Subscription management company Minna Technologies has raised £14m in a Series B round to fund the development of its open banking technology.

Swedish Minna Technologies was founded in Gothenburg in 2016 and has designed a product to help customers set up subscription services via their bank’s app, making it easier to manage subscriptions.

The idea is that this will empower customers to manage and cancel subscriptions with ease, meaning that they can save more money. To date, Minna Technologies claims to have saved over €40m on behalf of bank retail customers. In the past, it has inked partnerships with the likes of Swedbank, ING, Lloyds Bank and Danske Bank.

“Over the past four years the subscription economy has exploded from Spotify and Netflix to even iPhones and cars,” said Joakim Sjöblom, CEO and co-founder of Minna Technologies. “It’s becoming increasingly difficult for consumers to keep track of the payments and harder for banks to handle inquiries to shut them down.

“Minna’s tech improves the procedure for banks by simplifying the process, as well as providing an in-demand digital product that consumers are starting to expect from their financial institutions. This new funding will help us take Minna across the globe to reach more banks and customers than before, and we look forward to working with Element Ventures to achieve our next period of growth.”

Element Ventures led the raise with support from MiddleGame Ventures, Nineyards Equity and Visa. Elements Ventures raised a £100m fund in 2020 to support FinTech startups.

“At Element Ventures, we back bold firms that are revolutionising financial services,” said Michael McFadgen, partner at Element Ventures.

“Joakim and the team at Minna are doing exactly that, by providing banks with the tech they need to manage the millions of subscriptions their customers have, whilst bringing the switching service in-house to provide additional revenue streams. This is a clear example of the liberating services open banking promised us and we’re excited to be part of this journey with Minna.”

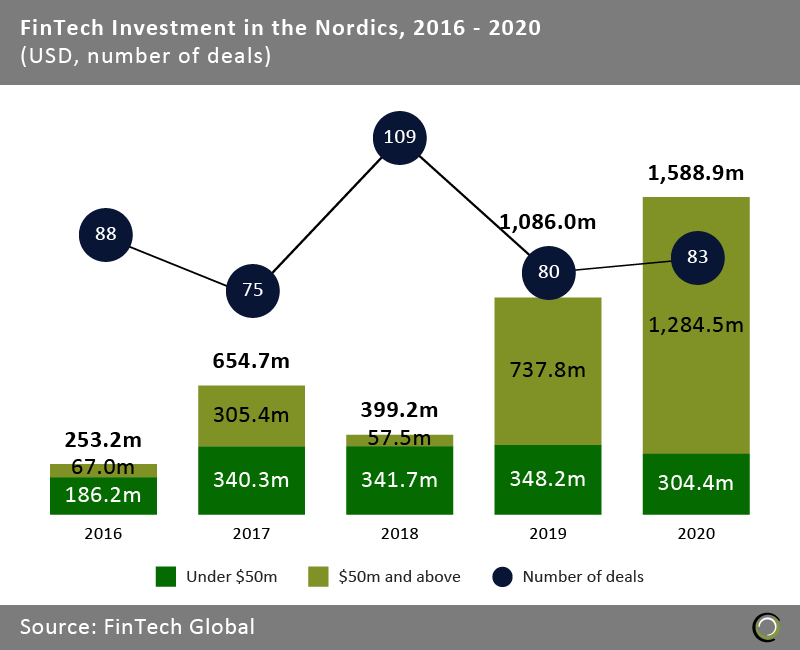

The news comes as the Nordic FinTech ecosystem had another record year in 2020, with e-commerce giant Klarna leading the charge with its $650m and $200m raises over the past year. In total, the FinTechs in the region raised $1.58bn in 2020. That’s a considerable jump from 2016 when they raised $253.2m in total.

Other successful FinTechs in the region include challenger banks such as Lunar and indó, contactless payment solutions, and FinTech unicorns such as Bambora and iZettle.

Other successful FinTechs in the region include challenger banks such as Lunar and indó, contactless payment solutions, and FinTech unicorns such as Bambora and iZettle.

Copyright © 2021 FinTech Global