Funding rounds for FinTechs focusing on younger generations have come in hot and fast lately, with Cleo becoming the latest one to top up its coffers by closing its $44m Series B.

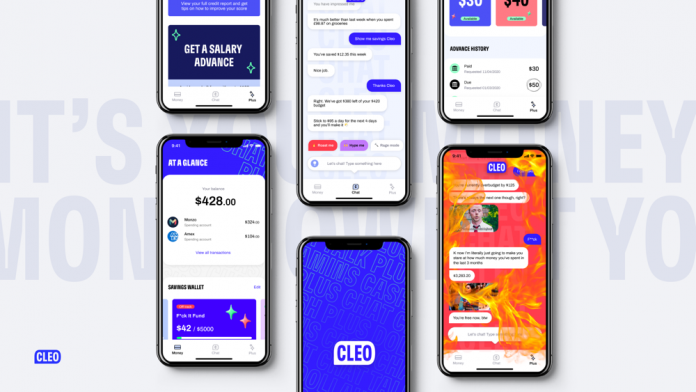

The financial assistant app is designed to help Gen-Z customers better manage their personal finances.

Luko investor EQT Ventures led the round and was joined by existing Cleo investors Balderton Capital, LocalGlobe and SBI.

They join existing angel investors including TransferWise co-founder Taavet Hinrikus, GoCardless’ Matt Robinson, Wonga founder Errol Damelin, Skype and Atomico founder Niklas Zennström, Zoopla founder Alex Chesterman and Songkick founder Ian Hogarth.

The company was founded in 2016 as a digital assistant with the goal of making money management fun and approachable for a young generation.

Since then the startup has since evolved into a trusted advisor for a generation by making a meaningful impact on user’s financial health. Cleo offers insights about a user’s financial life and the data needed to make strong financial decisions from day one.

To date, it has four million Gen-Z and millennial users on its books, 96% of which are US-based.

Cleo most recently picked up a $10m Series A round in 2018. Before that, FinTech Global reported that it had secured both a £2m round and a $700,000 round in 2017.

“We’re building Cleo to become the financial advisor that a billion people need,” said Barney Hussey-Yeo, CEO of Cleo. “One that talks to you like a real person, able to build trust and relationships like a bank never could. The work we do at Cleo has never been more urgent.”

He argued that the Covid-19 pandemic has proven the need for the services Cleo provides. “This crisis has been devastating to the generation we serve,” Hussey-Yeo said. “They’re facing true financial hardship with no one to turn to.”

The company will use the new cash injection to develop new ways to improve credit, build personalised spending plans to stabilise financial safety nets, continue its US expansion and bolster its leadership team.

“Barney and Cleo are truly disrupting consumer finance,” said Tom Mendoza, deal partner at EQT Ventures. “They’ve taken a radically different approach to money management and created an AI financial advisor with a personality that proactively delivers personalised insights that help customers spend less and save more.

“In the current climate, Cleo is now more relevant than ever. Getting answers to financial questions is particularly important for the younger generation, many of whom are trying to navigate the economic consequences of coronavirus – from graduates entering a dwindling job market to young professionals struggling to pay rent.”

Cleo is the latest in a string of FinTechs focusing on providing services to younger people to have raised money.

For instance, investment app QUIN, InsurTech Urban Jungle and Justin Timberlake-backed teen challenger bank Step are just some of the startups in this segment of the industry to have raised fresh capital in 2020.

However, this may not be that surprising given that young people are driving the FinTech revolution. It’s common knowledge that challenger banks are more popular among younger generations than among baby boomers.

Moreover, speaking at the Sthlm Fintech Week earlier this year, Jeffrey Kim, vice president, head of Nordics and Baltics product at Visa, warned that if businesses don’t pay attention to the fact that millennials and Gen-Z are increasingly demanding seamless digital financial services, then they risk losing out on a lot of custom.

Copyright © 2020 FinTech Global