Democratic representative Alexandria Ocasio-Cortez has called for an inquiry into why Robinhood shut users out of trading GameStop stocks.

Her call for a hearing came after Motherboard published a report stating that Robinhood had prevented users from buying stocks in GameStop, AMC, BlackBerry and Nokia.

On Thursday, the stock-trading app had published a notification shared on social media, saying that users would be able to close their position on GameStop’s stocks, but that they would not be able to buy any additional shares.

“We continuously monitor the markets and make changes where necessary,” Robinhood later wrote in a blog post. “In light of recent volatility, we are restricting transactions for certain securities to position closing only, including $AMC, $BB, $BBBY, $EXPR, $GME, $KOSS, $NAKD and $NOK. We also raised margin requirements for certain securities.”

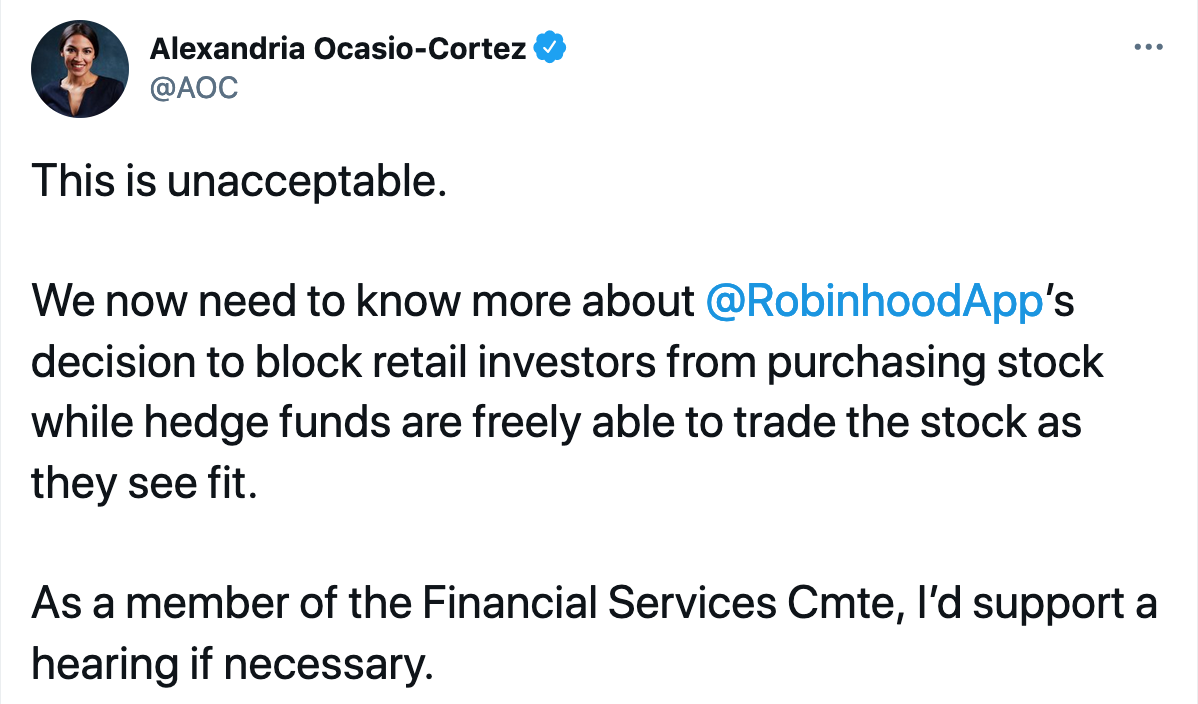

In response to the reports, Ocasio-Cortez tweeted, “This is unacceptable. We now need to know more about @RobinhoodApp’s decision to block retail investors from purchasing stock while hedge funds are freely able to trade the stock as they see fit. As a member of the Financial Services [Committee], I’d support a hearing if necessary.”

She then added, “Inquiries into freezes should not be limited solely to Robinhood. This is a serious matter. Committee investigators should examine any retail services freezing stock purchases in the course of potential investigations especially those allowing sales, but freezing purchases.”

She then added, “Inquiries into freezes should not be limited solely to Robinhood. This is a serious matter. Committee investigators should examine any retail services freezing stock purchases in the course of potential investigations especially those allowing sales, but freezing purchases.”

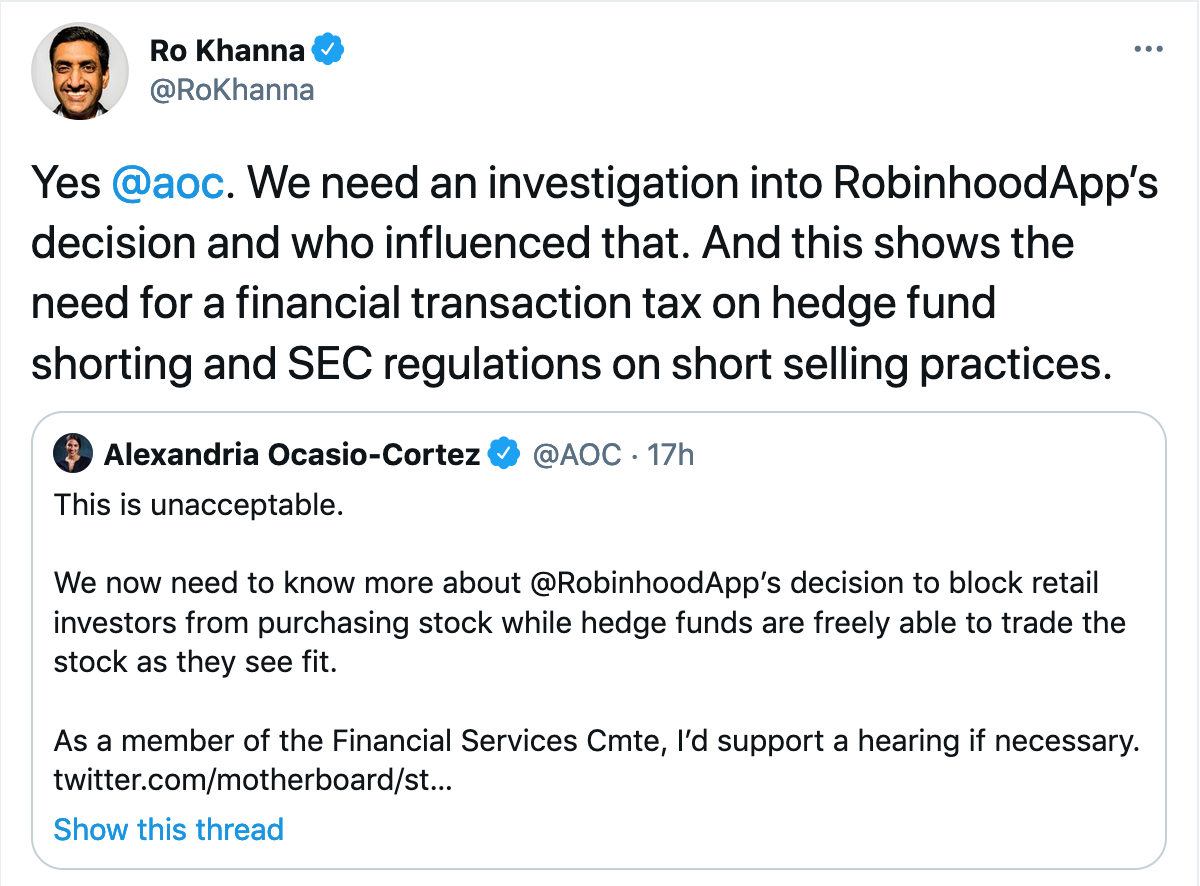

Ocasio-Cortez’s call for an inquiry quickly gained support on the social media platform. One of the people supporting a hearing was Tesla and SpaceX founder Elon Musk who replied, “Absolutely.”

Others pointed out the apparent irony “of a company named Robinhood protecting the rich from the poor.”

Others pointed out the apparent irony “of a company named Robinhood protecting the rich from the poor.”

The politicians’ call for a hearing is the latest setback that Robinhood has faced this week amidst the GameStop trading chaos.

Earlier this week, news stories reported that the stock-trading app had gone down for some users.

In response to enquires made by Motherboard, Lavinia Chirico, product communications lead at Robinhood, said, “Equities and options trading through our iOS and Android apps were fully operational, but some customers may have briefly experienced difficulties accessing our web app this morning.

“Our crypto trading platform, Robinhood Crypto, experienced a disruption in service which impacted crypto trading for some customers – which has also been resolved.”

The trading turmoil started after members of the WallStreetsBets subreddit called for the support of GameStop, pushing the stock higher than expected.

These redditors’ actions were in direct conflict with bets made by massive hedge funds such as Melvin Capital and Citron who had bought into the idea that GameStop would collapse. The hedge funds have faced billions in losses as a direct result of the WallStreetBets subreddit’s call to arms, according to The Guardian.

GameStop, the gaming store, had previously been seen as one of the big losers from the pandemic as people were less willing to go to physical stores to buy their games, accelerating the death of the high street reported on for years prior to the Covid-19 crisis.

Copyright © 2021 FinTech Global