Mozper is the latest FinTech lining up to digitalise children’s pocket money and has just secured $3.55m in seed capital to expand across Latin America.

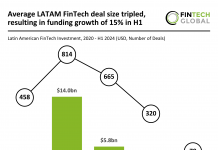

Latin American FinTech deals have come fast and in bulk lately. In the last week alone, ventures like crypto exchange Bitso, challenger bank albo and money exchange Valiu secured impressive funding rounds. These cash injections highlight just how much the region’s FinTech ecosystem has evolved over the past few years. Companies in the sector have secured $1.91bn in funding so far in 2020, up from the $350.4m raised in 2016.

Now, children-focused startup Mozper has added its name to the list by topping up its coffers with $3.55m in seed capital. Hetz Ventures led the round. Other investors backing the raise included F-Prime Capital, Foundation Capital and Secocha Ventures, as well as previous investors Dux Capital and John Farrell. The company had previously received $1.6m in pre-seed funding in a round led by Dux, Farrell and Y Combinator.

Clearly, the opportunity to tap into the Latin American market has been a deciding factor for the investors. “We think that the Latin American market is a blue ocean for FinTech innovation,” said Pavel Livshiz, partner at Hetz Ventures, in a written statement seen by Crunchbase.

The goal of the company is to help parents in the region better educate their children about financial health. Mozper will do that by offering a digital banking service for teenagers and parents. To support its operations, the company has partnered with Toka as its sponsor bank and Visa for card processing support.

This has enabled the startup to provide a mobile app and physical debit card aimed at helping teenagers better manage their money. Kids are taught good money habits, monitor balances, make payments and receive money top-ups from parents.

In other words, Mozper is basically tapping into the same type of audience as gohenry and Cleo, which closed a $40m funding round and a $44m Series B round respectively last week. Greenlight Financial Technology, which secured a $54m Series B round in September 2019, is another example of an enterprise catering to parents who want to educate their children about the realities of money.

These companies are part of a growing trend of family-focused FinTech solutions that have emerged over the past few years. Other examples include investment app QUIN and Justin Timberlake-backed neobank Step as well as challenger banks like Revolut and Starling Bank that have both launched services catering to young people this year.

The difference between these and Mozper is that the Latin American startup is tapping into a new market.

“Speaking about money is traditionally taboo, but Covid-19 removed a lot of those personal insecurities, and now it is easier to speak about money,” Yael Israeli, co-founder of Mozper, told Crunchbase. “We need to help parents create and foster these conversations around money, and we are giving them tips and tools to do this with their kids.”

Copyright © 2020 FinTech Global