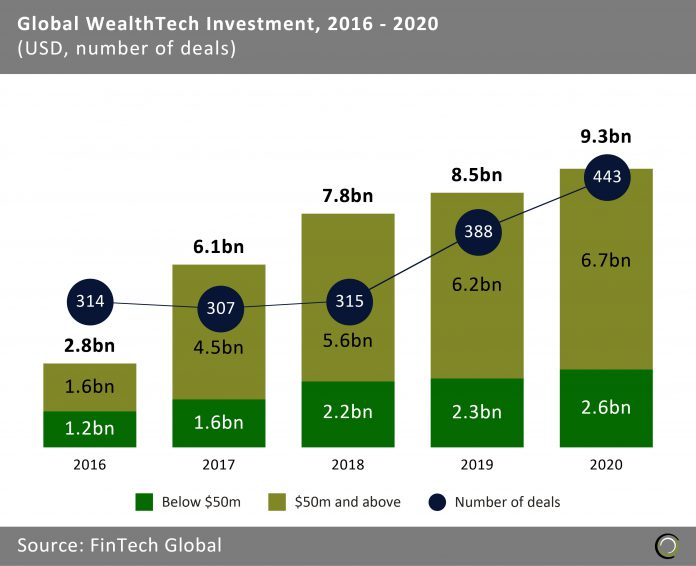

WealthTech companies globally raised $9.3bn last year across 443 transactions setting a record for both funding and deal activity.

- Global WealthTech investment recorded its highest funding ever despite the coronavirus-caused economic uncertainty. WealthTech companies raised over $9.2bn last year, a growth of 9.6% year-on-year. At the same time deal activity also increased in 2020 with 443 deals being completed compared to 388 transaction in 2019.

- Bigger share of the total funding came from deals over $50m reaching 71.8% of the total investment in 2020. However, capital invested under that threshold also increased. In fact, last year more than $2.6bn was invested in funding rounds under $50m as WealthTech innovation spread to developing markets as the pandemic increased the need for digital and banking services.

- Overall, investment in the sector has been on an upward trajectory and hit $34.5bn across 1,767 transactions since 2016. WealthTech funding grew at a CAGR of 35% over that period.

- US companies accounted for 50.5% of the global deals over $50m in 2020. Deals in the country tend to be larger in comparison to the rest of the world as the market is more matured. Investment in deals below $50m tends to come from other regions as WealthTech hubs start to form in other countries around the world. US WealthTech deals account only for 23.8% of the overall investment in that size bracket in comparison to deals over $50m where they make up 76.19% of the overall investment.

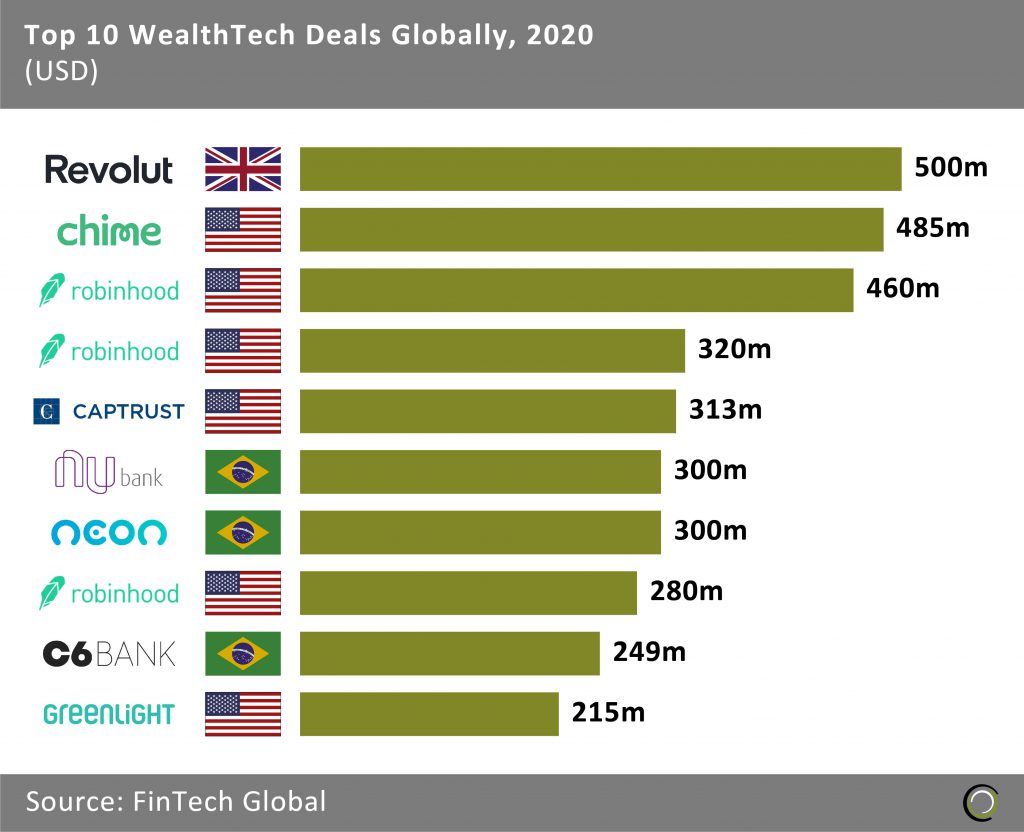

US companies account for more than half of the top 10 WealthTech deals globally in 2020

- The top ten WealthTech deals completed globally in 2020 raised in aggregate over $3.4bn making up 36.9% of the overall investment in the sector during the year.

- US companies took two out of the three top deals via Chime and Robinhood. Chime is a neobank that helps its members avoid bank fees, save money automatically and lead healthier financial lives. It raised a $485m Series F round led by Coatue, Iconiq and Tiger Global. The funding will be used to complete a number of initiatives the company has over the next 12 months to put them in a position to be IPO-ready.

- Robinhood, a stock brokerage mobile app that allows customers to buy and sell stocks, options, ETFs and cryptocurrencies with zero commission, raised a $460m Series G round led by Andreessen Horowitz, Sequoia and Ribbit Capital. The funding will be used to underpin the launch of a new cash management and recurring investment feature.

- The largest deal of the year was completed by Revolut a digital bank offering a range of services, raised a $500m Series D round led by US based investor TCV. The funding will be used to further strengthen product development in existing markets, roll out banking operations in Europe and increase daily engagement.

- The largest deal outside the US and the UK was completed by Nubank, a Brazilian challenger bank that offers digital credit cards, transfers, and payments, which raised $300m from Kaszek Ventures, Ribbit Capital and Sequoia Capital. The company added six million new users in 2020 which helped increase its transaction volume by 54%. The challenger bank also managed to decline its losses from $25m to $17m resulting in a 32% reduction. Conversely, Nubank began 2021 by raising a $400m investment round at an eye-watering $25bn valuation.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global