegTech solutions previously to have a bit of a re-think.”

Arctic Intelligence is by far not the only company to face disruption in the FinTech and RegTech space. Every business – from challenger banks to compliance-focused companies – have put structures in place to enable its employees to work from home.

Theta Lake was one of the companies that did so. “[Ensuring] employee safety and continuing to support clients are our highest priorities,” says Marc Gilman, general counsel and VP of compliance. “Given our business focus on compliance for collaboration tools, we were able to transition to remote working with very minimal disruption by using all of the tools we support. This seamlessness also allowed us to support clients without interruption.”

While measures like these help fight the spread of the virus, they have also contributed to raising the risk of cybersecurity threats. “The dark web community was quick to grasp the new opportunities a disconnected workforce offered in terms of social engineering,” says Brennan. “We experience the exponential rise of collaboration-ware, which in turn exposed that firm to very targeted focus from the threat community.”

In short, bad actors have taken the opportunity to monetise on the pandemic as many people are working from home, meaning that they don’t have access to the same defence structures that they would have at work. As a result, there has been an increase in phishing scams and ransomware attacks that leverage the coronavirus.

To some extent, this has also created an opportunity for developers providing security and compliance solutions to put their offerings forward.

The same thing can be said for the rapid changes in legislation in the investment management space. “The investment management industry is not set up to handle rules that are changing with such short notice, in high volumes and with extreme ranges in the nuances applicable to apparently similar rules,” Brennan argues.

Yet, this has created an opportunity for firms that have highly focused teams of regulatory expertise that can apply concentrated focus of deeply resourced teams beyond the capability of any single investment firm. “They can do this because many investment managers recognise that substantial shareholding disclosures, position limit monitoring, takeover panels, sensitive industries and issuer specific limits are common threats faced by every investment management business,” Brennan continues.

Similarly, with global authorities like the Financial Action Task Force (FATF) warning that money laundering, terrorism financing and other types of financial fraud are on the rise, it has also created a demand for businesses that can quickly enable businesses to meet their compliance obligations.

“However, with the current level of demand, from a capacity perspective, I think that RegTech suppliers may find it harder to close sales where the integration of their solution relies on IT resources,” says Thomas Russell, CEO of Think Evolve Solve, the Irish RegTEch company. “These resources, working from home and focused on remote working support may not have the capacity to adapt and develop tools and technology.” He adds that Think Evolve’s solution to this conundrum has been to offers its data processing and analytics tools to RegTech companies, empowering them to innovate faster.

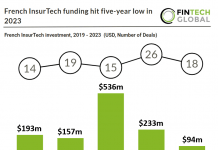

The RegTech industry is not the only segment of the FinTech industry that could benefit from the coronavirus if it plays its cards right. The InsurTech industry is, for instance, particularly well-placed to tackle the disruption caused by the global pandemic.

COVID-19 has given many insurers a rough awakening about the limitations of their legacy systems. Whether it’s dealing with a spike in customers seeking to have their policies paid out because of the crisis or finding that their risk estimation solutions have been found wanting, there is an argument that lean tech startups could provide the solutions they are looking for.

“Where insurance companies need to adapt fast InsurTechs are well positioned to allow insurance carriers to adapt rapidly,” Samuel Falmagne, CEO and co-founder of Akur8, the InsurTech company, recently told FinTech Global.

A similar case could be made for payment technology providers. As entire societies have been confined their citizens to their own homes and taken other measures to avoid catching or spreading the contagion through physical money, there has been a rise in cashless payments. In recent research, Finance In Bold believed that could be an advantage for neobanks like Revolut.

Speaking of Revolut, the challenger bank recently revealed its coronavirus game plan, saying it planned to scoop up some of the FinTech startups that are struggling as their backers are less prone to invest during the global crisis. Through these acquisitions, it plans to build out its offering faster than before.

Rosenblatt Securities noted that there might be some positive outcomes of the outbreak for payment companies, with many non-financial companies embedding online payment solutions as they look for new sources of revenue.

Nevertheless, it is still unclear when the pandemic will stop, meaning that only time will tell what the end result for the FinTech space will look like.

Copyright © 2020 FinTech Global