Revolut has added the option for a second parent to supervise children’s Revolut Junior accounts.

The UK neobank launched the new type of accounts in March this year, with the official goal of teaching children about money easy. Starling Bank launched its version, Kite, in September 2020.

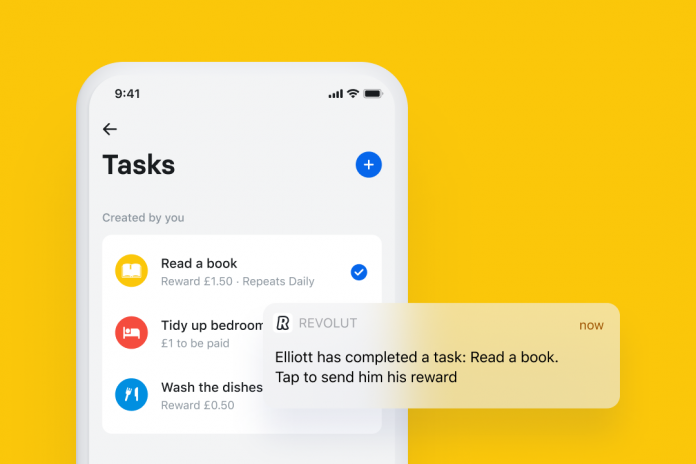

Here’s how it works. All Revolut Junior accounts have a lead parent that can now add a second co-parent to help guide the child. Those on Premium and Metal plans can add the new feature at no extra cost. The co-parent can be another family member, carer or guardian who is responsible for the financial wellbeing of the kids.

“We have added the co-parent feature to Revolut Junior so parents, guardians and carers alike can come together to teach their kids valuable skills for life,” said Felix Jamestin, head of premium product at Revolut.

“We have made sure that those with unconventional or multigenerational families will also be able to use this, so not only parents but grandparents, carers or members of their wider family can also support their child through their financial education with Revolut Junior.”

Revolut Junior’s Co-Parent feature is currently available to all Revolut Premium and Metal users in the EEA and the UK.

The past few years have seen a wave of family-oriented FInTech companies enter the market.

PCKT Money, Jassby, Greenlight Financial Technology and Pigzbe have all introduced similar services over the years.

Copyright © 2020 FinTech Global