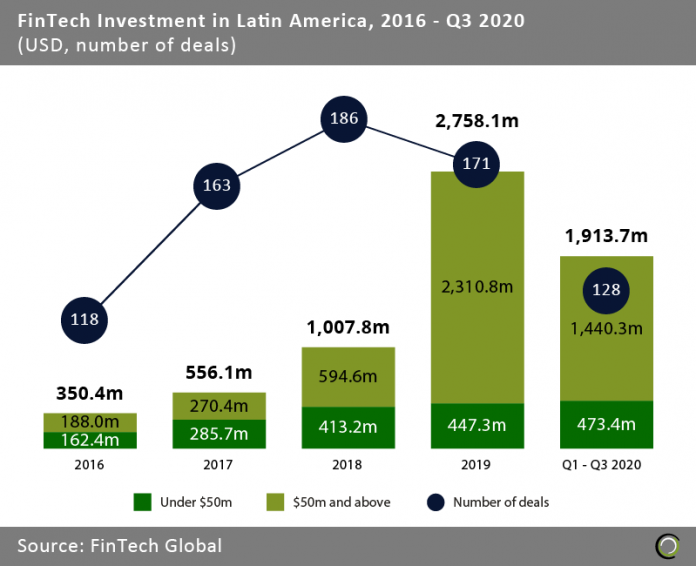

FinTech companies in the region raised over $1.9bn across 128 transactions in the first nine months of 2020.

- The FinTech industry in Latin America experienced huge growth in funding between 2016 and 2019 as investors backed innovative startups making financial services more accessible for the large unbanked population in the region. Total capital invested grew at a CAGR of 98.9% from $350.4m in 2016 to over $2.7bn at the end of last year.

- Deal activity also increased during the period, peaking at 186 transactions in 2018 before dropping slightly to 171 in 2019. Despite that small drop, last year saw a record amount of funding mainly driven by ten deals over $100m, including a mammoth $400m Series F round raised by Nubank, a Brazilian challenger bank. As a side-note, the round saw Nubank join the coveted decacorn club consisting of companies with a valuation over $10bn, which made it one of the most valuable neobanks in the world.

- Investment in the region in the first three quarters of 2020 has been little affected by the Covid-19 pandemic as companies raised $1.91bn, which is 89.6% of the total capital raised over the same period last year. However, as mentioned earlier, last year’s record-breaking figures were driven by several huge transactions. If we exclude the volatile over time large rounds, funding coming from deals under $50m this year is already higher than the capital raised from transactions under that threshold during the whole of 2019.

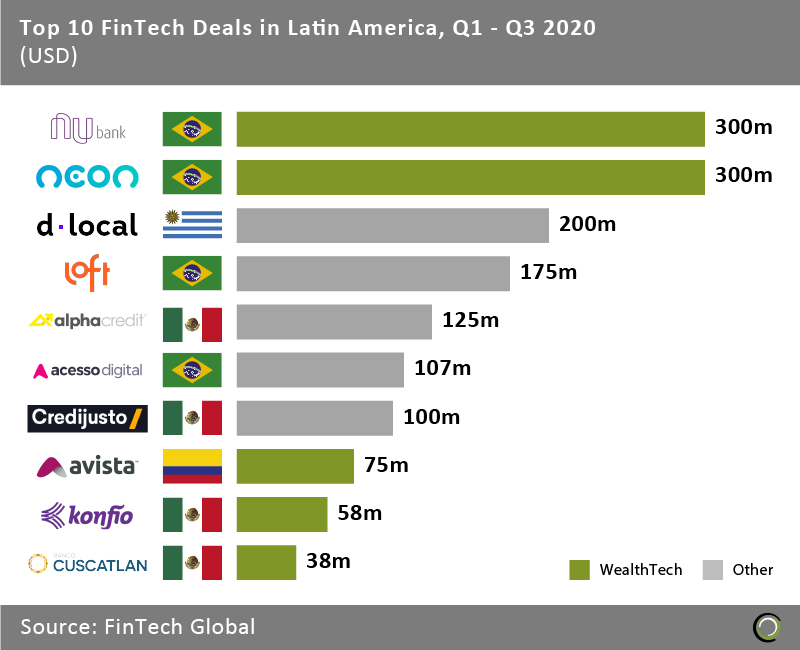

WealthTech companies raised half of the top ten FinTech deals in Latin America in Q1 2020

- The top ten FinTech deals in Latin America completed in the first three quarters of 2020 raised in aggregate nearly $1.5bn, making up 77.3% of the overall investment in the region during the period. WealthTech companies took five spots on the list as their prospects grew with people in Latin America increasingly looking for digital financial services given the social distancing measures.

- The two largest transactions were completed by Brazilian challenger banks. Nubank raised $300m in June from Sequoia Capital, Kaszek Ventures and Ribbit Capital according to an SEC Filing. While Neon received a $300m Series C investment to increase hiring efforts, grow its user base and enhance the technology’s capabilities. Neon also plans to launch new products and features and pursue mergers and acquisitions.

- The biggest round outside of the WealthTech sector was completed by dLocal, a cross-border payment platform, which raised $200m in September. The round, led by General Atlantic, puts the company’s valuation at $1.2bn making it Uruguay’s first FinTech unicorn. With the new capital, the FinTech hopes to enter 13 new markets over the course of 18 months, including in Central America, Africa and Southeast Asia. Funds will also be leveraged to support the development of its product and expand customer relationships.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global